10-K: Annual report [Section 13 and 15(d), not S-K Item 405]

Published on March 7, 2025

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

(Mark One)

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the fiscal year ended |

|

TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

|

For the transition period from to . |

Commission File Number:

(Exact Name of Registrant as Specified in its Charter)

|

(State or other jurisdiction of incorporation or organization) |

(I.R.S. Employer Identification No.) |

(Address of principal executive offices, including zip code)

(

(Registrant’s telephone number, including area code)

Securities registered pursuant to Section 12(b) of the Act:

Title of Each Class |

Trading Symbol(s) |

Name of Each Exchange on Which Registered |

||

The |

Securities registered pursuant to Section 12(g) of the Act: Warrants to purchase Common Stock

Indicate by check mark if the registrant is a well-known seasoned issuer, as defined in Rule 405 of the Securities Act. Yes ☐

Indicate by check mark if the registrant is not required to file reports pursuant to Section 13 or Section 15(d) of the Act. Yes □

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days.

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§ 232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files).

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

Large accelerated filer |

☐ |

☒ |

|

|

|

|

|

Non-accelerated filer |

☐ |

Smaller reporting company |

|

|

|

|

|

|

|

Emerging growth company |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Indicate by check mark whether the registrant has filed a report on and attestation to its management’s assessment of the effectiveness of its internal control over financial reporting under Section 404(b) of the Sarbanes-Oxley Act (15 U.S.C. 7262(b)) by the registered public accounting firm that prepared or issued its audit report.

If securities are registered pursuant to Section 12(b) of the Act, indicate by check mark whether the financial statements of the registrant included in the filing reflect the correction of an error to previously issued financial statements.

Indicate by check mark whether any of those error corrections are restatements that required a recovery analysis of incentive-based compensation received by any of the registrant’s executive officers during the relevant recovery period pursuant to § 240.10D-1(b). ☐

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes

The aggregate market value of common stock held by non-affiliates of the registrant as of June 30, 2024 was $

As of February 28, 2025, there were

DOCUMENTS INCORPORATED BY REFERENCE

Portions of the registrant’s proxy statement for the 2024 Annual Meeting of Stockholders are incorporated herein by reference in Part III of this Annual Report on Form 10-K where indicated. Such proxy statement will be filed with the U.S. Securities and Exchange Commission within 120 days of the registrant’s fiscal year ended December 31, 2024.

TABLE OF CONTENTS

2

FORWARD-LOOKING STATEMENTS

References to the “Company,” “Cryoport,” “we,” “us,” “our” and other similar words refer to Cryoport Inc. and its consolidated subsidiaries, unless the context suggests otherwise. This Annual Report on Form 10-K (this “Form 10-K”) contains certain forward-looking statements. These forward-looking statements involve a number of risks and uncertainties. These forward-looking statements can generally be identified as such because the context of the statement will include certain words, including but not limited to, “believes,” “may,” “will,” “expects,” “intends,” “estimates,” “anticipates,” “plans,” “seeks,” “continues,” “predicts,” “potential,” “likely,” or “opportunity,” and also contains predictions, estimates and other forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended (the “Securities Act”), and Section 21E of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), and in reliance upon the safe harbor provisions of the Private Securities Litigation Reform Act of 1995. Such forward-looking statements are based on the current beliefs of the Company’s management, as well as assumptions made by and information currently available to the Company’s management. Readers of this Form 10-K should not put undue reliance on these forward-looking statements, which speak only as of the time this Form 10-K was filed with the Securities and Exchange Commission (the “SEC”). Reference is made in particular to forward-looking statements regarding our expectations about future business plans, new products or services, regulatory approvals, strategies, development timelines, prospective financial performance and opportunities, including potential acquisitions; expectations about future benefits of our acquisitions and our ability to successfully integrate those businesses and our plans related thereto; liquidity and capital resources; plans relating to our cost reduction and capital realignment measures and expectations about resulting annual cost savings and financial impact; assumptions relating to the impairment of assets; plans relating to any repurchases of our common stock and/or convertible notes; projected trends in the market in which we operate; our expectations relating to current supply chain impacts; inflationary pressures and the effect of foreign currency fluctuations; anticipated regulatory filings or approvals with respect to the products of our clients; expectations about securing and managing strategic relationships with global couriers or large clinical research organizations; our future capital needs and ability to raise capital on favorable terms or at all; results of our research and development efforts; and approval of our patent applications.

Although we believe that our opinions and expectations reflected in the forward-looking statements are reasonable as of the date of this Form 10-K, we cannot guarantee future results, levels of activity, performance or achievements, and our actual results may differ substantially from the views and expectations set forth in this Form 10-K. You should be aware that these statements are projections or estimates as to future events and are subject to a number of factors that may tend to influence the accuracy of the statements, including, but not limited to, risks and uncertainties associated with the effect of changing economic and geopolitical conditions, supply chain constraints, inflationary pressures, and the effects of foreign currency fluctuations, trends in the products markets, variations in the Company’s cash flow, market acceptance risks, and technical development risks. Other factors that might cause such a difference include, but are not limited to, those discussed in this Form 10-K, including in “Risk Factors” in “Part I, Item 1A — Risk Factors” and in “Part II, Item 7 — Management’s Discussion and Analysis of Financial Condition and Results of Operations,” as well as those discussed in reports filed with the SEC after the date of this Form 10-K.

Past financial or operating performance is not necessarily a reliable indicator of future performance, and you should not use our historical performance to anticipate results or future period trends. We can give no assurances that any of the events anticipated by the forward-looking statements will occur or, if any of them do, what impact they will have on our results of operations and financial condition. Except as required by law, we do not undertake to update any such forward-looking statements and expressly disclaim any duty to update the information contained in this Form 10-K.

3

PART I

Item 1. Business

Overview

We are global leader in integrated temperature-controlled supply chain solutions for the life sciences industry, with a strong focus on supporting the Cell and Gene Therapy market (CGT). Our broad array of products and services are designed to mitigate risks and ensure the safe and reliable storage and delivery of critical therapies and other high value biologic materials. We support the entire continuum from biomaterial collection to final delivery, ‘Enabling the Future of MedicineTM.

Our integrated supply chain platform leverages advanced temperature-controlled packaging, systems, and informatics to deliver essential solutions for companies in the CGT ecosystem, including:

| ● | BioLogistics services |

| ● | BioStorage/BioServices |

| ● | Cryopreservation services |

| ● | Cryogenic systems |

We have a market leading role in supporting the CGT market and other markets in the life sciences industry that require comprehensive, technology-centric supply chain solutions for high-value products and materials.

| • | As of December 31, 2024, we supported 701 clinical trials and 19 commercial cell and gene therapies. |

| • | Our integrated solutions help ensure the integrity of cellular material throughout the supply chain from the time biological materials are extracted from the patient for the cell and gene manufacturing process to the delivery of the therapies to the point of care. |

| • | These solutions include BioLogistics, BioServices, and Cryopreservation services, all of which are critical for the development and delivery of these lifesaving therapies. |

| • | Our newly introduced Cryopreservation services (IntegriCell®) provide enhanced cryopreservation and characterization services to maintain the quality of cellular therapy starting materials. |

| • | Our informatics, led by the Cryoportal® Logistics Management Platform, provides visibility of real-time monitoring and tracking and Chain-of-Compliance®. It also provides the process control and information that ensures quality and regulatory compliance. The Cryoportal® Logistics Management Platform has integration capabilities with clients, partners and vendors through Application Program Interfaces (API). |

| • | MVE Biological Solutions, the global leader for cryogenic systems used in the life sciences for storage and transportation, is known for its reliability, safety, high-quality manufacturing, and innovation. This inhouse manufacturing capability protects Cryoport Systems by ensuring the reliable supply of essential purpose-built cryogenic equipment and technology that enables us to quickly scale our services capabilities as the CGT market grows and expands worldwide. |

We have a global presence through our directly operated global supply chain centers, logistics centers and depots, biostorage/bioservices, and cryoprocessing centers. We have partner networks in the Americas, EMEA (Europe, the Middle East, and Africa) and APAC (Asia-Pacific) regions. In addition, our MVE Biological Solutions business unit operates three cryogenic systems manufacturing centers in the U.S. (2) and China (1).

The Markets We Serve

We are an integrated temperature-controlled supply chain solutions and have developed industry-leading products and services that seamlessly integrate into a comprehensive supply chain platform supporting the life sciences market, including the biopharma/pharma, animal health, and reproductive medicine markets. With a historical focus on biopharmaceuticals, high-value temperature-controlled products and commodities, animal health vaccines, and reproductive medicine materials, we have developed best practices and industry standards for these critical areas within the life sciences supply chain.

4

In the biopharmaceutical space, we have concentrated on emerging fields, particularly cell and gene therapies. These therapies are among the most sensitive pharmaceutical products, requiring stringent distribution standards supported by informatics

Cryoport Products and Services

We continuously work to expand and improve our products and services across the life sciences supply chain with innovative, technology-centric solutions.

Our suite of market leading products and services include, but are not limited, to the following:

Cryoport Express® Shippers - Cryoport Express® Shippers range from liquid nitrogen dry vapor shippers (-150℃) to our C3™ Shippers (2-8℃), which are powered by phase-change materials. The Cryoport Express® Shippers are precision-engineered assemblies that are reliable, cost-effective, and reusable or recyclable. Our liquid nitrogen dry vapor Cryoport Express® Shippers utilize an innovative application of ‘dry vapor’ liquid nitrogen technology and, most often, include a SmartPak™ Condition Monitoring System. Cryoport Express® Shippers meet IATA requirements for transport, including Class 6.2 infectious substances, are also ISTA (International Safe Transit Association) “Transit Tested” certified and carry the “CE” (“Conformité Européenne”) mark demonstrating conformance with European Union (“EU”) health, safety, and environmental protection standards.

Cryoport ELITE™ Shippers - The first product, in this high-performance line of Cryoport ELITE™ Shippers, is a best-in-class -80°C shipper that has superior temperature management properties as well as incorporating next generation protection, handling, and data collection and management systems including our SmartPak™ Condition Monitoring System. The Cryoport ELITE™ -80°C Gene Therapy Shipper was developed in conjunction with one of the leaders in the gene therapy space for clinical and commercial gene therapy distribution and was launched during the second quarter of 2023.

Cryoport Express® Cryogenic HV3 Shipping System (HV3) – During the first quarter of 2025, we introduced the HV3 which provides optimized hold times for interior payloads, improved storage efficiency, and full compliance with airline requirements including narrow bodied aircraft. Tailored to meet the specific needs of advanced therapies, the HV3 ensures enhanced payload security, superior temperature control, payload integrity and extended temperature stability at cryogenic temperatures. Its innovative enclosure design and configuration eliminates the need for palletization on narrow-bodied aircraft, ensuring compliance with regional carriers and reducing flight rejections and delays. This enhancement also opens additional shipping lanes, making it easier for life-saving therapies to reach more remote destinations. Designed with the end-user in mind, the HV3 features robust wheels and an integrated, front-facing handle to ensure easy mobility at any stage of transit.

Smartpak II® Condition Monitoring System and Tec4Med – Cryoport’s Smartpak II® Condition Monitoring System (“Smartpak II®”) delivers comprehensive visibility into the location and conditions of valuable materials throughout the entire shipment process. The system also provides critical data to validate that sample integrity is maintained during transit. The Smartpak II® monitors key parameters, including location, temperature, shock, orientation, and pressure, with immediate alerts enabling swift intervention when necessary. Seamlessly integrating with our Cryoportal® Logistics Management Platform, the Smartpak II® provides visibility of near real-time reporting, combining condition monitoring, logistics management, and shipper qualification performance into a single data stream for enhanced oversight and reliability.

We acquired Tec4Med, a company providing cold-chain packaging temperature and location monitoring, warehouse monitoring as well as bench top monitoring for laboratories and research facilities during the fourth quarter of 2023. Technological innovations from Tec4Med include:

| • | The SmartHub is an intelligent Beacon-Gateway Monitoring System and can be integrated into any logistics process at box, pallet, container, truck or warehouse level. In doing so, it enables full supply chain visibility in real-time. |

| • | The CryoBeacon serves as an intelligent temperature and humidity data logger with advanced capabilities. It effectively records all data internally and offers two methods of data retrieval: manual access through the Tec4App and automated retrieval via the SmartHub gateway. Designed for multiple applications, the CryoBeacon can be utilized repeatedly for different shipments. |

With our solutions, our clients have the peace of mind that comes with knowing exactly where their shipments are, at all times, ensuring that they can deliver high-quality pharmaceutical products to their clients with confidence. By adopting risk mitigation measures, our clients can proactively identify and address potential threats to their operations and supply chain. This saves valuable resources that can be redirected toward other critical areas of their business, allowing them to operate

5

more efficiently and effectively. Through Tec4Med technology, they can optimize their operations and build a more resilient business for the long term. We intend to leverage the Tec4Med technology across many of Cryoport’s products and services in the coming years.

Cryoport accessories – Our purpose-built accessories are integral to our comprehensive integrated temperature-controlled supply chain solutions. Designed to seamlessly integrate with our advanced shipping systems, our accessories safeguard materials and minimize risks at every stage of s their journey—spanning critical phases of development and manufacturing. From our proprietary Safepak® and SoftRackTM Systems to specialized labels, cassette racks and cryovial boxes, each accessory is meticulously engineered to help ensure security and preserve the integrity of critical therapies and biomaterials throughout the supply chain. Our accessories include: Safepak® System 1800, Safepak® XL, Soft Rack™, Cryostrap®, and Cryoport Elite® Ultra Cold Shipping Systems' Payload Holding System among others.

Cryoport BioStorage/Bioservices – We offer biostorage and bioservices solutions through two of our business units, CRYOGENE and Cryoport Systems.

CRYOGENE - Acquired in 2019, CRYOGENE provides biostorage solutions primarily for the provision of pre-clinical temperature-controlled biological materials management services to the life sciences industry. With a focus on pre-clinical commodities, it is one of the medical research industry’s leading biorepository, focusing on the secure storage of biological specimens and associated supplies. Utilizing the latest freezer and cryogenic storage technologies and computer inventory control software, CRYOGENE can cost-effectively fulfill life sciences bio-storage and distribution requirements. Our services include comprehensive specimen storage, processing, collection, and retrieval at our CRYOGENE operations in Houston, Texas, and San Antonio, Texas, the latter which was opened during the first quarter of 2024. Both facilities are FDA registered for storage and distribution and compliant with Current Good Tissue Practice (CGTP), Current Good Manufacturing Practices (cGMP), and the American Association of Tissue Banks (AATB). In January 2025, we announced a strategic partnership with the Moffitt Cancer Center (MCC), a leading National Cancer Institute-designated comprehensive cancer center, whereby CRYOGENE will establish a state-of-the-art biorepository center in conjunction with MCC’s planned 775-acre global innovation life sciences campus in Pasco County, Florida. CRYOGENE facilities in Florida are expected to be fully validated and open during the second half of 2026.

| ● | Cryoport Systems Bioservices - In June 2022, we launched its first two Global Supply Chain Centers in Houston, Texas and Morris Plains, New Jersey. These state-of-the-art facilities combine our existing logistics processes and capabilities with our BioServices infrastructure – all under one roof, as Cryoport Systems’ Global Supply Chain Center Network. These Global Supply Chain Centers offer a new and fully integrated approach designed to support cell and gene therapies including comprehensive controlled temperature storage, kitting, labelling, fulfillment, sample management, drug return, and Qualified Person (QP) drug product release, along with advanced BioLogistics. Cryoport Systems’ BioServices facilities in the United States are registered with the FDA as Tissue Establishments, complying with FDA CFR 1271.10. In April 2022, we acquired Cell&Co BioServices in Clermont-Ferrand, France with additional bioservices operations in Pont-du-Château, France to accelerate the setup of our BioServices capabilities in the EMEA region. Our sites are ISO 9001 and ISO 20387 accredited and all GMP IT systems are 21CFR Part 11, and GAMP-5 compliant (both US and EU). |

Cryopreservation Services (IntegriCellTM) - In conjunction with our acquisition of Cell Matters in July 2022, we developed our IntegriCellTM service platform. The IntegriCellTM platform is a fully standardized, scalable apheresis cryo-processing platform that can be expanded on a global basis. The platform services include apheresis/leukapheresis collection via partners, CryoshuttleTM transportation services, cryo-process optimization, cryopreservation services, and BioServices. We have recently opened our first two facilities in Liège, Belgium and Houston, Texas. These two facilities became operational during the fourth quarter of 2024.

Cryoport Consulting Services – Cryoport Consulting Services functions in an expert advisory capacity to offer solutions to address risk factors present in temperature-controlled supply chain and logistics. To develop tailored scalable solutions, our cross-functional team collaborates with our clients to understand their supply chain, logistics, time, shipper, and packaging concerns. Cryoport Consulting Services employs a structured approach to managing, executing, and developing risk mitigation plans. Our clients benefit from our quality driven processes and solutions delivered by our high integrity team leveraging industry-standard best practices and years of experience partnering with leading life science companies from early clinical through post-commercialization. Service solutions range from comprehensive physical, thermal and shipping qualifications of shipping systems and/or packaging to developing user-friendly custom packaging solutions focused on the challenges unique to our life science clients.

6

CRYOPDP Temperature-controlled Logistics - CRYOPDP is a premier global specialty courier dedicated to the life sciences industry that we acquired in 2020. CRYOPDP operates with expertise an exhaustive range of temperature-controlled logistics services including temperature-controlled packaging and premium transport solutions. In recent years, CRYOPDP further expanded organically as well as through acquisitions in Ireland, Belgium, Spain, Australia and the United States. Through the acquisition of CRYOPDP, we expanded our global presence and provided Cryoport with inhouse specialty courier capabilities to complement our network of global partners.

MVE Biological Solutions - The acquisition of MVE Biological Solutions in 2020 enabled Cryoport to become the leading global provider of cryogenic systems and solutions. MVE Biological Solutions supplies cryogenic systems globally and is an important part of our global supply chain platform. With its long history of producing the most reliable, highest quality products in the industry, it has set the standard for the manufacture of cryogenic systems including freezer, and shipper solutions used for storage and/or distribution of critical biological material, for 60 years. Two examples of MVE Biological Solutions advance development achievements are:

| ● | MVE Biological Solutions’ Fusion® Cryogenic System – The MVE Fusion is a self-sustaining cryogenic freezer. The MVE Fusion® can operate as a stand-alone unit, requiring no on-going liquid nitrogen supply or connection to an external liquid nitrogen source. Fusion® cryogenic freezers are a perfect solution for remote geographic locations, isolated laboratories, high elevation facilities, or facilities without existing liquid nitrogen infrastructure. |

| ● | MVE Biological Solutions’ Vario® Cryogenic System – is an innovative cryogenic freezer system that can support temperatures anywhere between -20°C and -150°C. In addition to providing greater flexibility, the Vario® series of cryogenic freezer systems provide effective and consistent temperature profiles with less than 1% of the power consumption and a 70% reduction in overall operating cost savings compared to traditional mechanical freezers. |

Competitive Advantages

With our first-to-market integrated platform of technology-driven supply chain solutions serving the life sciences industry, we have established a lead over potential competitors by focusing on de-risking critical processes in the life sciences including those central to the manufacture and distribution of cell and gene therapies. Working with our in-depth knowledge of information technology, cryopreservation services, packaging, temperature-controlled logistics, BioServices, and cryogenic systems, our management, technical, business development and service support teams approach our growing markets with valued insights, adaptability, innovation, and a mindset of problem resolution which provides clients with certainty of performance.

Through our experience, we know that supply chain processes can have a large impact on temperature sensitive product/commodity conditions. We therefore seek to exceed the most demanding standards in the industry, such as, among others, ISO 13485, ISO 21973, ISO 9001, ISTA, and IATA.

Cryoport Systems’ Cryoportal® Logistics Management Platform (Cryoportal®) is an important backbone technology. The Cryoportal® handles order entry, keeps track of our global inventory, and provides algorithms for predictive analysis on every shipment while in transit, globally. Cryoport Systems’ customer service team monitors every in-transit shipment 24/7/365 and, by leveraging the Cryoportal®, they have the unique ability to see issues that arise and take corrective measures up to and including intervention to potentially save a shipment in trouble.

A key driver in differentiating our service platform is the fact that we are the only organization that has a fully integrated supply chain platform that encompasses products, services, and informatics within a single organization which is anchored by our Chain of Compliance® solution. Our integrated temperature-controlled supply chain solutions are built for purpose, fully integrate products, services, and informatics and are focused on the management of irreplaceable therapies, vaccines, and biological materials such as biological samples and reproductive materials.

Segment Reporting

Operating segments are identified as components of an enterprise about which separate discrete financial information is available for evaluation by the chief operating decision maker in making decisions regarding resource allocation and assessing performance. The chief operating decision maker is our Chief Executive Officer.

7

Effective in the fourth quarter of 2024, the Company realigned the reportable segment information that the CODM regularly reviews to evaluate the business, make key operating decisions and allocate resources which resulted in the identification of two reportable segments: Life Sciences Services and Life Sciences Products. Previously the Company had one reportable segment and the CODM utilized consolidated financial results to evaluate performance and has transitioned to utilizing disaggregated financial information between the Life Sciences Services and Life Science Products segments.

Adjusted earnings before interest, income taxes, depreciation and amortization (“adjusted EBITDA”) for each operating segment is the profit measure used by the CODM in measuring the performs of the business and in the annual budget and forecasting process. Adjusted EBITDA is defined by the Company as earnings before interest, income taxes, depreciation, amortization and certain items that do not contribute directly to management’s evaluation of its operating results. Asset information by reportable segment is not provided to the CODM.

We have three operating segments that are aggregated as Life Sciences Services which provides temperature-controlled logistics and cryogenic biostorage within the life science industry through direct sales. Revenues from this segment include an immaterial amount of product revenues. The Company’s Life Sciences Products segment manufactures and sells cryogenic freezers, cryogenic dewars and accessories within the life science industry through direct sales or a distribution network. Revenues from this reportable segment are exclusively life sciences product revenues.

In addition, the CODM manages and evaluates the operating performance of the segments, as described above, on a pre-corporate cost allocation basis. Accordingly, for segment reporting purposes, the company does not allocate corporate costs, which include certain aspects of the Company’s executive management, legal, compliance, human resources, information technology and finance departments, to its reportable segments.

Customers and Distribution

We believe that our platform of integrated temperature-controlled supply chain solutions, expertise, and geographic footprint enables us to take advantage of the growing demand for effective and efficient global transport and biostorage of temperature sensitive life sciences commodities. This is especially the case for cell and gene therapies that require tightly controlled temperatures through the development, biostorage, transportation, and delivery processes to maintain efficacy and safety.

During the year ended December 31, 2024, no customer accounted for more than 10% of our total revenues. During the year ended December 31, 2023, one customer accounted for 10.5% of our total revenues. During the year ended December 31, 2022, no single customer accounted for over 10% of our total revenues.

Our geographical revenues, by origin, for the years ended December 31, 2024, 2023 and 2022, were as follows:

2024 |

2023 |

2022 |

|

||||

Americas |

|

55.3 |

% |

54.5 |

% |

54.0 |

% |

Europe, the Middle East and Africa (EMEA) |

|

26.1 |

% |

26.1 |

% |

28.2 |

% |

Asia Pacific (APAC) |

|

18.6 |

% |

19.4 |

% |

17.8 |

% |

Customer types

Our major customer types include Biotechnology and Pharmaceutical Companies, Contract Research Organizations, Contract Development & Manufacturing Companies, Central Laboratories, Fertility Clinics, Animal Health Companies, Universities & Research Facilities.

Sales and Marketing

We serve clients across the life sciences industry, with a particular focus on the rapidly evolving Cell and Gene Therapy market. Our global sales and marketing efforts are centered on addressing each customer’s unique challenges and anticipating their future needs through our specialized temperature-controlled supply chain solutions. Our marketing teams create and execute targeted digital campaigns that align with our commercial strategy, showcasing our innovative portfolio of solutions and capabilities. These initiatives are designed to fuel business development, program management, and consulting activities, while also enhancing awareness of our advanced temperature-controlled supply chain solutions.

8

Competition

We believe Cryoport is unique in its product and services offerings. However, we do have competition from companies that offer products and/or services that could be considered competitive to certain components or elements of our platform of temperature-controlled supply chain solutions, including specialty couriers, such as World Courier Group, Inc., Marken (a UPS company), Biocair and Quick (a Kuehne+Nagel company), along with companies that offer products such as Azenta Life Sciences, and IC Biomedical and services such as the American Red Cross and Gift of Life Biologics. In addition, life science companies may develop their own in-house temperature-controlled supply chain solutions, systems and procedures to cover their specific needs.

Engineering and Development

Our research, development, and engineering efforts are focused on continually investigating new technologies that can improve our services, and the features of our products and solutions in order to address market needs.

Cryoport Data Management Systems

Tec4Med and SkyTrax™ Condition Monitoring Systems - Cryoport’s Tec4Med and SkyTrax™ Condition Monitoring Systems are connected data platforms for the temperature sensitive supply chain. Tec4med provides an integrated suite of hardware and user-friendly software delivering intelligent supply chain data and predictive analytics. The Tec4med eco-system enables end-to-end supply chain visibility and optimization, unifying a digitization of the supply chain. The Tec4Cloud FDA 21 CFR Part 11 compliant web platform delivers actionable supply chain data (including multi-channel alerts) and can be white label customized with client branding. SkyTrax™ is a next generation proprietary-designed Condition Monitoring System, custom-built for the cell and gene industry. In addition to being 4G/LTE compliant, cellular network agnostic, with a full sensor array to track location, temperature, humidity, light, shock, orientation, and geofencing, with Bluetooth and Wi-Fi capabilities. The Cryoport team is currently developing a product roadmap for a unified approach to the suite of condition monitoring solutions.

Cryoportal® 2.0 and UnITy™ - Cryoport Systems’ Cryoportal® 2.0. Logistics Management Platforms was launched during the second quarter of 2023 and is ISO 21973 compliant as a supply chain management platform. In addition to managing all aspects of a given client shipment, it also manages the Chain of Compliance™ based aspects of our packaging. The Cryoportal® 2.0 is complemented by CRYOPDP’s UnITy™ Transportation Management System. UnITy™ provides functionalities in addition to transport management that include warehousing management, quality management, customer experience portal, mobile apps for track and trace during transport and storage as well as integration with transportation agents and business partners. The combination of these two powerful informatics platforms provides Cryoport clients with a comprehensive status of their clinical or commercial distribution activities, while supporting regulatory requirements and further sets Cryoport apart from competition.

Manufacturing and Raw Materials

Manufacturing - We source components for our products from multiple suppliers, including those that manufacture to our engineering specifications, using, in part, proprietary technology and know-how to mitigate supply chain risks. We also use “off-the-shelf” products, which we may modify to meet our requirements. For some components, there are relatively few alternate sources of supply and the establishment of additional or replacement suppliers may or may not be accomplished immediately. When this occurs, we endeavor to mitigate risk by locating an alternative qualified supplier and, as appropriate, increasing our inventory level.

Our vendor/partner relationships allow us to concentrate on further advancing and expanding our platform of systems, products, and solutions for the life sciences to meet the growing and varied demands for validated temperature-controlled solutions in the life sciences industry. We endeavor to keep our supply structure up to date and agile as it provides us the opportunity to rapidly scale to support our client’s commercialization, systems, products, and solutions requirements; however, we are ever mindful of the work we must do to improve our current sourcing and to continue to mitigate risks therein.

Raw Materials - Various raw materials are used in the manufacture of our products and in the development of our technologies. Most raw materials are generally available from several alternate distributors and/or manufacturers. Where we have experienced significant difficulty in obtaining these raw materials, we have established alternative global sources or work with existing suppliers to overcome any deficiencies.

9

Patents, Copyrights, Trademarks, and Proprietary Rights

To remain competitive, we develop and maintain protection on the proprietary aspects of our platform of technologies. We rely on a combination of patents, copyrights, trademarks, trade secret laws and confidentiality agreements to protect our intellectual property rights.

To remain competitive, we develop and maintain protection on the proprietary aspects of our platform of technologies. We rely on a combination of patents, copyrights, trademarks, trade secret laws and confidentiality agreements to protect our intellectual property rights.

We file patent applications to protect innovations arising from our research, development and design. As of December 31, 2024, we owned approximately 95 issued patents and have more than 140 pending patent applications throughout the world. Our patents generally protect certain aspects of our products and related technology. We also own common law and registered trademarks in the U.S. and in certain foreign countries to protect the names of our company, certain products, and key service brands. We own certain copyrights relating to certain aspects of our systems, products and services.

Our success is influenced, in part, by our ability to continue to develop proprietary products and technologies. It is desirable to obtain patent coverage for these products and technologies; however, some are protected as trade secrets. We intend to file trademark and patent applications covering any newly developed products, methods and technologies. However, there can be no guarantee that any of our pending or future filed applications will be issued as patents or registered as trademarks. There can be no guarantee that the various patent and trademark governmental agencies from around the world or some third party will not initiate an interference proceeding involving any of our pending applications or issued patents. Finally, there can be no guarantee that our issued patents or future issued patents, if any, will provide adequate protection from competition.

Patents provide some degree of protection for our proprietary technology. However, the pursuit and assertion of patent rights involve complex legal and factual determinations and, therefore, are characterized by significant uncertainty. In addition, the laws governing patent issuance, and the scope of patent coverage continue to evolve. Moreover, the patent rights we possess or are pursuing generally cover our technologies to varying degrees. As a result, we cannot ensure that patents will issue from any of our patent applications, or that any of the issued patents will offer meaningful protection. In addition, our issued patents may be successfully challenged, invalidated, circumvented, or rendered unenforceable so that our patent rights may not create an effective barrier to competition. We must also pay maintenance fees at set intervals for our patents to not expire prematurely. The laws of some foreign countries may not protect our proprietary rights to the same extent as the laws of the United States. There can be no assurance that any patents issued to us will provide a legal basis for establishing an exclusive market for our products or provide us with any competitive advantages, or that patents of others will not have an adverse effect on our ability to do business or to continue to use our technologies freely. As with all patents, we may be subject to third parties filing claims that our technologies or products infringe on their intellectual property. We cannot predict whether third parties will assert such claims against us or whether those claims will hurt our business. If we are forced to defend against such claims, regardless of their merit, we may face costly litigation and diversion of management’s attention and resources. As a result of any such disputes, we may have to develop, at a substantial cost, non-infringing technology or enter into licensing agreements. These agreements may be unavailable on terms acceptable to such third parties, or at all, which could seriously harm our business or financial condition.

With respect to our trademarks, we file and pursue trademark registrations on words, symbols, logos, and other source identifiers that clients use to associate our products and services with us. Although our registered trademarks carry a presumption of validity, they can be challenged and possibly invalidated and as such, we cannot guarantee that any trademark registration is infallible.

We also rely on trade secret protection of our intellectual property. We attempt to protect trade secrets by entering into confidentiality agreements with employees, consultants and third parties, although, in the past, we have not always obtained such agreements. It is possible that these agreements may be breached, invalidated, or rendered unenforceable, and if so, our trade secrets could be disclosed to our competitors. Despite the measures we have taken to protect our intellectual property, parties to such agreements may breach confidentiality provisions in our contracts or infringe or misappropriate our patents, copyrights, trademarks, trade secrets and other proprietary rights. In addition, third parties may independently discover or invent competitive technologies, or reverse engineer our trade secrets or other technology. Therefore, the measures we are taking to protect our proprietary technology may not be adequate.

10

Cryoport’s Quality Assurance and Regulatory Affairs Programs

Cryoport is committed to quality, and this is reflected in all aspects of our global organization. From our innovative design of products and services to our continuous improvement initiatives, Cryoport has implemented comprehensive quality standards that match or exceed the stringent requirements within the markets we serve. Cryoport’s Quality Management Systems have been designed, implemented, and certified to meet ISO 9001:2015 and ISO 13485 standards in key global locations, demonstrating the discipline necessary to maintain a positive compliance profile. With our strong foundation in ISO 9001:2015 and ISO 13485, we leverage industry-specific experience with applicable regulatory requirements, and industry expectations, to create processes and procedures that incorporate strong operational practices of checks with verification. Our Quality Management Systems are designed to ensure proper controls in manufacturing, temperature-controlled supply chain services, logistics, bioprocessing, customer/client education, contracting, processing, shipping and biostorage, accumulation, and communication.

Our Quality Management Systems incorporate notable good practice quality guidelines and regulations (GxP) elements, beyond those stipulated in ISO 9001:2015 and ISO 13485, to ensure our customers are supported in the manner necessary to maintain standards and to secure a positive compliance profile for Cryoport as a supplier and partner.

Through procedural requirements, Cryoport provides substantial risk-mitigation strategies throughout its full offering of products, systems, and services to support and maintain customer confidence. Metrics and key performance indicators are accumulated regularly, and are trended to predict, and mitigate, potential risks to operations. Operating and senior management utilized this information to enact decisions regarding procedures, processes, resource allocation, and corrective actions. Quality-driven initiatives are supported throughout our global organization. We are also subject to GMED, which is an international reference body in the certification of health care and medical devices quality management systems under ISO 9001, NF EN, and ISO 13485. As such, we are subject to audits by a Medical Device Single Audit Program (MDSAP) auditing organization. Cryoport’s cryogenic biostorage facilities are routinely inspected by the FDA and The Foundation for the Accreditation of Cellular Therapy (FACT) to confirm regulatory compliance to industry requirements related to drug applications, filings, and maintenance of various cryogenically stored materials.

Government Regulation

Globally, Cryoport is subject to regulations in numerous country jurisdictions and international regulations relating to manufacturing, shipments, customs, import, export, safe working conditions, environmental protection, and disposal of hazardous or potentially hazardous substances. In addition, we must ensure compliance with economic sanctions and/or restrictions on individuals, corporations, or countries, and other government regulations affecting trade that may apply to our international cross border business activities.

The shipping of biologic products, biologic commodities, diagnostic specimens, infectious substances, and dangerous goods, whether via air or ground, falls under the jurisdictions of many country, state, federal, local and international agencies. The quality of the packaging that protects such commodities is critical in determining successful shipping conditions and to ensure a commodity will arrive at its destination in a satisfactory condition. Meeting stringent regulations such as Dangerous Goods Regulations, ISTA, and IATA, as applicable, Cryoport has demonstrated compliance and adhesion to these requirements. Many of the regulations for transporting dangerous goods in the United States are determined by international rules formulated under the auspices of the United Nations. Dangerous goods are typically one-time shipments and are not a part of our routine services. When called upon to ship dangerous goods, Cryoport follows strict and stringent guidelines. International Civil Aviation Organization (“ICAO”) is the United Nations organization that develops regulations (Technical Instructions) for the safe transport of dangerous goods by air. If shipment is by air, compliance with the rules established by the IATA is required. IATA is a trade association made up of airlines and air cargo couriers that publishes annual editions of the IATA Dangerous Goods Regulations. These regulations interpret and add to the ICAO Technical Instructions to reflect industry practices. Additionally, the Centers for Disease Control (“CDC”) has regulations (published in the Code of Federal Regulations) for interstate shipping of specimens.

Our Cryoport Express® and ELITE™ Shippers meet Packing Instructions 602 and 650 and are certified for the shipment of Class 6.2 Dangerous Goods per the requirements of the ICAO Technical Instructions for the Safe Transport of Dangerous Goods by Air and IATA. Our present and planned future versions of the Cryoport SmartPak™ Condition Monitoring Systems will likely be subject to regulation by the Federal Aviation Administration (“FAA”), Federal Communications Commission (“FCC”), FDA, IATA and possibly other agencies which may be difficult to determine on a global basis. Additionally, our Chain of Compliance™ processes comply fully with ISO 21973 guidelines.

11

Storage of biological materials that are classified as drug products for human therapeutic use (either for investigational use or commercially approved) or materials used in the manufacture of drug products for human therapeutic use, is regulated by the FDA under Title 21 Code of Federal Regulations (“CFR”) part 210 & 211. Facilities must be compliant with current GMP regulations which are enforced by the FDA through registration and audit. When drug products are exported to other countries, biostorage upon receipt must meet relevant local regulations.

Our MVE Biological Solutions cryogenic stainless-steel freezers and aluminum dewars are certified to the Medical Device Directive (MDD) in the EU. MVE is compliant with current Good Manufacturing Practices (“GMP”) regulations which are enforced by the FDA through registration and audit of compliance with 21 CFR Part 820 and GMP. This FDA registration and product listing is in addition to MVE’s existing ISO 13485 certification.

Additionally, registrations for import are in place for various countries with these requirements.

Cryoport’s advanced integrated temperature-controlled supply chain solutions platform is designed to support the global distribution of high-value commercial biologic and cell-based products and therapies regulated by the United States Food and Drug Administration (FDA), the European Medicines Association (EMA) and other international regulatory bodies. Cryoport’s solutions are also relied upon for the support of pre-clinical, clinical trials, Investigational New Drug Applications (IND), Biologics License Applications (BLA), and New Drug Applications (NDA) with the FDA, as well as global clinical trials initiated in other geographies, where strict regulatory compliance and quality assurance is mandated.

For additional information, see “Part I, Item 1A — Risk Factors—Risks Related to Regulatory and Legal Matters” in this Form 10-K.

Environmental, Social and Governance (“ESG”) Program

Since 2022, our key ESG focus has been on measuring our Greenhouse Gas (GHG) Emissions. GHG emissions represent a clear global significance for companies, consumers, and other stakeholders. Cryoport engages an ESG advisor to assist us in creating an annual report of the previous years’ estimated global GHG emissions. The following summarizes that report.

Summary of our 2023 GHG Emissions Report

Methodology

We used the World Resource Institute’s Greenhouse Gas Protocol - Corporate Accounting and Reporting Standard (Revised Edition) to calculate the company’s GHG emissions. The standard provides accounting tools to measure, manage, and report on GHG emissions. This protocol classifies emissions into three “scopes.” Scope 1 emissions includes direct GHG emissions, which occur from sources that are owned or controlled by a company. Scope 2 emissions include indirect GHG emission from purchased electricity. Scope 3 emissions include all other indirect GHG emissions.

Organizational Boundary

The reporting boundary for the purposes of the report is Cryoport, Inc. and its consolidated subsidiaries, which includes four business units (MVE, Cryoport Systems, CRYOPDP, and Cryogene) and over 50 facility locations across 17 countries (United States, China, Netherlands, Portugal, France, Belgium, United Kingdom, Poland, Germany, Singapore, India, South Korea, Australia, Spain, Ireland, Philippines and Japan) in 2023.

Scope

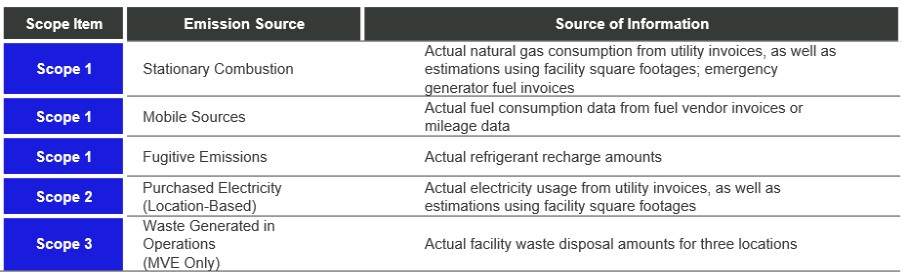

The scope of the report includes our Scope 1 emissions (Direct) and Scope 2 emissions (Indirect emissions from purchased electricity), but generally excludes Scope 3 emissions (Other indirect emissions). However, we did quantify Scope 3 emissions from waste generated in operations for one business unit because the data was readily available to quantify such emissions. The following sources of emissions were included in the scope of the report for the identified business units:

12

Some of the Scope 3 emissions that contribute to our global carbon footprint, but for which we determined that data was not reasonably available for us to quantify in this report include, but are not limited to, transportation and distribution provided by third parties in the performance of our services; use and end-of-life treatment of sold products; and purchased goods and services.

Assumptions

We used various assumptions to quantify GHG emissions in the report. As with any projections or estimates, actual results or numbers may vary based upon factors such as variations in processes and operations, availability and quality of data, and methodologies used for measurement and estimation. Changes to emission estimates may occur if updated data or emission methodologies become available. The following are some primary assumptions or estimates that we made in the 2023 report:

Stationary Combustion – Natural Gas. Natural gas usage for heating was estimated for several company locations based on spend data and regional utility rates.

Mobile Sources – Vehicle Fuel Consumption. For fleet vehicles where actual fuel usage was not available, vehicle fuel consumption was estimated based on the miles driven and average fuel economy of the vehicle type.

Purchased Electricity (Location-Based). Electricity usage was estimated for several company locations based on either (i) square footage using average intensity for offices, or (ii) spend data and regional utility rates, depending on what information was available.

Utility Estimations. When there were gaps in electricity or natural gas data, the average of the prior and following months data was used to estimate the missing information.

13

Results

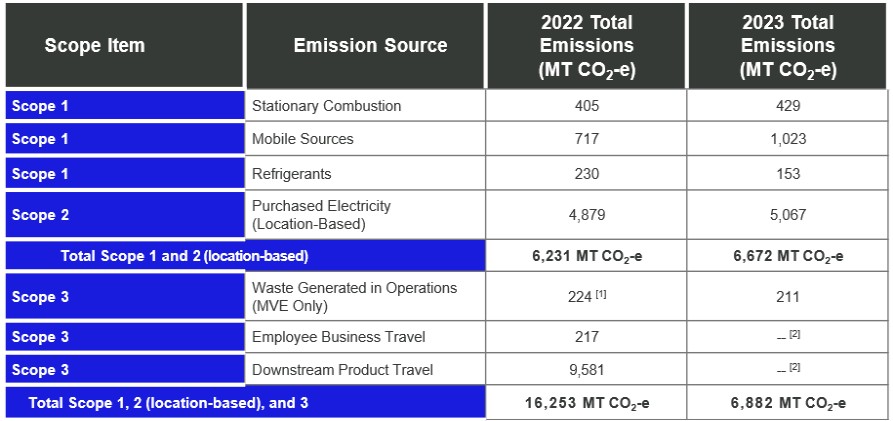

Our 2022 and 2023 Total Emissions, as calculated in the 2022 and 2023 reports, are as follows:

[1] The Total Emissions from Waste Generated in Operations for 2022 also included information for one Cryoport Systems location.

[2] Total Emissions from Employee Business Travel and Downstream Product Travel was not quantified in the 2023 report.

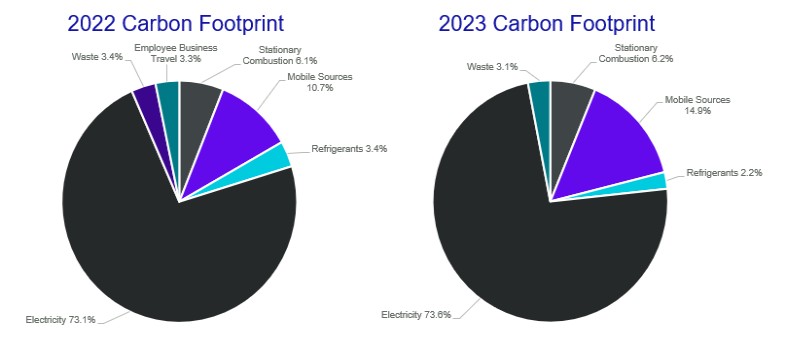

The following charts show the percent of total emissions in 2022 and 2023 that was contributed by each type of emission quantified in the 2022 and 2023 reports:

14

Carbon Footprint Intensities

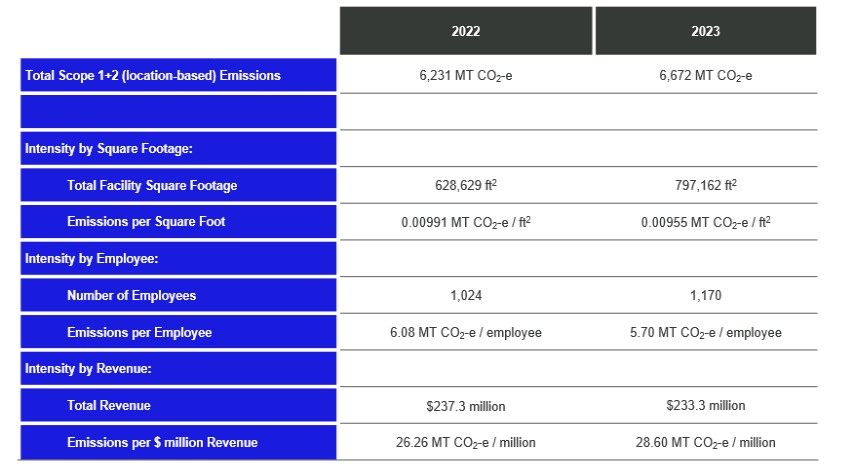

The following table shows our 2022 and 2023 carbon footprint intensities in relation to square feet of our facilities, revenue, and employees as calculated in our 2022 and 2023 reports.

Next Steps

Cryoport plans to continue to calculate an annual carbon footprint. Conducting an annual carbon footprint allows Cryoport to track changes (i.e., increases or reductions in emissions, fuel usage, or energy usage by facility) and refine our processes and procedures used to estimate our carbon footprint. The Nominations and Governance Committee of the Board of Directors meets annually to review the GHG Emissions Report and will decide, along with Cryoport’s executive team, the next steps that we will take on our ESG journey.

Supporting Our People (December 31, 2024)

| ● | Total Headcount: 1,186 (Full-Time 1,090, Part-Time 15, Contingent 81) |

| ● | Languages Spoken: 22 |

| ● | Countries: 19 |

| ● | Average Years of Service: 5.27 Years |

Cryoport’s global team of employees are our most valuable resource, from our teams on the front line in our global supply chain and logistics centers, to our manufacturing operations, to our business development personnel, to the engineers who design our products and services, to our quality assurance and regulatory teams that assure the safety, quality, compliance, and integrity of our products.

Our success depends on the health, talent, and dedication of our global team. As we grow our team, we strive to retain, develop, and provide advancement opportunities for our employees. We endeavor to make Cryoport a superior growth workplace with a diverse, inclusive, and equitable environment where all team members have the opportunity to flourish.

15

Diversity, Equity & Inclusion (DEI)

We are committed to diversity, equity, and inclusion for our employees across our global Company. Cryoport is an Equal Employment Opportunity employer and currently tracks gender distribution across its operations and management. We maintain clear policies related to anti-harassment, discrimination, and retaliation, and provide an anonymous, third party-managed reporting hotline for employees to report incidents of harassment, discrimination, and policy violations. We provide annual online corporate training programs on harassment, diversity and inclusion, business ethics and code of conduct. In addition, Cryoport’s recruiting process includes targeted outreach to a variety of under-represented constituents.. Cryoport has partnered with or targeted organizations like Hire Heroes, Career OneStop, recruiting at Historical Black Colleges, Accounting and Financial Women’s Alliance, and Women in Technology.

The Human Resources (“HR”) departments in each Cryoport business unit manage HR priorities, including team member career development, engagement, and health and wellness. Our Corporate HR department promotes consistency of policies across our operating companies and manages executive development and employee benefits.

As of December 31, 2024, women represented a total of approximately 35% of all employees, 32% of all managers, 38% of all directors, and 22% of all senior leadership positions (Vice President and above). Cryoport understands that there is work to be done to create a more equitable and representative senior leadership team and continue to push diversity throughout our operations.

We are committed to offering competitive compensation that accounts for geography, industry, experience, and performance. Our compensation programs and practices are designed to attract new employees, motivate, and reward performance, drive growth and support retention. Compensation at Cryoport includes base wages and generally includes incentive opportunities such as restricted stock units, equity stock options, and/or cash bonuses.

Employee Health & Safety

Safety is a priority in every aspect of our business. Across our companies, we are committed to making our workplaces and communities safer for our employees, customers, and the public. Our corporate philosophy is embedded in our day-to-day work through policies and continual education.

Cryoport’s Employee Health & Safety (EHS) programs have demonstrated strong safety performance, as evidenced by our total injury rates (TIR) and lost time injury rates (LTIR) being significantly lower than the global industry averages. Driven by our culture of continuous improvement, we are committed to continue to work toward reducing our TIR and LTIR figures even further.

To understand and improve our safety performance, we measure our operational performance across a variety of indicators—including lost-time-injury rate (LTIR)—on a daily basis. In 2024, our LTIR for our United States operations was 0.46. In addition to looking at past indicators of safety performance, we frequently evaluate the effectiveness of new metrics, including leading indicators, as we strive to improve our safety performance. Cryoport’s operating companies are responsible for implementing policies and procedures aligned with international standards that account for their business and the associated health and safety risks.

Innovating Responsibility

Cryoport recognizes that we play a role in protecting the health and safety of current and future generations through services and solutions that promote sustainability, resilience, and respect for the environment. We strive for a product base that is of the highest quality and with long life spans to minimize impact associated with the production of new products, and Cryoport reviews opportunities to eliminate materials of concern and related managed waste streams.

Product & Service Quality

As a temperature-controlled supply chain provider to the life sciences industry, Cryoport must comply with the safe transportation of regulated hazardous materials. As a result, we have designed and developed several features in its various products to comply with US DOT, IATA, ICAO, and other regulatory and guidance bodies. Additionally, safety warnings are included in our product labeling as well as our manuals. Our products are designed to conform to the following standards (where applicable):

| ● | ISO 13485 (Section 7.3 Design and Development, ISO, QMS) |

| ● | ISO 14971 Application of Risk Management, ISO |

16

| ● | Medical Device Directive Medical Devices Directive 93/42/EEC, and Directive 2007/47/EC amending Council Directive 93/42/EEC concerning medical devices |

| ● | Low Voltage Directive (LVD) (2014/35/EU) |

| ● | Electromagnetic Compatibility Directive (2014/30/EU) |

| ● | RoHS 2 (2011/65/EU) (we are actively working on RoHS 3 and REACH) |

| ● | Safety Requirements For Electrical Equipment For Measurement, Control, And Laboratory Use - Part 1: |

| ● | General Requirements [UL 61010-1:2012 Ed.3+R:29Apr2016] |

| ● | Safety Requirements For Electrical Equipment For Measurement, Control, And Laboratory Use – Part 1: |

| ● | General Requirements (R2017) [CSA C22.2#61010-1-12:2012 Ed.3+U1; U2] |

| ● | IEC 60601-1 - Medical electrical equipment - Part 1: General requirements for basic safety and essential performance |

| ● | IEC 61326-1:2012 - Electrical Equipment For Measurement, Control And Laboratory Use - EMC Requirements - Part 1: General Requirements |

| ● | ASME SEC. VIII Pressure Vessel Code (Fusion Only) |

| ● | EU Pressure Equipment Directive (EU97/23/EC) (Fusion Only) |

| ● | FCC 47 CFR Class B Verification (Fusion Only) |

| ● | IEC 62304 Medical device software — Software life cycle processes |

These standards are integrated into our development methodology used to design new products and services within our company. The development process includes a risk management assessment done in accordance with ISO 14971 that identifies hazards and mitigates risks via design improvements, process improvements, and warnings (including labels and safety information shipped with the product).

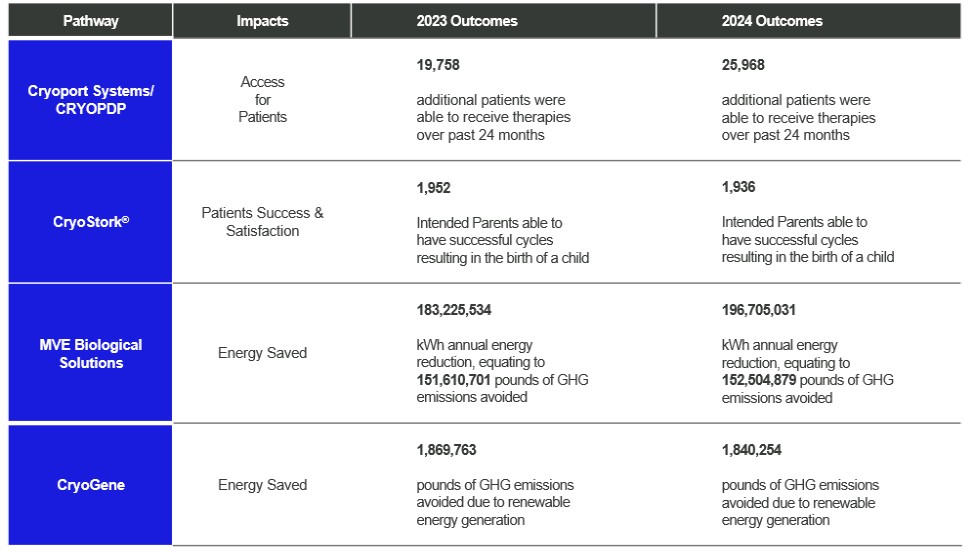

We pride ourselves on our exceptional operational quality. In 2024, we estimate that our temperature-controlled supply chain solutions focused on cell and gene therapies had a 99.97% delivery success rate and due to this performance we estimate that 25,968 additional patients were able to receive therapies over the past 24 months. In 2024, we estimate that our CryoStork® solution had a 99.88% delivery success rate and due to this performance we estimate that 1,936 intended parents are potentially able to have successful cycles resulting in the birth of a child on an annual basis because of our CryoStork® solution.

While rare, recalls of products may become necessary. The primary responsibility for recall management lies with our Vice President of Quality Assurance and Regulatory Affairs for manufacturing. The executive team is involved in the decision and implementation processes depending upon the specifics of any recall that may be required. Customer service personnel, sales staff and other resources would then be utilized to reach all distributors and direct end users. The results of recalls are evaluated daily until the recall is closed. There were no product recalls during 2024.

Product Lifecycle Management

Cryoport’s unique products are developed with long-term use in mind. Cryoport’s products are primarily constructed of recyclable aluminum or stainless steel, and we approach the extension of product lifecycles through the following four areas:

| ● | Longevity |

| ● | Reparability |

| ● | Reusability |

| ● | Recyclability |

We strive for a product base with long life spans to minimize the impact associated with production of a new product. At our MVE Biological Solutions production facility, in 2024, we manufactured cryogenic freezer units that we estimate utilize approximately 1/1865 of the energy used by conventional mechanical freezers used for similar applications. For example, our freezer production displaced annual electricity consumption by 196,705,031 kWh from what would otherwise be consumed from alternative products. This amount of electricity could power 19,172 homes annually. This reduction in energy consumption from our freezer lines alone equates to 152,504,879 pounds of GHG emissions avoided or the emissions equivalent to 16,135 passenger vehicles driven for one year.

Cryoport regularly reviews opportunities to eliminate the use of materials considered hazardous and related managed waste streams. Cryoport does not utilize any substances of concern in our products; we do currently utilize minimal quantities of hazardous materials that are not listed as substances of concern in our operations, primarily in the form of isopropanol, epoxies, butyl cellosolve,

17

lacquer thinner, paint, hyamine and isopropyl alcohol. These materials and the insignificant quantities of hazardous wastes generated by our production facilities are managed in compliance with all state and federal regulations. Any hazardous waste that is generated is tracked and managed with an overall goal of eliminating hazardous materials where possible. Cryoport strives to have a conflict-free supply chain and is committed to working with its suppliers to increase transparency regarding the origin of minerals contained in its products, including minerals identified as conflict minerals (tin, tungsten, tantalum, and gold), and has adopted a Conflict Minerals Policy, which is available on our website at www.cryoportinc.com on the “Investor Relations: Governance” page under the heading “Governance Documents.”

Governing Ethically

Cryoport recognizes that solid supplier relationships are essential to our ability to meet customer requirements for quality solutions. We expect our business partners to share our commitment to ethics, integrity, regulatory compliance, safety, human rights, data security, and environmental protection. By the same token, as a provider accountable to thousands of companies worldwide, we pledge, through our ESG performance, to meet or exceed our clients’ requirements for the same.

Business Ethics

We are committed to operating with honesty and transparency in accordance with the highest ethical and corporate governance standards – mutual respect, integrity and trust are the foundation of our company. Our Code of Ethical Business Conduct (the “Code of Ethics”) serves as the foundation of our corporate integrity and compliance program and applies to our directors and all employees, including our Chief Executive Officer and Chief Financial Officer. The Code of Ethics is available on our website at www.cryoportinc.com on the “Investor Relations: Governance” page under the heading “Governance Documents.” All employees across our operations are provided with training and reference materials to reinforce this commitment to integrity and ethics in our business. Our Code of Ethics is is translated into local languages for our employees where applicable and includes guidance on topics including, but not limited to the following:

| ● | Corruption |

| ● | Anti-Trust and Anti-Competitive Behavior |

| ● | Insider Dealings |

| ● | Gifts |

| ● | Bribes (e.g., explicit prohibition of facilitation payments) |

| ● | Conflicts of Interest |

| ● | Intellectual Property |

| ● | Regulatory Compliance |

| ● | Truthful and Accurate Reporting |

| ● | Human Rights |

| ● | Equal Employment Opportunity |

| ● | Anti-harassment |

| ● | Environmental Compliance and Sustainability |

| ● | Whistleblower protections (including non-retaliation) |

| ● | Political Activity and Contributions (e.g., explicit prohibition of contribution of any kind to any candidate or political party without express prior approval of our board of directors – this covers both direct contributions and indirection support; no political contributions have been made in recent years) |

| ● | Reporting Violations of Company Policy |

Our officers, directors, and managers are responsible for promoting the principles within the Code of Ethics and fostering a culture of ethical conduct. Our commitment to doing the right thing depends on our employees’ being comfortable in reporting any suspected violations of law or unethical conduct, and our leaders’ abilities to address suspected violations promptly, with respect. Our global policy against retaliation encourages employees to come forward to report concerns in good faith. When a matter is reported to a manager or our HR department, the concern is reviewed to determine whether it should be escalated to the legal department. The legal department also has criteria for further escalation, if necessary, to legal department management. Every new employee is introduced to the Code of Ethics through training and orientation.

18

We develop and update these policies when we identify a need for employee clarification, the emergence of new laws or regulations, or other external factors. We routinely review and update the language in our policies, and how we present information, to ensure our employees understand the risks they face in their jobs, and steps they can take to mitigate those risks and report potential problems.

Our commitment to human rights is an important part of the Code of Ethics. We are committed to protecting and advancing human rights in our operations around the world. We pay fair wages and comply with wage laws in all the countries where we operate. We prohibit the use of child, compulsory, or forced labor, and we share the zero-tolerance policies adopted by the United States and other governments against slavery and human trafficking. We prohibit the trafficking of persons for any purpose and trafficking-related activities, and we expect the same from our suppliers and vendors.

In addition to our Code of Conduct, our senior leadership team actively oversees the governance of our ethics programs to help ensure that commitment is driven from the top down, and that program owners are accountable for successful program compliance.

Cryoport does not conduct clinical trials, animal testing or use human tissue of any kind in the manufacture or design of our products, and our Code of Conduct governs the ethical behavior of our employees across all of Cryoport’s global operations. Further, we do not conduct lobbying activities.

Supplier Management

Temperature-controlled supply chain support to the life sciences industry is critical to all that Cryoport does; therefore, we take an active approach to managing suppliers and partners to ensure that appropriate compliance, health, safety, labor practices, and ethical standards are employed. Our internal diligence process for third-party vendors includes a supplier questionnaire that is required for vendor approval and a regular auditing process thereafter for existing suppliers. The questionnaire is intended to verify that our suppliers have programs in place to manage material risk areas associated with the given supplier’s operations and particular consideration is paid to bribery or other forms of corrupt activity. Suppliers are not approved until this mandatory due diligence is complete and a completed assessment form is on file.

As an example, if one of our transportation suppliers employs or works with a Dangerous Goods Safety Advisor, we confirm the presence of a credentialed role responsible for overseeing activities associated with dangerous goods, including but not limited to, employee training and coaching, reporting, and monitoring of activities associated with the transportation of dangerous goods. The purpose of this inquiry is to gauge the degree of oversight over dangerous goods management by our suppliers to help ensure product and employee welfare.

Our Code of Conduct extends throughout our approved suppliers and thus sets an expectation for our suppliers to commit to operating with honesty, truthfulness and transparency in accordance to the highest ethical and corporate governance standards, as Cryoport personifies through our operations. Per our Code of Conduct, Cryoport will not tolerate the use by suppliers of forced labor in any form.

Data Privacy & Security

Cryoport uses an outside Center for Internet Security (CIS) assessment firm to evaluate our data security controls in an effort to protect our businesses and secure the information of our employees and customers. The CIS evaluation process utilizes the CIS’ Critical Security Controls Capability Maturity Model Integration (CMMI) methodology, and is an ongoing initiative used to continuously improve the CMMI rating for the Company.

Our customers rely on Cryoport to securely and reliably deliver temperature-controlled supply chain solutions globally, including providing a secure online portal for order entry, tracking, condition monitoring, and for the retrieval of historic information. Protecting the privacy of our customers and suppliers is essential to maintaining their trust, and we take a proactive approach to safeguard all data and ensure a secure environment. With the increasing presence and sophistication of online threats, we strive for continuous improvements that aim to protect our business and our customers. We regularly review our technology, policies, and practices to maintain compliance with all relevant global regulations. We do not sell customers’ data to third parties. Additionally, Cryoport employees with a computer are required to complete a annual online training courses on information security and data privacy. The courses addresses a range of topics related to information security and data privacy, including awareness regarding social engineering and cybercrimes, protecting the workplace, and protecting data.

19

Cryoport Societal and Environmental Impact Statements

Examples of some of our positive societal and environmental impacts for 2023 and 2024 include the following:

Our positive impacts for 2023 and 2024 were based on the following:

Access to Patients. Our calculation of the number of additional patients that were able to receive therapies was based our success rate for shipments, which is higher than the average success rate in the cold chain markets of 80%, pursuant to Rodrigue, J-P (2020), The Geography of Transport Systems, Fifth Edition, New York: Routledge.

Patient Success & Satisfaction. Our calculation of the number of intended parents able to have successful cycles resulting the birth of a child is based on the weighted average chance of a live singleton birth per intended egg retrieval across women of all ages of 27.23% as reported in the 2020 Society for Assisted Reproductive Technology (SART) Clinic Summary Report (CSR).

Energy Saved – MVE Biological Solutions. Our calculation of energy reduction is based on the reduced energy consumption from MVE freezer use compared to the average energy consumed by operation of mechanical freezers, which we assumed to be 31.7 kWh/day based on product specifications from a mechanical freezer manufacturer.

Energy Saved – CRYOGENE. Our calculation of GHG emissions avoided is based on the output mission rates for GHG emissions from the EPA eGRID data (2023) for the Electric Reliability Council of Texas (ERCOT).

Employees

We refer to our employees as our “team.” They are critical to our success, and we are in constant communication and training. We believe that we have assembled a strong management and leadership team with the experience and expertise needed to execute our business strategy. As of December 31, 2024, we had 1,186 employees: 1,090 full-time, 15 part-time, and 81 temporary, of which 489 are located in the Americas, 333 in EMEA and 364 in APAC. This increase of over 16 employees compared to December 31, 2023 is, primarily as a result of the further build out of our global organization, both organically and through acquisitions, to support our expanded

20

solutions offering and the expected growth in the markets we serve. We anticipate hiring additional personnel as required to support our global growth strategy.

Corporate History and Structure

We are a Nevada corporation originally incorporated under the name G.T.5-Limited (“GT5”) on May 25, 1990. In connection with a Share Exchange Agreement in March 2005, we changed our name to Cryoport, Inc. and acquired all of the issued and outstanding shares of common stock of Cryoport Systems, Inc., a California corporation. Cryoport Systems, Inc., which was originally formed in 1999 as a California limited liability company, was reorganized into a California corporation on December 11, 2000 and converted into Cryoport Systems, LLC, a California limited liability company, on September 17, 2020, and remains one of our operating companies under Cryoport, Inc. Our principal executive offices are located at 112 Westwood Place, Suite 350, Brentwood, TN 37027. The telephone number of our principal executive office is (949) 470-2300, and our main corporate website is www.cryoportinc.com. The information on or that can be accessed through our website is not part of this Form 10-K.

Information about our Executive Officers

The following are our executive officers as of the filing date of this Form 10-K: