EXHIBIT 4.1

Published on December 17, 2018

Exhibit 4.1

THESE SECURITIES HAVE NOT BEEN REGISTERED WITH THE SECURITIES AND EXCHANGE COMMISSION IN RELIANCE UPON AN EXEMPTION FROM REGISTRATION UNDER THE SECURITIES ACT OF 1933, AS AMENDED (THE “SECURITIES ACT”), OR UNDER ANY APPLICABLE STATE SECURITIES LAWS AND, ACCORDINGLY, MAY NOT BE OFFERED OR SOLD EXCEPT PURSUANT TO AN EFFECTIVE REGISTRATION STATEMENT UNDER THE SECURITIES ACT OR PURSUANT TO AN AVAILABLE EXEMPTION FROM, OR IN A TRANSACTION NOT SUBJECT TO, THE REGISTRATION REQUIREMENTS OF THE SECURITIES ACT AND IN COMPLIANCE WITH APPLICABLE STATE SECURITIES LAWS OR BLUE SKY LAWS.

Cryoport, Inc.

CONVERTIBLE NOTE

| Issuance Date: December 14, 2018 | Original Principal Amount: U.S. $15,000,000 |

FOR VALUE RECEIVED, Cryoport, Inc., a Nevada corporation (the “Company”), hereby promises to pay to Petrichor Opportunities Fund I LP or registered assigns (the “Holder”) in cash the amount set out above as the Original Principal Amount (as reduced pursuant to the terms hereof pursuant to redemption, conversion or otherwise, the “Principal”) when due, whether upon the Maturity Date, acceleration, redemption or otherwise (in each case in accordance with the terms hereof) and to pay interest (“Interest”) on any outstanding Principal at the applicable Interest Rate from the date set out above as the Issuance Date (the “Issuance Date”) until the same becomes due and payable, whether upon an Interest Date, the Maturity Date, acceleration, conversion, redemption or otherwise (in each case in accordance with the terms hereof). This Convertible Note (including all Convertible Notes issued in exchange, transfer or replacement hereof, this “Note”) is one of a series of Convertible Notes issued pursuant to the Securities Purchase Agreement on the Issuance Date (collectively, the “Notes” and such other Convertible Notes, the “Other Notes”). Certain capitalized terms used herein are defined in Section 31.

1. Payments of Principal. On the Maturity Date, the Company shall pay to the Holder an amount in cash equal to (i) all outstanding Principal, plus (ii) all accrued and unpaid Interest and accrued and unpaid Late Charges on such Principal and Interest. Other than as specifically permitted by this Note, the Company may not prepay any portion of the outstanding Principal, accrued and unpaid Interest, or accrued and unpaid Late Charges on Principal or Interest, if any. Notwithstanding anything herein to the contrary, with respect to any repayment, conversion or redemption hereunder, as applicable, the Company shall repay, convert or redeem, as applicable, (i) first, all accrued and unpaid Interest hereunder and under any other Notes held by such Holder, (ii) second, all accrued and unpaid Late Charges on any Principal and Interest hereunder and under any other Notes held by such Holder, (iii) third, all other amounts (other than Principal, but including any Redemption Premium) outstanding under any other Notes held by such Holder, and (v) fourth, all Principal outstanding hereunder and under any other Notes held by such Holder, in each case, allocated pro rata among this Note and such other Notes held by such Holder.

2. Interest. Interest on this Note shall commence accruing on the Issuance Date at the Interest Rate and shall be computed on the basis of a 360-day year and the actual number of days elapsed per month and shall be payable in arrears for each Calendar Quarter on the first (1st) Business Day of each Calendar Quarter after the Issuance Date (each, an “Interest Date”). Interest shall be payable on each Interest Date, to the record holder of this Note on the applicable Interest Date, by wire transfer of immediately available funds pursuant to wire instructions provided by the Holder in writing to the Company. Prior to the payment of Interest on an Interest Date, Interest on this Note shall accrue at the Interest Rate and be payable by way of inclusion of the Interest in the Conversion Amount in connection with any conversion of this Note under Section 3, on each Redemption Date and/or in connection with any required payment upon any Bankruptcy Event of Default.

1

3. Conversion of Notes. At any time after the Issuance Date, this Note shall be convertible into validly issued, fully paid and non-assessable shares of Common Stock, on the terms and conditions set forth in this Section 3.

3.1 Conversion Right. Subject to the provisions of Section 3.4, at any time or times on or after the Issuance Date, the Holder shall be entitled to convert any portion of the outstanding and unpaid Conversion Amount into fully paid and nonassessable shares of Common Stock in accordance with Section 3.3, at the Conversion Rate. The Company shall not issue any fraction of a share of Common Stock upon any conversion. If the issuance would result in the issuance of a fraction of a share of Common Stock, the Company shall round such fraction of a share of Common Stock up to the nearest whole share. The Company shall pay any and all transfer, stamp and similar taxes, costs and expenses (including, without limitation, fees and expenses of the transfer agent of the Company (the “Transfer Agent”)) that may be payable with respect to the issuance and delivery of Common Stock upon conversion of any Conversion Amount.

3.2 Conversion Rate. The number of shares of Common Stock issuable upon conversion of any Conversion Amount pursuant to Section 3 shall be determined by dividing (x) such Conversion Amount by (y) the Conversion Price (the “Conversion Rate”).

3.3 Mechanics of Conversion.

(a) Optional Conversion.

1. To convert any Conversion Amount into shares of Common Stock on any date (a “Conversion Date”), the Holder shall deliver (whether via facsimile, electronic mail or otherwise), for receipt on or prior to 11:59 p.m., New York time, on such date, a copy of an executed notice of conversion in the form attached hereto as Exhibit I (the “Conversion Notice”) to the Company. If required by Section 3.3(c), within two (2) Trading Days following a conversion of this Note as aforesaid, the Holder shall surrender this Note to a nationally recognized overnight delivery service for delivery to the Company (or an indemnification undertaking with respect to this Note in the case of its loss, theft or destruction as contemplated by Section 17.2).

2. On or before the second (2nd) Trading Day following the date of receipt of a Conversion Notice, the Company shall transmit by facsimile or electronic mail the transfer agent instructions and representation as to whether such shares of Common Stock may then be resold pursuant to (A) an effective and available registration statement, (B) Rule 144 unless the Holder affirmatively indicates on the applicable Conversion Notice that the shares of Common Stock issuable in connection with such Conversion Notice are not being resold either (x) prior to, (y) contemporaneously with, or (z) within thirty (30) days after, as applicable, the date of the applicable Conversion Notice by the Holder, or (C) Rule 144 without having to comply with the information requirements under Rule 144(c)(1) (each, a “Permitted Securities Transaction”), in the form attached hereto as Exhibit II, to the Holder and the Transfer Agent which shall instruct the Transfer Agent to process such Conversion Notice in accordance with the terms herein.

2

3. On or before the third (3rd) Trading Day following the date on which the Company has received a Conversion Notice (the “Share Delivery Deadline”), the Company shall (1) provided that the Transfer Agent is participating in The Depository Trust Company’s (“DTC”) Fast Automated Securities Transfer Program, with respect to the shares of Common Stock included in the Conversion Notice that may then be resold by the Holder pursuant to a Permitted Securities Transaction, credit such aggregate number of shares of Common Stock to which the Holder shall be entitled pursuant to such conversion to the Holder’s or its designee’s balance account with DTC through its Deposit/Withdrawal at Custodian system or (2) if the Transfer Agent is not participating in the DTC Fast Automated Securities Transfer Program or with respect to the shares of Common Stock included in the Conversion Notice that may not then be resold by the Holder pursuant to a Permitted Securities Transaction, a certificate, registered in the name of the Holder or its designee, for the number of shares of Common Stock to which the Holder shall be entitled pursuant to such conversion.

4. If this Note is physically surrendered for conversion pursuant to Section 3.3(c) and the outstanding Principal of this Note is greater than the Principal portion of the Conversion Amount being converted, then the Company shall as soon as practicable and in no event later than five (5) Business Days after receipt of this Note and at its own expense, issue and deliver to the Holder (or its designee) a new Note (in accordance with Section 17.4) representing the outstanding Principal not converted.

5. The Person or Persons entitled to receive the shares of Common Stock issuable upon a conversion of this Note shall be treated for all purposes as the record holder or holders of such shares of Common Stock on the Conversion Date.

3

(b) Company’s Failure to Timely Convert. If the Company shall fail, for any reason or for no reason, on or prior to the applicable Share Delivery Deadline, to either (A) if (i) the Transfer Agent is not participating in the DTC Fast Automated Securities Transfer Program or (ii) such applicable shares of Common Stock may not then be resold by the Holder pursuant a Permitted Securities Transaction, deliver a certificate for the number of shares of Common Stock to which the Holder is entitled and register such shares of Common Stock on the Company’s share register, or (B) if (i) the Transfer Agent is participating in the DTC Fast Automated Securities Transfer Program and (ii) such applicable shares of Common Stock may then be resold by the Holder pursuant to a Permitted Securities Transaction, credit the balance account of the Holder or the Holder’s designee with DTC for such number of shares of Common Stock to which the Holder is entitled upon the Holder’s conversion of this Note (as the case may be) (the occurrence of an event described in either clause (A) or (B) above, a “Conversion Failure”), then, in addition to all other remedies available to the Holder, (1) the Company shall pay in cash to the Holder on each day after such Share Delivery Deadline that the issuance of such shares of Common Stock is not timely effected an amount equal to 1.00% of the product of (A) the sum of the number of shares of Common Stock not issued to the Holder on or prior to the Share Delivery Deadline and to which the Holder is entitled, multiplied by (B) the greater of (x) the Closing Sale Price of the Common Stock on the applicable Conversion Date, and (y) the highest Closing Sale Price during the period (a) beginning on the later of (i) the applicable Conversion Date and (ii) the 45th day prior to the Share Delivery Date (as defined below), and (b) ending on the date on which the Company shall deliver the shares of Common Stock to which the Holder shall be entitled pursuant to such conversion in accordance with Section 3.3(a)(3) above (such date, the “Share Delivery Date”), and (2) the Holder, upon written notice to the Company, may void its Conversion Notice with respect to, and retain or have returned (as the case may be) any portion of this Note that has not been converted pursuant to such Conversion Notice, provided that the voiding of a Conversion Notice shall not affect the Company’s obligations to make any payments which have accrued prior to the date of such notice pursuant to this Section 3.3(b) or otherwise. In addition to the foregoing, if a Conversion Failure occurs and if on or after such Share Delivery Deadline the Holder purchases (in an open market transaction or otherwise) shares of Common Stock corresponding to all or any portion of the number of shares of Common Stock issuable upon such conversion that the Holder is entitled to receive from the Company and has not received from the Company in connection with such Conversion Failure (a “Buy-In”), then, in addition to all other remedies available to the Holder, the Company shall, within three (3) Business Days after receipt of the Holder’s request and in the Holder’s discretion, either: (I) pay cash to the Holder in an amount equal to the Holder’s total purchase price (including brokerage commissions and other out-of-pocket expenses, if any) for the shares of Common Stock so purchased (including, without limitation, by any other Person in respect, or on behalf, of the Holder) (the “Buy-In Price”), at which point the Company’s obligation to so issue and deliver such certificate (and to issue such shares of Common Stock) or credit the balance account of such Holder or such Holder’s designee, as applicable, with DTC for the number of shares of Common Stock to which the Holder is entitled upon the Holder’s conversion hereunder (as the case may be) (and to issue such shares of Common Stock) shall terminate, or (II) promptly honor its obligation to so issue and deliver to the Holder a certificate or certificates representing such shares of Common Stock or credit the balance account of such Holder or such Holder’s designee, as applicable, with DTC for the number of shares of Common Stock to which the Holder is entitled upon the Holder’s conversion hereunder (as the case may be) and pay cash to the Holder in an amount equal to the excess (if any) of the Buy-In Price over the product of (x) such number of shares of Common Stock multiplied by (y) the lower of (a) the Closing Sale Price of the Common Stock on the applicable Conversion Date, and (b) the lowest Closing Sale Price during the period (A) beginning on the later of (i) the applicable Conversion Date and (ii) the 45th day prior to the Share Delivery Date, and (B) ending on the Share Delivery Date. Nothing shall limit the Holder’s right to pursue any other remedies available to it hereunder, at law or in equity, including, without limitation, a decree of specific performance and/or injunctive relief with respect to the Company’s failure to timely deliver certificates representing shares of Common Stock (or to electronically deliver such shares of Common Stock) upon the conversion of this Note as required pursuant to the terms hereof. Notwithstanding anything herein to the contrary, with respect to any given Conversion Failure, this Section 3.3(b) shall not apply to the Holder to the extent the Company has already paid such amounts in full to such Holder with respect to the facts underlying such Conversion Failure, as applicable, pursuant to the analogous sections of the Securities Purchase Agreement.

4

(c) Registration; Book-Entry. The Company shall maintain a register (the “Register”) for the recordation of the names and addresses of the holders of each Note and the principal amount of the Notes held by such holders (the “Registered Notes”). The entries in the Register shall be conclusive and binding for all purposes absent manifest error. The Company and the holders of the Notes shall treat each Person whose name is recorded in the Register as the owner of a Note for all purposes (including, without limitation, the right to receive payments of Principal and Interest hereunder) notwithstanding notice to the contrary. A Registered Note may be assigned, transferred or sold in whole or in part only by registration of such assignment or sale on the Register. Upon its receipt of a written request to assign, transfer or sell all or part of any Registered Note by the holder thereof, the Company shall record the information contained therein in the Register and issue one or more new Registered Notes in the same aggregate principal amount as the principal amount of the surrendered Registered Note to the designated assignee or transferee pursuant to Section 17, provided that if the Company does not so record an assignment, transfer or sale (as the case may be) of all or part of any Registered Note within two (2) Business Days of such a request, then the Register shall be automatically deemed updated to reflect such assignment, transfer or sale (as the case may be). Notwithstanding anything to the contrary set forth in this Section 3, following conversion of any portion of this Note in accordance with the terms hereof, the Holder shall not be required to physically surrender this Note to the Company unless (A) the full Conversion Amount represented by this Note is being converted (in which event this Note shall be delivered to the Company following conversion thereof as contemplated by Section 3.3(a)) or (B) the Holder has provided the Company with prior written notice (which notice may be included in a Conversion Notice) requesting reissuance of this Note upon physical surrender of this Note. The Holder and the Company shall maintain records showing the Principal, Interest and Late Charges converted and/or paid (as the case may be) and the dates of such conversions and/or payments (as the case may be) or shall use such other method, reasonably satisfactory to the Holder and the Company, so as not to require physical surrender of this Note upon conversion. If the Company does not update the Register to record such Principal, Interest and Late Charges converted and/or paid (as the case may be) and the dates of such conversions, and/or payments (as the case may be) within two (2) Business Days of such occurrence, then the Register shall be automatically deemed updated to reflect such occurrence.

(d) Pro Rata Conversion; Disputes. In the event that the Company receives a Conversion Notice from more than one holder of Notes for the same Conversion Date and the Company can convert some, but not all, of such portions of the Notes submitted for conversion, the Company, subject to Section 3.4, shall convert from each holder of Notes electing to have Notes converted on such date a pro rata amount of such holder’s portion of its Notes submitted for conversion based on the principal amount of Notes submitted for conversion on such date by such holder relative to the aggregate principal amount of all Notes submitted for conversion on such date. In the event of a dispute as to the number of shares of Common Stock issuable to the Holder in connection with a conversion of this Note, the Company shall issue to the Holder the number of shares of Common Stock not in dispute and resolve such dispute in accordance with Section 22.

5

3.4 Limitations on Conversions.

(a) General. Subject to Section 3.4(b) below, the Company shall not effect the conversion of any portion of this Note, and the Holder shall not have the right to convert any portion of this Note pursuant to the terms and conditions of this Note and any such conversion shall be null and void and treated as if never made, to the extent that after giving effect to such conversion, the Holder together with the other Attribution Parties collectively would beneficially own in excess of 4.99% (the “Maximum Percentage”) of the shares of Common Stock outstanding immediately after giving effect to such conversion. For purposes of the foregoing sentence, the aggregate number of shares of Common Stock beneficially owned by the Holder and the other Attribution Parties shall include the number of shares of Common Stock held by the Holder and all other Attribution Parties plus the number of shares of Common Stock issuable upon conversion of this Note with respect to which the determination of such sentence is being made, but shall exclude shares of Common Stock which would be issuable upon (A) conversion of the remaining, nonconverted portion of this Note beneficially owned by the Holder or any of the other Attribution Parties and (B) exercise or conversion of the unexercised or nonconverted portion of any other securities of the Company (including, without limitation, any convertible notes or convertible preferred stock or warrants) beneficially owned by the Holder or any other Attribution Party subject to a limitation on conversion or exercise analogous to the limitation contained in this Section 3.4. For purposes of this Section 3.4, beneficial ownership shall be calculated in accordance with Section 13(d) of the Exchange Act. For purposes of determining the number of outstanding shares of Common Stock the Holder may acquire upon the conversion of this Note without exceeding the Maximum Percentage, the Holder may rely on the number of outstanding shares of Common Stock as reflected in (x) the Company’s most recent Annual Report on Form 10-K, Quarterly Report on Form 10-Q, Current Report on Form 8-K or other public filing with the SEC, as the case may be, (y) a more recent public announcement by the Company or (z) any other written notice by the Company or the Transfer Agent, if any, setting forth the number of shares of Common Stock outstanding (the “Reported Outstanding Share Number”). If the Company receives a Conversion Notice from the Holder at a time when the actual number of outstanding shares of Common Stock is less than the Reported Outstanding Share Number, the Company shall notify the Holder in writing of the number of shares of Common Stock then outstanding and, to the extent that such Conversion Notice would otherwise cause the Holder’s beneficial ownership, as determined pursuant to this Section 3.4, to exceed the Maximum Percentage, the Holder must notify the Company of a reduced number of shares of Common Stock to be purchased pursuant to such Conversion Notice. For any reason at any time, upon the written or oral request of the Holder, the Company shall within one (1) Business Day confirm orally and in writing or by electronic mail to the Holder the number of shares of Common Stock then outstanding. In any case, the number of outstanding shares of Common Stock shall be determined after giving effect to the conversion or exercise of securities of the Company, including this Note, by the Holder and any other Attribution Party since the date as of which the Reported Outstanding Share Number was reported. In the event that the issuance of shares of Common Stock to the Holder upon conversion of this Note results in the Holder and the other Attribution Parties being deemed to beneficially own, in the aggregate, more than the Maximum Percentage of the number of outstanding shares of Common Stock (as determined under Section 13(d) of the Exchange Act), the number of shares so issued by which the Holder’s and the other Attribution Parties’ aggregate beneficial ownership exceeds the Maximum Percentage (the “Excess Shares”) shall be deemed null and void and shall be cancelled ab initio, and the Holder shall not have the power to vote or to transfer the Excess Shares. Upon delivery of a written notice to the Company, the Holder may from time to time increase (with such increase not effective until the sixty-first (61st) day after delivery of such notice) or decrease the Maximum Percentage to any other percentage as specified in such notice; provided that (i) any such increase in the Maximum Percentage will not be effective until the sixty-first (61st) day after such notice is delivered to the Company and (ii) any such increase or decrease will apply only to the Holder and the other Attribution Parties and not to any other holder of Notes that is not an Attribution Party of the Holder. In addition, the Maximum Percentage shall be modified in the manner set forth in Section 3.4(b) below. For purposes of clarity, the shares of Common Stock issuable pursuant to the terms of this Note in excess of the Maximum Percentage shall not be deemed to be beneficially owned by the Holder for any purpose including for purposes of Section 13(d) or Rule 16a-1(a)(1) of the Exchange Act. No prior inability to convert this Note pursuant to this paragraph shall have any effect on the applicability of the provisions of this paragraph with respect to any subsequent determination of convertibility. The provisions of this paragraph shall be construed and implemented in a manner otherwise than in strict conformity with the terms of this Section 3.4 to the extent necessary to correct this paragraph (or any portion of this paragraph) which may be defective or inconsistent with the intended beneficial ownership limitation contained in this Section 3.4 or to make changes or supplements necessary or desirable to properly give effect to such limitation. The limitation contained in this paragraph may not be waived and shall apply to a successor holder of this Note.

6

(b) Mandatory Conversion and Optional Redemption Adjustments. Notwithstanding the provisions of Section 3.4(a), the Maximum Percentage shall be adjusted as set forth in Section 3.5(b)(iv) and Section 8.1(f)(iv), as applicable.

3.5 Mandatory Conversion.

(a) General. If, at any time on or prior to December 14, 2021 (the “Mandatory Conversion Expiration Date”), (x) the VWAP of the Common Stock listed on the Principal Market exceeds 1331/3% of the Conversion Price (the “Mandatory Conversion Minimum Price”) for fifteen (15) consecutive Trading Days (each, a “Mandatory Conversion Measuring Period”), and (y) no Equity Conditions Failure exists as of the last day of such Mandatory Conversion Measuring Period (the last day of the first occurring Mandatory Conversion Period satisfying the conditions set forth in clause (x) and (y), the “Mandatory Conversion Date”), then, on the Mandatory Conversion Date, all of the Conversion Amount of this Note shall automatically convert into fully paid, validly issued and nonassessable shares of Common Stock in accordance with Section 3.3 hereof at the Conversion Rate as of the Mandatory Conversion Date (a “Mandatory Conversion”). The Company shall deliver within two (2) Trading Days following the Mandatory Conversion Date a written notice thereof by facsimile and overnight courier to all, but not less than all, of the holders of Notes and the Transfer Agent (the “Mandatory Conversion Notice”). The Mandatory Conversion Notice shall state (i) the Mandatory Conversion Date, (ii) the aggregate Conversion Amount of the Notes subject to mandatory conversion from the Holder and all of the holders of the Notes pursuant to this Section 3.5 (and analogous provisions under the Other Notes) (the “Mandatory Conversion Amount”), (iii) the number of shares of Common Stock issued to the Holder on the Mandatory Conversion Date and (iv) that there has been no Equity Conditions Failure as of the last day of the applicable Mandatory Conversion Measuring Period. Notwithstanding anything herein to the contrary, at any time prior to the date all of the shares of Common Stock to be delivered to the Holder (or its designee) in such Mandatory Conversion have been delivered in full in compliance with Section 3.3 above, the Mandatory Conversion Amount may be converted, in whole or in part, by the Holders into shares of Common Stock pursuant to Section 3.

7

(b) Maximum Percentage. Notwithstanding the provisions of Section 3.5(a) above, in the event that (x) a Mandatory Conversion Date would otherwise be deemed to have occurred but for the existence of an Equity Condition Failure resulting solely as a result of the failure of the condition set forth in clause (iii) of the definition of “Equity Conditions” and (y) such Mandatory Conversion Date would have so occurred on a date on or prior to the Mandatory Conversion Expiration Date (such date satisfying clauses (x) and (y), the “First Deemed Mandatory Conversion Date”), then, notwithstanding anything to the contrary set forth herein:

(i) the condition set forth in clause (iii) of the definition of “Equity Conditions” shall be deemed satisfied on such First Deemed Mandatory Conversion Date;

(ii) on the First Deemed Mandatory Conversion Date, the portion of this Note representing the maximum portion of the Conversion Amount of this Note that could be converted into shares of Common Stock pursuant to Section 3.5(a) on such date such that the Holder together with the other Attribution Parties did not collectively own in excess of the then effective Maximum Percentage of the shares of Common Stock outstanding immediately after giving effect to such conversion (such portion of the Conversion Amount, the “First Conversion Amount”) shall be converted into fully paid, validly issued and nonassessable shares of Common Stock in accordance with Section 3.5(a) hereof at the Conversion Rate (assuming, for such purpose, that (x) the “Conversion Amount” referred to in Section 3.5(a) were equal to the First Conversion Amount and (y) the “Mandatory Conversion Date” referred to in Section 3.5(a) was the First Deemed Mandatory Conversion Date);

(iii) the Company shall otherwise comply with the provisions of Section 3.5(a) as though the “Mandatory Conversion Date” referred to in Section 3.5 was the First Deemed Mandatory Conversion Date;

(iv) upon the delivery by the Company to the Holder of the Mandatory Conversion Notice in accordance with Section 3.5(a), the Maximum Percentage shall automatically be increased, effective as of the sixty-first (61st) day following the First Deemed Mandatory Conversion Date (the “Second Deemed Mandatory Conversion Date”), to a percentage sufficient to permit the conversion in full of the remaining portion of this Note representing the remaining portion of the Conversion Amount (after giving effect to the conversion of the First Conversion Amount pursuant to clause (ii) above) as of the Second Deemed Mandatory Conversion Date (the “Remaining Conversion Amount”); and

(v) on the Second Deemed Mandatory Conversion Date, the portion of this Note representing the Remaining Conversion Amount shall be converted into fully paid, validly issued and nonassessable shares of Common Stock in accordance with Section 3.5(a) hereof at the Conversion Rate (assuming, for such purpose, that (x) the “Conversion Amount” referred to in Section 3.5(a) were equal to the Remaining Conversion Amount and (y) the “Mandatory Conversion Date” referred to in Section 3.5(a) was the Second Deemed Mandatory Conversion Date).

8

(c) Expiration. For the avoidance of doubt, the provisions of this Section 3.5 shall expire and cease to exist on the Mandatory Conversion Expiration Date; provided, however, if a First Deemed Mandatory Conversion Date occurs, then the provisions of this Section 3.5 shall expire and cease to exist on the Second Deemed Mandatory Conversion Date.

4. Rights Upon and Event of Default.

4.1 Event of Default. Each of the following events shall constitute an “Event of Default” and each of the events in clauses (f), (g) and (h) below shall constitute a “Bankruptcy Event of Default”:

(a) the Company’s failure to cure a Conversion Failure by delivery of the required number of shares of Common Stock within ten (10) Trading Days after the applicable Conversion Date;

(b) except to the extent the Company is in compliance with Section 10.2 below, at any time following the tenth (10th) Trading Day that the Holder’s Authorized Share Allocation is less than the number of shares of Common Stock that the Holder would be entitled to receive upon a conversion of the full Conversion Amount of this Note (without regard to any limitations on conversion set forth in Section 3.4 or otherwise);

(c) the Company’s or any Subsidiary’s failure to pay to the Holder any amount of Principal, Interest, Late Charges or other amounts within three (3) Trading Days after such amounts were due under this Note (including, without limitation, the Company’s or any Subsidiary’s failure to pay any redemption payments or amounts hereunder) or any other Transaction Document or any other agreement, document, certificate or other instrument delivered in connection with the transactions contemplated hereby and thereby;

(d) the Company fails to remove any restrictive legend on any certificate or any shares of Common Stock issued to the Holder as and when required by the Securities Purchase Agreement or this Note, unless otherwise then prohibited by applicable federal securities laws, and any such failure remains uncured for at least five (5) Trading Days;

(e) the occurrence of any default under, redemption of or acceleration prior to maturity of, any Indebtedness of the Company or any of its Subsidiaries, other than with respect to any Other Notes;

(f) bankruptcy, insolvency, reorganization or liquidation proceedings or other proceedings for the relief of debtors shall be instituted by or against the Company or any Subsidiary and, if instituted against the Company or any Subsidiary by a third party, shall not be dismissed within thirty (30) days of their initiation;

9

(g) the commencement by the Company or any Subsidiary of a voluntary case or proceeding under any applicable federal, state or foreign bankruptcy, insolvency, reorganization or other similar law or of any other case or proceeding to be adjudicated a bankrupt or insolvent, or the consent by it to the entry of a decree, order, judgment or other similar document in respect of the Company or any Subsidiary in an involuntary case or proceeding under any applicable federal, state or foreign bankruptcy, insolvency, reorganization or other similar law or to the commencement of any bankruptcy or insolvency case or proceeding against it, or the filing by it of a petition or answer or consent seeking reorganization or relief under any applicable federal, state or foreign law, or the consent by it to the filing of such petition or to the appointment of or taking possession by a custodian, receiver, liquidator, assignee, trustee, sequestrator or other similar official of the Company or any Subsidiary or of any substantial part of its property, or the making by it of an assignment for the benefit of creditors, or the execution of a composition of debts, or the occurrence of any other similar federal, state or foreign proceeding, or the admission by it in writing of its inability to pay its debts generally as they become due, the taking of corporate action by the Company or any Subsidiary in furtherance of any such action or the taking of any action by any Person to commence a Uniform Commercial Code foreclosure sale or any other similar action under federal, state or foreign law;

(h) the entry by a court of (i) a decree, order, judgment or other similar document in respect of the Company or any Subsidiary of a voluntary or involuntary case or proceeding under any applicable federal, state or foreign bankruptcy, insolvency, reorganization or other similar law or (ii) a decree, order, judgment or other similar document adjudging the Company or any Subsidiary as bankrupt or insolvent, or approving as properly filed a petition seeking liquidation, reorganization, arrangement, adjustment or composition of or in respect of the Company or any Subsidiary under any applicable federal, state or foreign law or (iii) a decree, order, judgment or other similar document appointing a custodian, receiver, liquidator, assignee, trustee, sequestrator or other similar official of the Company or any Subsidiary or of any substantial part of its property, or ordering the winding up or liquidation of its affairs, and the continuance of any such decree, order, judgment or other similar document or any such other decree, order, judgment or other similar document unstayed and in effect for a period of thirty (30) consecutive days;

(i) any default by the Company in the due performance and observance of any of the covenants or agreements contained Section 13;

(j) any representation, warranty or other written statement of the Company set forth in any Transaction Document or any certification provided by the Company pursuant to any Transaction Document is incorrect or misleading in any material respect when given;

(k) other than as specifically set forth in another clause of this Section 4.1, any default by the Company in the due performance and observance of any of the covenants or agreements of any Transaction Document, except, in the case of a breach of a covenant that is curable, only if such breach remains uncured for a period of two (2) consecutive Trading Days;

10

(l) a false or inaccurate certification (including a false or inaccurate deemed certification) by the Company that either (A) the Equity Conditions are satisfied, (B) there has been no Equity Conditions Failure, or (C) as to whether any Event of Default has occurred;

(m) any material provision of any Transaction Document shall at any time for any reason (other than pursuant to the express terms thereof) cease to be valid and binding on or enforceable against the parties thereto in any material respect, or the validity or enforceability thereof shall be contested by any party thereto, or a proceeding shall be commenced by the Company or any Subsidiary or any governmental authority having jurisdiction over any of them, seeking to establish the invalidity or unenforceability thereof, or the Company or any Subsidiary shall deny in writing that it has any liability or obligation purported to be created under any Transaction Document; or

(n) any Event of Default (as defined in the Other Notes) occurs with respect to any Other Notes.

4.2 Notice of an Event of Default: Event of Default Redemption Right. Upon the occurrence of an Event of Default with respect to this Note or any Other Note, the Company shall within one (1) Business Day of becoming aware of such Event of Default deliver written notice thereof via facsimile or electronic mail and overnight courier (with next day delivery specified) (an “Event of Default Notice”) to the Holder. At any time after the earlier of the Holder’s receipt of an Event of Default Notice and the Holder becoming aware of an Event of Default and ending (such ending date, the “Event of Default Right Expiration Date”) on the twentieth (20th) Trading Day after the later of (x) the date such Event of Default is cured and (y) the Holder’s receipt of an Event of Default Notice that includes (I) a reasonable description of the applicable Event of Default, (II) a certification as to whether, in the opinion of the Company, such Event of Default is capable of being cured and, if applicable, a reasonable description of any existing plans of the Company to cure such Event of Default and (III) a certification as to the date the Event of Default occurred and, if cured on or prior to the date of such Event of Default Notice, the applicable Event of Default Right Expiration Date, the Holder may require the Company to redeem (regardless of whether such Event of Default has been cured on or prior to the Event of Default Right Expiration Date) all or any portion of this Note by delivering written notice thereof (the “Event of Default Redemption Notice”) to the Company, which Event of Default Redemption Notice shall indicate the portion of this Note the Holder is electing to redeem. Each portion of this Note subject to redemption by the Company pursuant to this Section 4.2 shall be redeemed by the Company at a price equal to the product of (A) the Conversion Amount to be redeemed multiplied by (B) the Redemption Premium as of the date of the Event of Default (the “Event of Default Redemption Price”). Redemptions required by this Section 4.2 shall be made in accordance with the provisions of Section 11. To the extent redemptions required by this Section 4.2 are deemed or determined by a court of competent jurisdiction to be prepayments of this Note by the Company, such redemptions shall be deemed to be voluntary prepayments. Notwithstanding anything to the contrary in this Section 4.2, but subject to Section 3.4, until the Event of Default Redemption Price (together with any Late Charges thereon) is satisfied in full, the Conversion Amount submitted for redemption under this Section 4.2 (together with any Late Charges thereon) may be converted, in whole or in part, by the Holder into Common Stock pursuant to the terms of Section 3. In the event of the Company’s redemption of any portion of this Note under this Section 4.2, the Holder’s damages would be uncertain and difficult to estimate because of the parties’ inability to predict future interest rates and the uncertainty of the availability of a suitable substitute investment opportunity for the Holder. Accordingly, any redemption premium due under this Section 4.2 is intended by the parties to be, and shall be deemed, a reasonable estimate of the Holder’s actual loss of its investment opportunity and not as a penalty. Any redemption upon an Event of Default shall not constitute an election of remedies by the Holder, and all other rights and remedies of the Holder shall be preserved.

11

4.3 Mandatory Redemption upon Bankruptcy Event of Default. Notwithstanding anything to the contrary herein, and notwithstanding any conversion that is then required or in process, upon any Bankruptcy Event of Default, whether occurring prior to or following the Maturity Date, the Company shall immediately pay to the Holder an amount in cash representing (i) all outstanding Principal, accrued and unpaid Interest, and accrued and unpaid Late Charges on such Principal and Interest, multiplied by (ii) the Redemption Premium as of the date of the Bankruptcy Event of Default, in addition to any and all other amounts due hereunder, without the requirement for any notice or demand or other action by the Holder or any other person or entity; provided that the Holder may, in its sole discretion, waive such right to receive payment upon a Bankruptcy Event of Default, in whole or in part, and any such waiver shall not affect any other rights of the Holder hereunder, including any other rights in respect of such Bankruptcy Event of Default, any right to conversion, and any right to payment of the Event of Default Redemption Price or any other Redemption Price, as applicable.

5. Fundamental Transactions; Change of Control.

5.1 Fundamental Transactions.

(a) Restrictions. The Company shall not enter into or be party to a Fundamental Transaction unless: either (i) the Company is the surviving Person; or (ii) the Successor Entity (if other than the Company) assumes in writing all of the obligations of the Company under this Note and the other Transaction Documents as provided in Section 5.1(b).

(b) Assumption. To satisfy clause (ii) of Section 5.1(a), (i) the Successor Entity shall assume in writing all of the obligations of the Company under this Note and the other Transaction Documents pursuant to written agreements in form and substance reasonably satisfactory to the Holder and the Company (or the Successor Entity, as applicable), including agreements to deliver to each holder of Notes in exchange for such Notes a security of the Successor Entity evidenced by a written instrument substantially similar in form and substance to the Notes, including, without limitation, having a principal amount and interest rate equal to the principal amounts then outstanding and the interest rates of the Notes, respectively, held by such holder, having similar conversion rights as the Notes and having similar ranking and security to the Notes, and reasonably satisfactory to the Holder and the Company (or the Successor Entity, as applicable) and (ii) the Successor Entity (including its Parent Entity) is a publicly traded corporation whose common stock is quoted on or listed for trading on an Eligible Market. Upon the occurrence of any Fundamental Transaction, the Successor Entity shall succeed to, and be substituted for (so that from and after the date of such Fundamental Transaction, the provisions of this Note and the other Transaction Documents referring to the “Company” shall refer instead to the Successor Entity), and may exercise every right and power of the Company and shall assume all of the obligations of the Company under this Note and the other Transaction Documents with the same effect as if such Successor Entity had been named as the Company herein.

12

(c) Confirmation. Upon consummation of a Fundamental Transaction, the Successor Entity shall deliver to the Holder confirmation that there shall be issued upon conversion or redemption of this Note at any time after the consummation of such Fundamental Transaction, in lieu of the shares of Common Stock (or other securities, cash, assets or other property) issuable upon the conversion or redemption of the Notes prior to such Fundamental Transaction, such shares of the publicly traded common stock (or their equivalent) of the Successor Entity (including its Parent Entity) which the Holder would have been entitled to receive upon the happening of such Fundamental Transaction had this Note been converted immediately prior to such Fundamental Transaction (without regard to any limitations on the conversion of this Note), as adjusted in accordance with the provisions of this Note.

(d) Waiver. Notwithstanding the foregoing, the Holder may elect, at its sole option, by delivery of written notice to the Company to waive this Section 5.1 to permit the Fundamental Transaction without the assumption of this Note.

(e) Applicability. The provisions of this Section 5 shall apply similarly and equally to successive Fundamental Transactions and shall be applied without regard to any limitations on the conversion of this Note.

5.2 Notice of a Change of Control; Redemption Right. No sooner than twenty (20) Trading Days nor later than ten (10) Trading Days prior to the consummation of a Change of Control (the “Change of Control Date”), but not prior to the public announcement of such Change of Control, the Company shall deliver written notice thereof via facsimile or electronic mail and overnight courier to the Holder (a “Change of Control Notice”). At any time during the period beginning after the Holder’s receipt of a Change of Control Notice or the Holder becoming aware of a Change of Control if a Change of Control Notice is not delivered to the Holder in accordance with the immediately preceding sentence (as applicable) and ending on the later of ten (10) Trading Days after (A) the date of receipt of such Change of Control Notice or (B) only if a Change of Control Notice is not delivered to the Holder in accordance with the immediately preceding sentence, the Holder becoming aware of the consummation of such Change of Control, the Holder may require the Company to redeem all or any portion of this Note by delivering written notice thereof (“Change of Control Redemption Notice”) to the Company, which Change of Control Redemption Notice shall indicate the Conversion Amount the Holder is electing to redeem. The portion of this Note subject to redemption pursuant to this Section 5.2 shall be redeemed by the Company in cash at a price (the “Change of Control Redemption Price”) equal to (a) so long as the Company has timely delivered to the Holder a Change of Control Notice in accordance with this Section 5.2, with respect to such portion of this Note that represents the portion of this Note that could be immediately converted by the Holder into shares of Common Stock in accordance with Section 3.3 (subject to the limitations set forth in Section 3.4) the product of (w) the Redemption Premium as of the date of the date of the Change of Control multiplied by (y) such portion of the Conversion Amount being redeemed, and (b) with respect to (A) in the event the Company shall have not timely delivered to the Holder a Change of Control Notice in accordance with this Section 5.2, the entire Conversion Amount being redeemed, or (B) in the event the Company shall have timely delivered to the Holder a Change of Control Notice in accordance with this Section 5.2, the portion of the Conversion Amount being redeemed that is not subject to clause (a) above, the greater of (i) the product of (w) the Redemption Premium as of the date of the date of the Change of Control multiplied by (y) the Conversion Amount being redeemed, and (ii) the product of (y) the Redemption Premium as of the date of the Change of Control multiplied by (z) the product of (A) the Conversion Amount being redeemed multiplied by (B) the quotient of (I) the aggregate cash consideration plus the aggregate cash value of any non-cash consideration per share of Common Stock to be paid to the holders of the shares of Common Stock upon consummation of such Change of Control (any such non-cash consideration constituting publicly-traded securities shall be valued at the highest of the Closing Sale Price of such securities as of the Trading Day immediately prior to the consummation of such Change of Control, the Closing Sale Price of such securities on the Trading Day immediately following the public announcement of such proposed Change of Control and the Closing Sale Price of such securities on the Trading Day immediately prior to the public announcement of such proposed Change of Control) divided by (II) the Conversion Price then in effect (the “Change of Control Redemption Price”). Redemptions required by this Section 5.2 shall be made in accordance with the provisions of Section 11 and shall have priority to payments to stockholders in connection with such Change of Control. To the extent redemptions required by this Section 5.2 are deemed or determined by a court of competent jurisdiction to be prepayments of this Note by the Company, such redemptions shall be deemed to be voluntary prepayments. Notwithstanding anything to the contrary in this Section 5.2, but subject to Section 3.4, until the Change of Control Redemption Price (together with any Late Charges thereon) is paid in full, the Conversion Amount submitted for redemption under this Section 5.2 (together with any Late Charges thereon) may be converted, in whole or in part, by the Holder into Common Stock pursuant to Section 3. In the event of the Company’s redemption of any portion of this Note under this Section 5.2, the Holder’s damages would be uncertain and difficult to estimate because of the parties’ inability to predict future interest rates and the uncertainty of the availability of a suitable substitute investment opportunity for the Holder. Accordingly, any redemption premium due under this Section 5.2 is intended by the parties to be, and shall be deemed, a reasonable estimate of the Holder’s actual loss of its investment opportunity and not as a penalty.

13

6. Intentionally Omitted.

7. Adjustments to the Conversion Price.

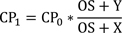

7.1 Adjustment of Conversion Price upon Subdivision or Combination of Common Stock or Stock Dividend. If the Company issues solely shares of Common Stock as a dividend or distribution on all or substantially all shares of the Common Stock, or if the Company effects a stock split or a stock combination of the Common Stock (in each case excluding an issuance solely pursuant to a Fundamental Transaction, as to which the provisions set forth in Section 5 will apply), then the Conversion Price will be adjusted based on the following formula:

Where:

| CP0 | = | the Conversion Price in effect immediately before the open of business on the ex-dividend date for such dividend or distribution, or immediately before the open of business on the effective date of such stock split or stock combination, as applicable |

| CP1 | = | the Conversion Price in effect immediately after the open of business on such ex-dividend date or the open of business on such effective date, as applicable |

| OS0 | = | the number of shares of Common Stock outstanding immediately before the open of business on such ex-dividend date or effective date, as applicable |

| OS1 | = | the number of shares of Common Stock outstanding immediately after giving effect to such dividend, distribution, stock split or stock combination |

14

For the avoidance of doubt, pursuant to the definition of CP1 above, any adjustment to the Conversion Price made pursuant to this Section 7.1 will become effective immediately after the open of business on such ex-dividend date or the open of business on such effective date, as applicable. If any dividend, distribution, stock split or stock combination of the type described in this Section 7.1 is declared or announced, but not so paid or made, then the Conversion Price, if previously adjusted, will be readjusted, effective as of the date the Board of Directors of the Company determines not to pay such dividend or distribution or to effect such stock split or stock combination, to the Conversion Price that would then be in effect had such dividend, distribution, stock split or stock combination not been declared or announced.

7.2 Rights, Options and Warrants. If the Company distributes, to all or substantially all holders of Common Stock, rights, options or warrants entitling such holders, for a period of not more than sixty (60) calendar days after the record date of such distribution, to subscribe for or purchase shares of Common Stock at a price per share that is less than the average of the Closing Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date such distribution is publicly announced (excluding such distributions made in connection with a bona fide capital raise by the Company where (x) the price per share of Common Stock is not less than sixty five percent (65%) of the average of the Closing Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date such distribution is publicly announced, and (y) the exercise period in which the holder of such right, option or warrant may exercise such right, option or warrant to purchase shares of Common Stock shall expire no later than the 60th day following the date of such distribution), then the Conversion Price will be decreased based on the following formula:

Where:

| CP0 | = | the Conversion Price in effect immediately before the open of business on the ex-dividend date for such distribution |

| CP1 | = | the Conversion Price in effect immediately after the open of business on such ex-dividend date |

| OS | = | the number of shares of Common Stock outstanding immediately before the open of business on such ex-dividend date |

| X | = | the total number of shares of Common Stock issuable pursuant to such rights, options or warrants |

| Y | = | a number of shares of Common Stock obtained by dividing (x) the aggregate price amount to exercise all such rights, options or warrants distributed by the Company by (y) the average of the Closing Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date such distribution is announced |

15

For the avoidance of doubt, any adjustment to the Conversion Price made pursuant to this Section 7.2 will be made successively whenever any such rights, options or warrants are issued and, pursuant to the definition of CP1 above, will become effective immediately after the open of business on the ex-dividend date for the applicable distribution. To the extent that shares of Common Stock are not delivered after the expiration of such rights, options or warrants (including as a result of such rights, options or warrants not being exercised), the Conversion Price, if previously adjusted, will be readjusted effective as of such expiration date to the Conversion Price that would then be in effect had the decrease to the Conversion Price for such distribution been made on the basis of delivery of only the number of shares of Common Stock actually delivered upon exercise of such rights, option or warrants. To the extent such rights, options or warrants are not so distributed, the Conversion Price will be readjusted effective as of the date the Board of Directors of the Company determines not to distribute such rights, options or warrants, to the Conversion Price that would then be in effect had the ex-dividend date for the distribution of such rights, options or warrants not occurred. For purposes of this Section 7.2, in determining whether any rights, options or warrants entitle holders of Common Stock to subscribe for or purchase shares of Common Stock at a price per share that is less than the average of the Closing Sale Prices per share of Common Stock for the ten (10) consecutive Trading Days ending on, and including, the Trading Day immediately before the date of the distribution of such rights, options or warrants is announced, and in determining the aggregate price payable to exercise such rights, options or warrants, there will be taken into account any consideration the Company receives for such rights, options or warrants and any amount payable on exercise thereof, with the value of such consideration, if not cash, to be determined by the Board of Directors of the Company.

7.3 Voluntary Adjustment by Company. The Company may at any time during the term of this Note, with the prior written consent of the Required Holders, reduce the then current Conversion Price to any amount and for any period of time deemed appropriate by the Board of Directors of the Company.

8. Redemptions at the Company’s Election.

8.1 Company Optional Redemption.

(a) At any time after June 14, 2019, the Company shall have the right to redeem all, but not less than all, of the Conversion Amount then remaining under this Note (the “Company Optional Redemption Amount”) on the Company Optional Redemption Date (a “Company Optional Redemption”). The portion of this Note subject to redemption pursuant to this Section 8.1 shall be redeemed by the Company in cash at a price (the “Company Optional Redemption Price”) equal to the product of (A) the Redemption Premium as of the Company Optional Redemption Date multiplied by (B) the Conversion Amount being redeemed as of the Company Optional Redemption Date.

16

(b) The Company may exercise its right to require redemption under this Section 8.1 by delivering a written notice thereof by facsimile or electronic mail and overnight courier to all, but not less than all, of the holders of Notes (the “Company Optional Redemption Notice” and the date all of the holders of Notes received such notice is referred to as the “Company Optional Redemption Notice Date”). The Company may deliver only one Company Optional Redemption Notice hereunder and such Company Optional Redemption Notice shall be irrevocable. The Company Optional Redemption Notice shall (x) state the date on which the Company Optional Redemption shall occur (the “Company Optional Redemption Date”) which date shall not be less than ten (10) Trading Days nor more than twenty (20) Trading Days following the Company Optional Redemption Notice Date, (y) certify that there has been no Equity Conditions Failure and (z) state the aggregate Conversion Amount of the Notes which is being redeemed in such Company Optional Redemption from the Holder and all of the other holders of the Notes pursuant to this Section 8.1 (and analogous provisions under the Other Notes) on the Company Optional Redemption Date.

(c) Notwithstanding anything herein to the contrary, (i) if no Equity Conditions Failure has occurred as of the Company Optional Redemption Notice Date but an Equity Conditions Failure occurs at any time prior to the Company Optional Redemption Date, (A) the Company shall provide the Holder a subsequent notice to that effect, and (B) unless the Holder waives the Equity Conditions Failure, the Company Optional Redemption shall be cancelled and the applicable Company Optional Redemption Notice shall be null and void, and (ii) at any time prior to the date the Company Optional Redemption Price is paid, in full, the Company Optional Redemption Amount may be converted, in whole or in part, by the Holder into shares of Common Stock pursuant to Section 3.

(d) All Conversion Amounts converted by the Holder after the Company Optional Redemption Notice Date shall reduce the Company Optional Redemption Amount of this Note required to be redeemed on the Company Optional Redemption Date. Redemptions made pursuant to this Section 8.1 shall be made in accordance with Section 11.

(e) In the event of the Company’s redemption of any portion of this Note under this Section 8.1, the Holder’s damages would be uncertain and difficult to estimate because of the parties’ inability to predict future interest rates and the uncertainty of the availability of a suitable substitute investment opportunity for the Holder. Accordingly, any redemption premium due under this Section 8.1 is intended by the parties to be, and shall be deemed, a reasonable estimate of the Holder’s actual loss of its investment opportunity and not as a penalty. For the avoidance of doubt, the Company shall have the right to effect a Company Optional Redemption if any Event of Default has occurred and continuing.

17

(f) Notwithstanding the foregoing provisions of this Section 8.1, in the event that (x) the Company desires to effect a Company Optional Redemption of this Note on a Company Optional Redemption that, but for the existence of an Equity Condition Failure resulting solely as a result of the failure of the condition set forth in clause (iii) of the definition of “Equity Conditions” as of the Company Optional Redemption Notice Date or the Company Optional Redemption Date, otherwise complies with this Section 8.1 and (y) such Company Optional Redemption Date would occur on a date not less than sixty one days prior to the Maturity Date (a Company Optional Redemption Date satisfying clauses (x) and (y), the “First Deemed Optional Redemption Date”), then, notwithstanding anything to the contrary set forth herein:

(i) the condition set forth in clause (iii) of the definition of “Equity Conditions” shall be deemed satisfied on such First Deemed Optional Redemption Date;

(ii) on the First Deemed Optional Redemption Date, the portion of this Note representing the maximum portion of the Conversion Amount of this Note that could be converted into shares of Common Stock pursuant to Section 3.3 (subject to the limitations in Section 3.4) on such date such that the Holder together with the other Attribution Parties did not collectively own in excess of the then effective Maximum Percentage of the shares of Common Stock outstanding immediately after giving effect to such conversion (such portion of the Conversion Amount, the “First Redemption Amount”) shall be redeemed by the Company in cash at the Company Optional Redemption Price in accordance with the foregoing provisions of this Section 8.1 (assuming, for such purpose, that (x) the “Company Optional Redemption Amount” referred to in Section 8.1(a) were equal to the First Redemption Amount and (y) the “Company Optional Redemption Date” referred to in Section 8.1(b) was the First Deemed Optional Redemption Date); provided, that, at any time prior to the date the Company Optional Redemption Price in respect of such redemption is paid, in full, the First Redemption Amount may be converted, in whole or in part, by the Holder into shares of Common Stock pursuant to Section 3;

(iii) the Company shall otherwise comply with the provisions of this Section 8.1 as though the “Company Optional Redemption Date” referred to in Section 8.1(b) was the First Deemed Optional Redemption Date;

(iv) upon the delivery by the Company to the Holder of the Company Optional Redemption Notice in accordance with Section 8.1(b), the Maximum Percentage shall automatically be increased, effective as of the sixty-first (61st) day following the First Deemed Optional Redemption Date (the “Second Deemed Optional Redemption Date”), to a percentage sufficient to permit the conversion in full of the remaining portion of this Note representing the remaining portion of the Conversion Amount (after giving effect to the redemption of the First Redemption Amount pursuant to clause (ii) above) as of the Second Deemed Optional Redemption Date (the “Remaining Redemption Amount”); and

(v) on the Second Deemed Optional Redemption Date, the portion of this Note representing the Remaining Redemption Amount shall be redeemed by the Company in cash at the Company Optional Redemption Price in accordance with the foregoing provisions of this Section 8.1 (assuming, for such purpose, that (x) the “Company Optional Redemption Amount” referred to in Section 8.1(a) were equal to the Remaining Redemption Amount and (y) the “Company Optional Redemption Date” referred to in Section 8.1(b) was the Second Deemed Optional Redemption Date); provided, that, at any time prior to the date the Company Optional Redemption Price in respect of such redemption is paid, in full, the Remaining Redemption Amount may be converted, in whole or in part, by the Holder into shares of Common Stock pursuant to Section 3 (and, for the avoidance of doubt, in the that the Holder delivers a Conversion Notice with respect to such Remaining Redemption Amount prior to the Second Optional Redemption Date, such the redemption contemplated by this clause (v) shall not occur).

18

8.2 Pro Rata Redemption Requirement. If the Company elects to cause a Company Optional Redemption of this Note pursuant to Section 8.1, then it must simultaneously take the same action with respect to all of the Other Notes.

9. Noncircumvention. The Company hereby covenants and agrees that the Company will not, by amendment of its certificate or articles of incorporation, bylaws or other governing document or through any reorganization, transfer of assets, consolidation, merger, scheme of arrangement, dissolution, issue or sale of securities, or any other voluntary action, avoid or seek to avoid the observance or performance of any of the terms of this Note, and will at all times in good faith carry out all of the provisions of this Note and take all action as may be required to protect the rights of the Holder of this Note. Without limiting the generality of the foregoing or any other provision of this Note or the other Transaction Documents, the Company (a) shall not increase the par value of any shares of Common Stock receivable upon conversion of this Note above the Conversion Price then in effect, and (b) shall take all such actions as may be necessary or appropriate in order that the Company may validly and legally issue fully paid and nonassessable shares of Common Stock upon the conversion of this Note.

10. Reservation of Authorized Shares.

10.1 Reservation. The Company shall initially reserve out of its authorized and unissued shares of Common Stock a number of shares of Common Stock for each of this Note and the Other Notes equal to 120% of the Conversion Rate with respect to the Conversion Amount of each such Note as of the Issuance Date. So long as any of this Note and the Other Notes are outstanding, the Company shall take all action necessary to reserve and keep available out of its authorized and unissued Common Stock, solely for the purpose of effecting the conversion of this Note and the Other Notes, the number of shares of Common Stock as shall from time to time be necessary to effect the conversion of all of the Notes then outstanding; provided, that at no time shall the number of shares of Common Stock so reserved be less than the number of shares required to be reserved pursuant hereto (in each case, without regard to any limitations on conversions) (the “Required Reserve Amount”). The initial number of shares of Common Stock reserved for conversions of this Note and the Other Notes and each increase in the number of shares so reserved shall be allocated pro rata among the Holder and the holders of the Other Notes based on the Principal amount of this Note and the Other Notes held by each holder at the Closing (as defined in the Securities Purchase Agreement) or at the time of the increase in the number of reserved shares, as the case may be (the “Authorized Share Allocation”). In the event that a holder shall sell or otherwise transfer this Note, or a portion thereof, or any of such holder’s Other Notes, each transferee shall be allocated a pro rata portion of such holder’s Authorized Share Allocation.

19

10.2 Insufficient Authorized Shares.

(a) If at any time while any of the Notes remain outstanding the Company does not have a sufficient number of authorized and unreserved shares of Common Stock to satisfy its obligation to have reserved for issuance upon conversion of the outstanding Notes at least a number of shares of Common Stock equal to the Required Reserve Amount (an “Authorized Share Failure”), then the Company shall promptly take all action necessary to increase the Company’s authorized shares of Common Stock to an amount sufficient to allow the Company to reserve the Required Reserve Amount for the Notes then outstanding. Without limiting the generality of the foregoing sentence, as soon as practicable after the date of the occurrence of an Authorized Share Failure, but in no event later than sixty (60) days after the occurrence of such Authorized Share Failure, the Company shall either (x) obtain the written consent of its stockholders for the approval of an increase in the number of authorized shares of Common Stock and provide each stockholder with an information statement with respect thereto or (y) file with the SEC a proxy statement for a meeting of its stockholders at which meeting the Company will seek the approval of its stockholders for an increase in the number of authorized shares of Common Stock. In connection with such meeting, the Company shall provide each stockholder with a proxy statement and shall use commercially reasonable efforts to solicit its stockholders’ approval of such increase in authorized shares of Common Stock and to cause its Board of Directors to recommend to the stockholders that they approve such proposal. Notwithstanding the foregoing, if during any such time of an Authorized Share Failure, the Company is able to obtain the written consent of a majority of the shares of its issued and outstanding Common Stock to approve the increase in the number of authorized shares of Common Stock, the Company may satisfy this obligation by obtaining such consent and submitting for filing with the SEC an Information Statement on Schedule 14C.

(b) If, upon any conversion of this Note, the Company does not have sufficient authorized shares to deliver in satisfaction of such conversion, then unless the Holder elects to rescind such attempted conversion, the Holder may require the Company, in lieu of issuing Common Stock in connection with such conversion and in full satisfaction of the Company’s obligations with respect to such conversion, to pay to the Holder within three (3) Trading Days of the applicable attempted conversion, cash in an amount equal to the product of (i) the number of shares of Common Stock that the Company is unable to deliver pursuant to this Section 10, and (ii) the highest Closing Sale Price of the Common Stock during the period beginning on the applicable Conversion Date and ending on the date the Company makes the applicable cash payment.

11. Redemptions.

11.1 Mechanics.

(a) If the Holder has submitted an Event of Default Redemption Notice in accordance with Section 4.2, the Company shall deliver the applicable Event of Default Redemption Price to the Holder in cash within five (5) Business Days after the Company’s receipt of the Holder’s Event of Default Redemption Notice (each, an “Event of Default Redemption Date”).

(b) If the Holder has submitted a Change of Control Redemption Notice in accordance with Section 5.2, the Company shall deliver the applicable Change of Control Redemption Price to the Holder in cash concurrently with the consummation of such Change of Control if such notice is received prior to the consummation of such Change of Control and within five (5) Business Days after the Company’s receipt of such notice otherwise (each, a “Change of Control Redemption Date”).

20

(c) In the event of a Company Optional Redemption, the Company shall deliver the applicable Company Optional Redemption Price to the Holder in cash on the applicable Company Optional Redemption Date (which, to the extent the provisions of Section 8.1(f) apply, include the First Deemed Optional Redemption Date and Second Deemed Optional Redemption Date, as applicable).

(d) Notwithstanding anything herein to the contrary, in connection with any redemption hereunder at a time the Holder is entitled to receive a cash payment under any of the other Transaction Documents, at the option of the Holder delivered in writing to the Company, the applicable Redemption Price hereunder shall be increased by the amount of such cash payment owed to the Holder under such other Transaction Document and, upon payment in full or conversion in accordance herewith, shall satisfy the Company’s payment obligation under such other Transaction Document.

(e) In the event of a redemption of less than all of the Conversion Amount of this Note, the Company shall promptly cause to be issued and delivered to the Holder a new Note (in accordance with Section 17.4) representing the outstanding Principal which has not been redeemed.

(f) In the event that the Company does not pay the applicable Redemption Price to the Holder within the time period required, at any time thereafter and until the Company pays such unpaid Redemption Price in full, the Holder shall have the option, in lieu of redemption, to require the Company to promptly return to the Holder all or any portion of this Note representing the Conversion Amount that was submitted for redemption and for which the applicable Redemption Price (together with any Late Charges thereon) has not been paid. Upon the Company’s receipt of such notice, (x) the applicable Redemption Notice shall be null and void with respect to such Conversion Amount, and (y) the Company shall immediately return this Note, or issue a new Note (in accordance with Section 17.4), to the Holder; provided, that, notwithstanding the applicable Redemption Notice being deemed null and void and such return or issuance of this Note or a new Note in accordance with the foregoing, a continual Event of Default shall thereafter be deemed to have occurred and be continuing until the subsequent repayment or conversion of this Note in full. Furthermore, the Holder’s delivery of a notice voiding a Redemption Notice and exercise of its rights following such notice shall not affect the Company’s obligations to make any payments of Late Charges which have accrued prior to the date of such notice with respect to the Conversion Amount subject to such notice.

11.2 Redemption by Other Holders. Upon the Company’s receipt of notice from any of the holders of the Other Notes for redemption or repayment as a result of an event or occurrence substantially similar to the events or occurrences described in Section 4 or Section 5.2 (each, an “Other Redemption Notice”), the Company shall immediately, but no later than two (2) Business Days after its receipt thereof, forward to the Holder by facsimile or electronic mail a copy of such notice. If the Company receives a Redemption Notice and one or more Other Redemption Notices, during the seven (7) Business Day period beginning on and including the date which is two (2) Business Days prior to the Company’s receipt of the Holder’s applicable Redemption Notice and ending on and including the date which is five (5) Business Days after the Company’s receipt of the Holder’s applicable Redemption Notice and the Company is unable to redeem all principal, interest and other amounts designated in such Redemption Notice and such Other Redemption Notices received during such seven (7) Business Day period, then the Company shall redeem a pro rata amount from each holder of the Notes (including the Holder) based on the principal amount of the Notes submitted for redemption pursuant to such Redemption Notice and such Other Redemption Notices received by the Company during such seven (7) Business Day period.

21

12. Voting Rights. The Holder shall have no voting rights as the holder of this Note, except as required by law and as expressly provided in this Note.

13. Covenants. Until all of the Notes have been converted, redeemed or otherwise satisfied, in full, in accordance with their terms:

13.1 Rank. All payments due under this Note (a) shall rank pari passu with all Other Notes and (b) shall be senior to all other Indebtedness of the Company and its Subsidiaries.

13.2 Incurrence of Indebtedness. The Company shall not, and the Company shall not permit any of its Subsidiaries to, directly or indirectly, incur or guarantee, assume or suffer to exist any Indebtedness (other than (i) the Indebtedness evidenced by this Note and the Other Notes and (ii) other Permitted Indebtedness).

13.3 Existence of Liens. The Company shall not, and the Company shall not permit any of its Subsidiaries to, directly or indirectly, allow or suffer to exist any mortgage, lien, pledge, charge, security interest or other encumbrance upon or in any property or assets (including accounts and contract rights) owned by the Company or any of its Subsidiaries (collectively, “Liens”) other than Permitted Liens.

13.4 Redemption and Dividends. The Company shall not, and the Company shall cause each of its Subsidiaries to not, directly or indirectly, redeem, repurchase or declare or pay any dividend or distribution on any of its capital stock (any of the foregoing, a “Restricted Payment”), other than (i) Restricted Payments made by any Subsidiary to the Company or any other Subsidiary of the Company, (ii) any dividend payments or other distributions by the Company or any Subsidiary payable solely in shares of capital stock of such Person and (iii) purchases, repurchases, redemptions, defeasances or other acquisitions or retirements of capital stock deemed to occur upon the exercise of stock options, warrants or other rights in respect thereof if such capital stock represents a portion of the exercise price thereof.

13.5 Transfer of Assets. The Company shall not, and the Company shall cause each of its Subsidiaries to not, directly or indirectly, sell, lease, license, assign, transfer, spin-off, split-off, close, convey or otherwise dispose of substantially all of the assets or rights of the Company and its Subsidiaries owned or hereafter acquired whether in a single transaction or a series of related transactions.