EXHIBIT 99.1

Published on May 19, 2014

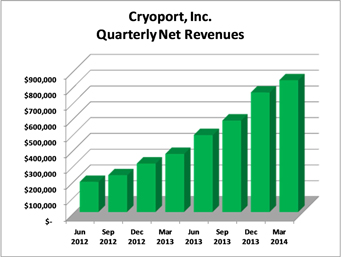

Cryoport Reports Fourth Consecutive Quarter of Triple Digit Year-over-Year Revenue Growth for Fourth Quarter of 2014

- - -

Revenue increases 127% and 142% year-over-year for the three month and twelve month periods ended March 31, 2014, respectively

- - -

Expanded cryogenic solutions offering being well received by market

LAKE FOREST, CA – May 19, 2014 — Cryoport, Inc. (OTCBB: CYRX) today announced financial results for the three and twelve month periods ended March 31, 2014.

Net revenues were $2.7 million for the year ended March 31, 2014, as compared to $1.1 million for the year ended March 31, 2013. The 142% increase was primarily driven by Cryoport’s Integrated Solution and overall growth in the number of customers using Cryoport Express® Solutions compared to the same period in the prior year.

Gross margin for the year ended March 31, 2014 was 16% of net revenues, or gross profit of $437,000, as compared to a negative gross margin of 44% of net revenues, or gross loss of $487,000, for the year ended March 31, 2013. Net loss for the year ended March 31, 2014 was $19.6 million, or $0.40 per basic and diluted share, compared to a net loss of $6.4 million, or $0.17 per basic and diluted share, for the same period last year. The increase in net loss for 2013 is attributable to a one-time, non-cash debt conversion expense of $13.7 million.

Net revenues were $835,000 for the quarter ended March 31, 2014, as compared to $368,000 for the same period last year. The 127% increase was primarily driven by Cryoport’s Integrated Solution and overall growth in the number of customers using Cryoport Express® Solutions compared to the same period in the prior year.

|

2 |

Gross margin for the three months ended March 31, 2014 was 17% of net revenues, or gross profit of $143,000, as compared to a negative gross margin of 41% of net revenues, or gross loss of $152,000, for the three months ended March 31, 2013. The decline in cost of revenues for the quarter demonstrates the Company’s ability to profitably scale its business over the past twelve months. Net loss for the three months ended March 31, 2014 was $1.4 million, or $0.02 per basic and diluted share, a decrease of $275,000 or 16%, compared to a net loss of $1.7 million, or $0.05 per basic and diluted share, for the same period last year.

Cryoport’s Chief Executive Officer, Jerrell Shelton, commented, “Over the past year we have delivered on several of our key goals and reported triple digit growth for each quarter. We have been able to quickly scale the business while also increasing our profitability, and improving gross profit over the prior year by $924,000. For this period, our SG&A and R&D costs were down slightly over last year, but will increase as we continue to scale the business. We believe the growth trend of our business and the overall growth trends for the life sciences industry, which uses our advanced, leading-edge cryogenic logistics solutions, are the perfect scenario to drive future profitable growth for Cryoport.

“The growth we reported throughout the year was driven by a diverse base of new and expanding customer relationships. Most of these customers are still in the early stages of bringing our solutions in to support their operations, which provides us with significant opportunities to expand our support of their cold chain logistics needs. And these customers are across a number of exciting markets that are experiencing significant growth, including stem cells, cell therapies and cell line manufacturing and research, vaccines, and other biologic drug development, as well as in vitro fertilization (IVF), just to name a few.

“We continue to move forward with our ‘powered by CryoportSM’ partnering strategy designed to expand our sales and marketing reach as well as to increase the awareness of our solutions in the life sciences community. The most significant client relationship that has ramped over the past year is with a leading animal health company through which we are providing our customer integrated solution. This solution includes on-site logistics personnel and our logistics management platform, the Cryoportal, to manage shipments from the client’s manufacturing site in the United States to their domestic customers as well as its international distribution centers. The success of this relationship should not be underestimated, as there are opportunities to expand our support of this client as well as utilize this relationship as a case study when speaking with potential clients about the advantages of our solutions.

“As announced earlier this year, we have just begun ramping up a program that fully combines our proprietary, purpose-built cold chain logistics solutions with Liventa Bioscience’s distribution capability in an extended use model to ‘points-of-use’ by US-based orthopedic medical care providers. The unique aspect of this relationship is that it uses our advanced cryogenic logistics expertise in a way that provides the client with an extended use model of our Turn-key Cryoport Express® Solution, utilizing our patented liquid nitrogen dry vapor shippers and thereby eliminating the need for locally based cryogenic freezers at each location of delivery. This will enable Liventa Bioscience to serve ambulatory surgery centers, pain clinics, hospitals, pharmacies, and orthopedists’ offices without impediment.

|

3 |

“Overall, the success we are experiencing is centered on our ability to offer flexible solutions that addresses each client’s specific needs. It is this ability to work with our customers that has brought our game changing end-to-end cryogenic logistics solutions to the forefront of the industry and gained the attention of large and small companies that require solutions to their cold chain logistics issues. Our central role in cold chain logistics in the fast growing life sciences market continues to be validated by the increasing attention we have receive from the life sciences industry and those who serve it, such as integrators, specialty couriers, freight forwarders, etc.; all of which provide us with additional opportunities for revenue producing partnerships,” concluded Mr. Shelton.

Further information on Cryoport’s results are included on the attached unaudited consolidated balance sheets and statements of operations and further explanation of Cryoport’s financial performance is provided in Cryoport’s annual report for the twelve months ended March 31, 2014 on Form 10-K, which will be filed with the SEC in early June 2014. The full report is available on the SEC Filings section of the Investor Relations section of our website at www.cryoport.com.

About Cryoport, Inc.

Cryoport provides leading edge cryogenic logistics solutions to the life sciences industry through the combination of purpose-built proprietary packaging, advanced information technology and highly skilled logistics expertise which manages the entire cold chain logistics process. Cryoport Express® liquid nitrogen dry vapor shippers are validated to maintain a constant -150°C temperature for a 10-plus day dynamic shipment duration, and its Cryoportal™ Logistics Management Platform assists in managing the entire logistics process, including initial order input, document preparation, customs clearance, courier management, shipment tracking, issue resolution, and delivery. Cryoport’s total turnkey logistics solutions offer reliability, cost effectiveness, and convenience, while the use of recyclable and reusable components provides a “green” and environmentally friendly solution. Cryoport service options include recording the “chain of condition” and “chain of custody” for all shipments thereby meeting the exacting requirements for scientific work and for regulatory purposes. For more information visit www.cryoport.com.

Forward Looking Statements

Statements in this press release which are not purely historical, including statements regarding Cryoport, Inc.’s intentions, hopes, beliefs, expectations, representations, projections, plans or predictions of the future are forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. It is important to note that the company's actual results could differ materially from those in any such forward-looking statements. Factors that could cause actual results to differ materially include, but are not limited to, risks and uncertainties associated with the effect of changing economic conditions, trends in the products markets, variations in the company's cash flow, market acceptance risks, and technical development risks. The company’s business could be affected by a number of other factors, including the risk factors listed from time to time in the company's SEC reports including, but not limited to, the annual report on Form 10-K for the year ended March 31, 2013. The company cautions investors not to place undue reliance on the forward-looking statements contained in this press release. Cryoport, Inc. disclaims any obligation, and does not undertake to update or revise, any forward-looking statements in this press release.

|

4 |

Contact:

Robert Stefanovich

619.481.6802

rstefanovich@cryoport.com

|

5 |

CRYOPORT, INC.

CONSOLIDATED STATEMENTS OF OPERATIONS

| Three Months Ended | Year Ended | |||||||||||||||

| March 31, | March 31, | |||||||||||||||

| (unaudited) | (unaudited) | |||||||||||||||

| 2014 | 2013 | 2014 | 2013 | |||||||||||||

| Net revenues | $ | 834,826 | $ | 368,490 | $ | 2,659,943 | $ | 1,100,539 | ||||||||

| Cost of revenues | 691,676 | 520,970 | 2,222,988 | 1,587,823 | ||||||||||||

| Gross margin (loss) | 143,150 | (152,480 | ) | 436,955 | (487,284 | ) | ||||||||||

| Operating expenses: | ||||||||||||||||

| Selling, general and administrative | 1,338,170 | 1,408,184 | 5,106,219 | 5,411,728 | ||||||||||||

| Research and development | 79,542 | 120,415 | 409,111 | 425,446 | ||||||||||||

| Total operating expenses | 1,417,712 | 1,528,599 | 5,515,330 | 5,837,174 | ||||||||||||

| Loss from operations | (1,274,562 | ) | (1,681,079 | ) | (5,078,375 | ) | (6,324,458 | ) | ||||||||

| Other income (expense): | ||||||||||||||||

| Debt conversion expense | — | — | (13,713,767 | ) | — | |||||||||||

| Interest expense | (157,673 | ) | (24,606 | ) | (784,454 | ) | (72,861 | ) | ||||||||

| Change in fair value of derivative liabilities | 3 | (11,226 | ) | 20,848 | 16,486 | |||||||||||

| Other expense, net | (8,078 | ) | — | (8,078 | ) | — | ||||||||||

| Loss before income taxes | (1,440,310 | ) | (1,716,911 | ) | (19,563,826 | ) | (6,380,833 | ) | ||||||||

| Provision for income taxes | 1,600 | — | 1,600 | 1,600 | ||||||||||||

| Net loss | $ | (1,441,910 | ) | $ | (1,716,911 | ) | $ | (19,565,426 | ) | $ | (6,382,433 | ) | ||||

| Net loss per share, basic and diluted | $ | (0.02 | ) | $ | (0.05 | ) | $ | (0.40 | ) | $ | (0.17 | ) | ||||

| Basic and diluted weighted average common shares | 59,569,990 | 37,760,628 | 48,850,513 | 37,760,628 | ||||||||||||

|

6 |

CRYOPORT, INC.

SUMMARY CONSOLIDATED BALANCE SHEETS

| March 31, | March 31, | |||||||

| 2014 | 2013 | |||||||

| (unaudited) | ||||||||

| Cash and cash equivalents | $ | 369,581 | 563,104 | |||||

| Accounts receivable, net | 515,825 | 217,097 | ||||||

| Inventories | 29,703 | 39,212 | ||||||

| Other current assets | 196,505 | 138,892 | ||||||

| Total current assets | 1,111,614 | 958,305 | ||||||

| Property and equipment, net | 408,892 | 505,485 | ||||||

| Intangible assets, net | 180,086 | 272,263 | ||||||

| Deposits and other assets | 9,358 | 19,744 | ||||||

| Total assets | $ | 1,709,950 | $ | 1,755,797 | ||||

| Accounts payable and accrued liabilities | $ | 579,678 | 858,709 | |||||

| Accrued compensation and related expenses | 454,288 | 217,432 | ||||||

| Convertible debentures payable and accrued interest, net of discount | 1,622,359 | 1,304,419 | ||||||

| Current portion of related party notes payable | 1,358,120 | 96,000 | ||||||

| Derivative liabilities | — | 20,848 | ||||||

| Total current liabilities | 4,014,445 | 2,497,408 | ||||||

| Related party notes payable and accrued interest, net of current portion | — | 1,321,664 | ||||||

| Total liabilities | 4,014,445 | 3,819,072 | ||||||

| Total stockholders’ deficit | (2,304,495 | ) | (2,063,275 | ) | ||||

| Total liabilities and stockholders’ deficit | $ | 1,709,950 | $ | 1,755,797 | ||||

|

7 |