EXHIBIT 99.1

Published on May 19, 2015

Exhibit 99.1

Cryoport Reports Record Revenues

For Fourth Quarter and Fiscal Year 2015

- - -

Strong performance in cryogenic logistics solutions and increase in customer base drives revenue growth of 44% for 4Q and 48% for FY2015

- - -

Flexible and expanded cryogenic solutions being well received by several new market segments

- - -

Board of Directors implement a 1-for-12 reverse stock split

LAKE FOREST, CA – May 19, 2015 — Cryoport, Inc. (OTCBB: CYRX) today announced financial results for the three and twelve-month periods ended March 31, 2015.

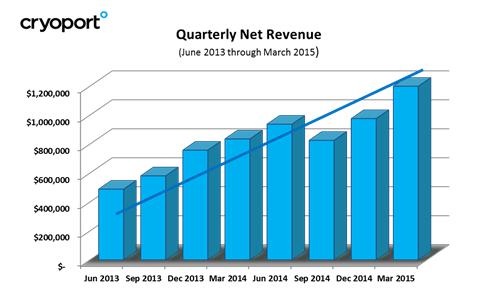

Results for the fiscal year ended March 31, 2015

Net revenues increased 48% to $3.9 million for the year ended March 31, 2015, as compared with $2.7 million for the year ended March 31, 2014. This increase was driven by Cryoport’s overall growth across the board and in the number of customers using Cryoport Express® Solutions compared with the same period in the prior year.

Gross margin nearly doubled to 30% of net revenues for the year ended March 31, 2015, as compared with a gross margin of 16% of net revenues for the year ended March 31, 2014. The increase in gross margin illustrates the operating leverage in the business model as revenue continues to ramp.

Selling, General and Administrative (“SG&A”) costs increased 26% to $6.4 million for the year ended March 31, 2015, compared with $5.1 million for the same period last year. The increase in SG&A is primarily attributable to the expansion of the company’s sales team to support future growth projections of the business in key regions, as well as an increase in investor relations activities and public company related expenses.

The Company reduced its net loss attributable to common stockholders by 38% for the fiscal year ended March 31, 2015 to $12.2 million or $2.44 per share, compared with a net loss of $19.6 million or $4.81 per share for the same period last year. The net loss attributable to common stockholders for the fiscal year ended March 31, 2015 included a non-cash, preferred stock beneficial conversion charge of $4.9 million; while the net loss attributable to common stockholders for fiscal year 2014 includes a one-time, non-cash debt conversion expense of $13.7 million.

|

1 |

Results for the fourth quarter ended March 31, 2015

Net revenues increased 44% to $1.2 million for the quarter ended March 31, 2015, as compared with $835,000 for the same period last year. This increase was primarily driven by Cryoport’s overall growth across the board and in the number of customers using Cryoport Express® Solutions compared with the same period in the prior year. In addition, Cryoport made a number of key announcements during the quarter including announcing relationships in which Cryoport is supporting the clinical programs of Kite Pharma, Sanaria, and Capricor Therapeutics.

Gross margin nearly doubled for the three months ended March 31, 2015 to 31% of net revenues, as compared with a gross margin of 17% of net revenues for the three months ended March 31, 2014. The decline in cost of revenue as a percentage of revenues for the quarter demonstrates Cryoport’s ability to profitably scale its business over the past twelve months.

Net loss attributable to common stockholders for the three months ended March 31, 2015 was $4.0 million, or $0.79 per basic and diluted share compared with a net loss attributable to common stockholders of $1.4 million, or $0.29 per basic and diluted share, for the same period last year. The net loss attributable to common stockholders for the quarter ended March 31, 2015 included a non-cash, preferred stock beneficial conversion charge of $1.9 million; while there were no comparable charges in the prior year quarter.

Cryoport’s Chief Executive Officer, Jerrell Shelton, commented, “We are pleased to deliver another quarter of double digit growth and close out the fiscal year with a 48% jump in revenue, year over year. We have scaled our operations to a level that our gross margin is in the range of 30%, or $1.2 million for the year, which is a 168% improvement over our previous fiscal year. With the momentum we are seeing in the business, we are also working towards an uplisting to the Nasdaq, to attract institutional investors, increase stock liquidity and enhance the value of our company.”

“The growth for the year was driven by a diverse base of new and expanding client relationships and a further increase in our IVF business. Most of these clients are either in the early stages of their product development or in the early stages of introducing our solutions to their operations. We view this as ‘built in’ growth as there are significant opportunities for these relationships to expand over time. Many of these companies are in exciting market segments that are experiencing significant growth, such as CAR-T Cells, stem cells, cell therapies, cell line manufacturing, research, and vaccines, as well as animal husbandry and in vitro fertilization (IVF). In addition, our support of clinical trials is also developing in all segments and across all regions. In fact, as of the end of the fourth quarter, Cryoport was actively supporting the logistics needs for 34 clinical trials including six phase III programs.”

|

2 |

“As an example, one leading animal health company and a significant client of ours, incorporates one of our most comprehensive solutions into their business with our on-site logistics personnel who use our Cryoportal™, which is our logistics management platform to provide a fully outsourced cryogenic logistics service. This outsourced solution is comprehensive and we can leverage it across various client bases to support their respective, specific and customized cryogenic logistics requirements.

“Another example of our capabilities is exhibited in our partnership with a biotechnology company in the orthopedic industry, which we think has significant potential. We designed and initiated a program that combines various elements of our proprietary, purpose-built cold chain logistics solutions with this company’s product and distribution capabilities. The unique relationship incorporates our advanced logistics expertise and utilizes our patented liquid nitrogen (LN2) dry vapor shippers allowing for ‘points-of-use’ by US-based orthopedic medical care providers. This extended use model, our Regenerative Medicine Point-of-Care Repository Solution, eliminates the need for locally based cryogenic freezers at each location of delivery.

“Looking ahead, our strategic growth initiatives position us to capture many of the new and growing opportunities ahead, as we scale our operations for accelerated success. This includes investments in our sales and marketing teams, as well as research and development, to capture a larger portion of the market. Due to overall growth trends for the life sciences industry, we believe the growth trajectory of our business of providing advanced, leading-edge cryogenic logistics solutions will advance at a robust pace,” concluded Mr. Shelton.

Plan for Uplisting of Common Stock

The Company also announced today that its Board of Directors (the “Board”) has implemented a strategy to support the uplisting of its common stock to The Nasdaq Capital Market® (the “Exchange”). As part of this strategy the Board approved a reverse stock split at a ratio of 1-for-12, which is effective today, May 19, 2015. Every 12 shares of common stock outstanding have been automatically combined into one new share of common stock with no change in the par value per share and the number of authorized shares of common stock has been reduced from 250,000,000 to 20,833,333. Any fractional shares resulting from the reverse stock split will be rounded to the next whole share.

The Company's ticker symbol, "CYRX", will remain unchanged; however the ticker symbol will be represented as "CYRXD" for a period of 20 business days after the reverse stock split has been effected in the marketplace. The Company’s common stock will also trade under a new CUSIP number (229050307). The reverse stock split is the first step in the Company’s plan to meet the listing requirements of the Exchange. Additional steps will need to be implemented before the Company will satisfy such requirements and there can be no assurance that the Exchange will approve the company’s listing application in the future.

Holders of shares of common stock held in book-entry form or through a bank, broker or other nominee do not need to take any action in connection with the reverse split, and will see the impact of the reverse split automatically reflected in their accounts. Beneficial holders may contact their bank, broker or nominee for more information. For those shareholders who hold physical stock certificates, the Company's transfer agent, Continental Stock Transfer & Trust Company (“Continental”), will exchange your current stock certificates for new stock certificates. For more information, contact the Reorganization Department of Continental at (917) 262-2378 or 17 Battery Place, 8th Floor, New York, New York 10004.

|

3 |

Cryoport’s breakthrough technologies, including it LN2 dry vapor dewars, enables 10 days of minus 150° C temperature stability for cryogenically frozen commodities including biospecimens, immunotherapeutics, general therapeutics, embryos, eggs, semen, keeping them well below glass transition (Tg) temperature where biological activity ceases. The old technology, dry ice, is often relied on for life sciences commodities, but it is considerably warmer at temperature of minus 80° C and which can introduce temperature fluctuations that could impact the integrity of a frozen specimen or the efficacy of a valuable therapeutic. Other methods include using LN2, in liquid form, stored in dewars that must be transported on bulky stabilizing platforms. Both present safety issues and can be hazardous.

Cryoport, on the other hand, provides standard and customized, safe, portable, and trackable solutions for shipping temperature-sensitive, cryogenically frozen biological materials through our proprietary and patented technologies, including our Cryoport Express® Shippers, which are charged by liquid nitrogen in the dry vapor phase. Cryoport Express® Solutions also provide complete “chain of custody” information and, at the client’s election, full “chain of condition” information along with intervention capability.

Further information on Cryoport’s results are included on the attached unaudited consolidated balance sheets and statements of operations and further explanation of Cryoport’s financial performance will be provided in Cryoport’s annual report for the twelve months ended March 31, 2015 on Form 10-K, which will be filed with the SEC later today. The full report will be available on the SEC Filings section of the Investor Relations section of our website at www.cryoport.com.

About Cryoport, Inc.

Cryoport is the premier provider of cryogenic logistics solutions to the life sciences industry through its purpose-built proprietary packaging, information technology and specialized cold chain logistics expertise. We provide leading edge logistics solutions for biologic materials such as immunotherapies, stem cells, CAR-T cells, and reproductive cells for clients worldwide including points-of-care, CRO’s, central laboratories, biopharmaceuticals, contract manufacturing, health centers and university research. Our packaging is built around our proprietary Cryoport Express® liquid nitrogen dry vapor shippers, which are validated to maintain a constant -150°C temperature for a 10-day dynamic shipment duration. Our information technology centers around our Cryoportal™ Logistics Management Platform, which facilitates management of the entire shipment process. Cryoport is the preferred cryogenic logistics solutions partner to the world’s largest shipping companies controlling more than 85% of the world’s air shipments. For more information, visit www.cryoport.com.

Forward Looking Statements

Statements in this press release which are not purely historical, including statements regarding Cryoport, Inc.’s intentions, hopes, beliefs, expectations, representations, projections, plans or predictions of the future are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. It is important to note that the company's actual results could differ materially from those in any such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, risks and uncertainties associated with the effect of changing economic conditions, trends in the products markets, variations in the company's cash flow, market acceptance risks, and technical development risks. The company’s business could be affected by a number of other factors, including the risk factors listed from time to time in the company's SEC reports including, but not limited to, the annual report on Form 10-K for the year ended March 31, 2014. The company cautions investors not to place undue reliance on the forward-looking statements contained in this press release. Cryoport, Inc. disclaims any obligation, and does not undertake to update or revise, any forward-looking statements in this press release.

Investor Contacts:

Todd Fromer / Garth Russell

tfromer@kcsa.com / grussell@kcsa.com

P: 1 212-682-6300

|

4 |

CRYOPORT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

| Three Months Ended March 31, |

Years Ended March 31, |

|||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| 2015 | 2014 | 2015 | 2014 | |||||||||||||

| Revenues | $ | 1,198,544 | $ | 834,826 | $ | 3,935,320 | $ | 2,659,943 | ||||||||

| Cost of revenues | 828,465 | 691,676 | 2,766,391 | 2,222,988 | ||||||||||||

| Gross margin | 370,079 | 143,150 | 1,168,929 | 436,955 | ||||||||||||

| Operating costs and expenses: | ||||||||||||||||

| Selling, general and administrative | 1,978,091 | 1,338,170 | 6,409,381 | 5,106,219 | ||||||||||||

| Research and development | 85,005 | 79,542 | 352,580 | 409,111 | ||||||||||||

| Total operating costs and expenses | 2,063,096 | 1,417,712 | 6,761,961 | 5,515,330 | ||||||||||||

| Loss from operations | (1,693,017 | ) | (1,274,562 | ) | (5,593,032 | ) | (5,078,375 | ) | ||||||||

| Other (expense) income: | ||||||||||||||||

| Debt conversion expense | - | - | - | (13,713,767 | ) | |||||||||||

| Interest expense | (242,678 | ) | (157,673 | ) | (1,428,015 | ) | (784,454 | ) | ||||||||

| Other expense, net | (1,437 | ) | (8,078 | ) | (4,266 | ) | (8,078 | ) | ||||||||

| Change in fair value of derivatives | - | 3 | - | 20,848 | ||||||||||||

| Loss before provision for income taxes | (1,937,132 | ) | (1,440,310 | ) | (7,025,313 | ) | (19,563,826 | ) | ||||||||

| Provision for income taxes | - | (1,600 | ) | (1,600 | ) | (1,600 | ) | |||||||||

| Net loss | (1,937,132 | ) | (1,441,910 | ) | (7,026,913 | ) | (19,565,426 | ) | ||||||||

| Preferred stock benefical conversion charge | (1,902,569 | ) | - | (4,864,292 | ) | - | ||||||||||

| Undeclared cumulative preferred dividends | (110,427 | ) | - | (305,328 | ) | - | ||||||||||

| Net loss attributable to common stockholders | $ | (3,950,128 | ) | $ | (1,441,910 | ) | $ | (12,196,533 | ) | $ | (19,565,426 | ) | ||||

| Net loss per share attributable to common stockholders - basic and diluted | $ | (0.79 | ) | $ | (0.29 | ) | $ | (2.44 | ) | $ | (4.81 | ) | ||||

| Weighted average shares outstanding - basic and diluted | 5,017,024 | 4,964,166 | 5,006,219 | 4,070,877 | ||||||||||||

|

5 |

CRYOPORT, INC.

SUMMARY CONSOLIDATED BALANCE SHEETS

| March 31, | ||||||||

| 2015 | 2014 | |||||||

| (unaudited) | ||||||||

| Current Assets: | ||||||||

| Cash and cash equivalents | $ | 1,405,186 | $ | 369,581 | ||||

| Accounts receivable, net | 589,699 | 515,825 | ||||||

| Inventories | 69,680 | 29,703 | ||||||

| Other current assets | 97,337 | 196,505 | ||||||

| Total current assets | 2,161,902 | 1,111,614 | ||||||

| Property and equipment, net | 307,926 | 408,892 | ||||||

| Intangible assets, net | 136,821 | 180,086 | ||||||

| Deposits and other assets | - | 9,358 | ||||||

| Total assets | $ | 2,606,649 | $ | 1,709,950 | ||||

| Current liabilities: | ||||||||

| Accounts payable and other accrued expenses | $ | 758,696 | $ | 579,678 | ||||

| Accrued compensation and related expenses | 725,712 | 454,288 | ||||||

| Notes payable and accrued interest, net of discount | 535,507 | - | ||||||

| Convertible debentures payable and accrued interest, net of discount | - | 1,622,359 | ||||||

| Related party notes payable and accrued interest, net of discount | 976,581 | 1,358,120 | ||||||

| Total current liabilities | 2,996,496 | 4,014,445 | ||||||

| Related party notes payable, net of current portion | 26,452 | - | ||||||

| Total liabilities | 3,022,948 | 4,014,445 | ||||||

| Total stockholders' deficit | (416,299 | ) | (2,304,495 | ) | ||||

| Total liabilities and stockholders' deficit | $ | 2,606,649 | $ | 1,709,950 | ||||

|

6 |