DEF 14A: Definitive proxy statements

Published on April 3, 2020

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant x

Filed by a Party other than the Registrant ¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | CONFIDENTIAL, FOR USE OF THE COMMISSION ONLY (AS PERMITTED BY RULE 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Section 240.14a-12 |

| CRYOPORT, INC. |

| (Name of Registrant as Specified In Its Charter) |

| (Name of Person(s) Filing Proxy Statement, if other than the Registrant) |

Payment of Filing Fee (check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| (1) | Title of each class of securities to which transaction applies: |

| (2) | Aggregate number of securities to which transaction applies: |

| (3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): |

| (4) | Proposed maximum aggregate value of transaction: |

| (5) | Total fee paid: |

| ¨ | Fee paid previously with preliminary materials. |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing. |

| (1) | Amount Previously Paid: |

| (2) | Form, Schedule or Registration Statement No.: |

| (3) | Filing Party: |

| (4) | Date Filed: |

| 1 |

112 Westwood Place, Suite 350

Brentwood, Tennessee 37027

NOTICE OF ANNUAL MEETING OF STOCKHOLDERS

To Be Held May 1, 2020

April 3, 2020

Dear Fellow Stockholders:

The 2020 Annual Meeting of the Stockholders (the “Annual Meeting”) of Cryoport, Inc., a Nevada Corporation (the “Company”), will be held at Cryoport, 112 Westwood Place, Suite 350, Brentwood, Tennessee 37027 on Friday, May 1, 2020, at 10:00 a.m. CST, for the following purposes:

| (1) | To elect six directors; | |

| (2) | To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company and its subsidiaries for the year ending December 31, 2020; | |

| (3) | To approve, on an advisory basis, the compensation of the named executive officers, as disclosed in our Proxy Statement for the Annual Meeting; and | |

| (4) | To transact such other business as may properly come before the meeting or any adjournment thereof. |

The Board of Directors has fixed the close of business on Friday, March 20, 2020 as the record date for the determination of stockholders who are entitled to notice of and to vote at the meeting, or any adjournments thereof. This Proxy Statement will be mailed to stockholders on or about April 3, 2020. We cordially invite you to attend the Annual Meeting. Whether or not you plan to attend the Annual Meeting, please sign, date, and return the enclosed proxy card in the envelope provided or take advantage of the opportunity to vote your proxy online.

Pursuant to rules promulgated by the Securities and Exchange Commission, we have elected to provide access to our proxy materials both by sending you this full set of proxy materials, including a proxy card, and by notifying you of the availability of our proxy materials on the Internet. The enclosed Proxy Statement and accompanying Annual Report on Form 10-K for the year ended December 31, 2019 (the “2019 Annual Report”) are available on the Internet at www.cstproxy.com/cryoport/2020. We urge you to read the information contained in the proxy materials carefully.

YOUR VOTE IS IMPORTANT. YOU ARE URGED TO VOTE YOUR PROXY PROMPTLY BY MAIL OR VIA THE INTERNET, WHETHER OR NOT YOU PLAN TO ATTEND THE MEETING.

| Sincerely, | |

| /s/ Jerrell W. Shelton | |

| Chairman, President and Chief Executive Officer |

| 2 |

PROXY STATEMENT

2020 ANNUAL MEETING OF STOCKHOLDERS

TO BE HELD ON FRIDAY, MAY 1, 2020

GENERAL INFORMATION

Introduction

This Proxy Statement is furnished in connection with the solicitation of proxies on behalf of the Board of Directors (the “Board”) of Cryoport, Inc., a Nevada corporation (referred to as “we,” “us,” “our,” “Company” or “Cryoport”), with respect to the 2020 Annual Meeting of Stockholders of the Company and any adjournment thereof (the “Annual Meeting”) to be held at Cryoport, 112 Westwood Place, Suite 350, Brentwood, Tennessee 37027 on Friday, May 1, 2020, at 10:00 a.m. CST.

The Proxy Statement and the form of proxy relating to the Annual Meeting are first being made available to stockholders on or about April 3, 2020.

Important Notice Regarding the Availability of Proxy Materials for the Stockholder Meeting to Be Held on May 1, 2020.

This Proxy Statement and the Company’s Annual Report on Form 10-K for the year ended December 31, 2019 (the “2019 Annual Report”) are available on the Internet at the following website: www.cstproxy.com/cryoport/2020. Other information on the website does not constitute a part of this Proxy Statement.

What is the purpose of the Annual Meeting?

The purpose of the Annual Meeting is to vote on the following matters:

| (1) | To elect six directors; |

| (2) | To ratify the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company and its subsidiaries for the year ending December 31, 2020; |

| (3) | To approve, on an advisory basis, the compensation of the named executive officers, as disclosed in this Proxy Statement; and |

| (4) | To transact such other business as may properly come before the meeting or any adjournment thereof. |

Why am I being provided with these materials?

Owners of record of the Company’s common stock as of the close of business on March 20, 2020 (the “Record Date”) are entitled to vote in connection with the Annual Meeting. As a stockholder, you are requested to vote on the proposals described in this Proxy Statement. This Proxy Statement describes the proposals presented for stockholder action at our Annual Meeting and includes information required to be disclosed to stockholders.

Who pays the cost of proxy solicitation?

Our Board is soliciting the enclosed proxy and we will bear the cost of this solicitation. Proxies may be solicited in person or by mail, telephone or electronic transmission on our behalf by our directors, officers or employees. However, we do not reimburse or pay additional compensation to our own directors, officers or other employees for soliciting proxies. We will request that banks, brokerage houses, nominees and other fiduciaries nominally holding shares of our common stock forward the proxy soliciting materials to the beneficial owners of such common stock and obtain authorization for the execution of proxies. We will, upon request, reimburse such parties for their reasonable expenses in forwarding proxy materials to the beneficial owners. In the event we decide to hire a service to solicit proxies, we would expect such service to cost less than $14,000, plus reasonable and approved out-of-pocket expenses.

| 3 |

Who can vote in connection with the Annual Meeting?

You may vote if you were the record owner of the Company’s common stock as of the close of business on the Record Date. Each share of the Company’s common stock is entitled to one vote. As of the Record Date, there were 37,670,047 shares of common stock outstanding and entitled to vote.

How do I vote?

There are several ways to cast your vote:

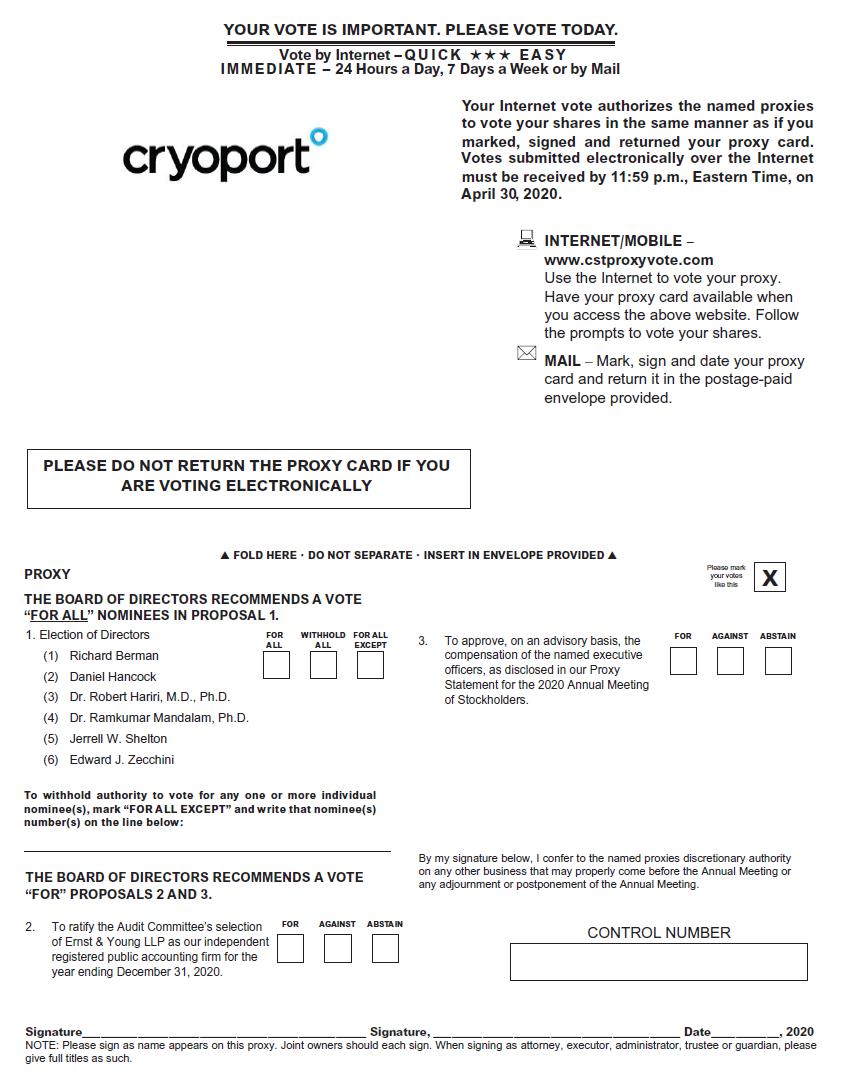

| · | You may vote over the Internet, by going to www.cstproxyvote.com. You will need to type in the Control Number indicated on your Proxy Card and follow the instructions. |

| · | You may vote by mailing in the Proxy Card ballot. To vote by mail using the Proxy Card, you will need to complete, sign and date your Proxy Card and return it promptly to Continental Stock Transfer & Co., 1 State Street Plaza, 30th Floor, New York, NY 10004, Attention: Proxy Department. |

| · | You may vote in person, at the commencement of our Annual Meeting. |

How does the Board recommend that I vote my shares?

Unless you give other instructions through your proxy vote, the persons named as proxy holders on the proxy card will vote in accordance with the recommendations of the Board. For the reasons set forth in more detail later in this Proxy Statement, the Board recommends the following:

| Proposal 1: | The Board recommends a vote “FOR” all the nominees to the Board. |

| Proposal 2: | The Board recommends a vote “FOR” the ratification of the appointment of Ernst & Young LLP as the independent registered public accounting firm of the Company and its subsidiaries for the year ending December 31, 2020. |

| Proposal 3: | The Board recommends a vote “FOR” the advisory vote to approve the compensation of the named executive officers, as disclosed in this Proxy Statement. | |

We encourage all stockholders to vote their shares. If you own your shares in “street name” and do not instruct your broker or other record owner of the shares as to how to vote, such broker or other record owner may vote your shares pursuant to its discretionary authority only with respect to Proposal 2. See “What are broker non-votes?” below for additional information.

What types of votes are permitted on each Proposal?

| Proposal 1: | You may either vote “FOR” all nominees, “WITHHOLD ALL” for all nominees, or “FOR ALL EXCEPT” as to specific nominees. |

| Proposal 2: | You may vote “FOR,” “AGAINST” or “ABSTAIN”. |

| Proposal 3: | You may vote “FOR,” “AGAINST” or “ABSTAIN”. | |

If you vote “WITHHOLD” (for any nominees in the case of Proposal 1 above) or “ABSTAIN” (in the case of Proposals 2 and 3 above) your vote will not be counted towards the vote total for such proposal.

| 4 |

How many votes are needed to approve each Proposal?

| Proposal 1: | Election of a director requires the affirmative vote of the holders of a plurality of the shares for which votes are cast. The six nominees receiving the most “FOR” votes will be elected. Since only affirmative votes count for this purpose, a properly executed proxy marked “WITHHOLD” with respect to the election of one or more directors will not be voted with respect to the director or directors indicated, although it will be counted for purposes of determining whether there is a quorum. Accordingly, abstentions and broker non-votes (as described below) as to the election of directors will not be counted in determining which nominees received the largest number of votes cast. Stockholders may not cumulate votes in the election of directors. |

| Proposal 2: | There must be a “FOR” vote from the majority of votes cast. Abstentions and broker non-votes will not be treated as votes cast for or against the proposal, and therefore will have no effect on the outcome of the proposal. |

| Proposal 3: | There must be a “FOR” vote from the majority of votes cast. Abstentions and broker non-votes will not be treated as votes cast for or against the proposal, and therefore will have no effect on the outcome of the proposal. | |

What constitutes a quorum?

To carry on the business of the meeting, we must have a quorum. A quorum is present when a majority of the outstanding shares of capital stock entitled to vote, as of the Record Date, are represented in person or by proxy. Shares owned by the Company are not considered outstanding or present at the meeting. Shares that are entitled to vote but that are not voted at the direction of the beneficial owner (called abstentions) and votes withheld by brokers in the absence of instructions from beneficial owners (called broker non-votes) will be counted for the purpose of determining whether there is a quorum for the transaction of business at the meeting.

What are broker non-votes?

Broker non-votes occur with respect to shares held in “street name,” in cases where the record owner (for instance, the brokerage firm or bank) does not receive voting instructions from the beneficial owner and the record owner does not have the authority to vote those shares.

Various national and regional securities exchanges, including the rules of the New York Stock Exchange, applicable to brokers, banks, and other holders of record determine whether the record owner (for instance, the brokerage firm, or bank) is able to vote on a proposal if the record owner does not receive voting instructions from the beneficial owner. The record owner may vote on proposals that are determined to be routine under these rules and may not vote on proposals that are determined to be non-routine under these rules. If a proposal is determined to be routine, your broker, bank, or other holder of record is permitted to vote on the proposal without receiving voting instructions from you. The proposal to ratify the appointment of our independent registered public accounting firm (Proposal 2) is a routine matter and the record owner may vote your shares on this proposal if it does not get instructions from you.

The proposal to elect directors (Proposal 1) and the proposal to approve, on an advisory basis, the compensation of the named executive officers (Proposal 3) are non-routine and the record owner may not vote your shares on any of these proposals if it does not get instructions from you. If you do not provide voting instructions on these matters, a broker non-vote will occur. Broker non-votes, as well as abstentions, will each be counted towards the presence of a quorum but will not be counted towards the number of votes cast for any proposal.

What if my shares are not registered directly in my name but are held in “street name”?

If at the Record Date your shares were held in “street name” (for instance, through a brokerage firm or bank), then you are the beneficial owner of such shares, and such shares are not registered directly in your name. The organization holding your account is considered the stockholder of record for purposes of the Annual Meeting. As a beneficial owner, you have the right to direct that organization on how to vote the shares in your account. You will receive the notice and other proxy materials if requested, as well as voting instructions, directly from that organization.

| 5 |

If I am a beneficial owner of Cryoport shares, how do I vote?

If you are a beneficial owner, you will need to follow the voting instructions provided to you by the organization holding your account (for instance, your brokerage firm). To request documents or if you have any questions about voting, you will need to contact your broker. As a beneficial owner, if you would like to vote in person at the Annual Meeting, you must obtain a legal proxy from your broker or other applicable registered owner of your shares, in advance of the meeting.

Can I dissent or exercise rights of appraisal?

Neither Nevada law nor our Amended and Restated Articles of Incorporation or Amended and Restated Bylaws provide our stockholders with dissenters’ or appraisal rights in connection with any of the proposals to be presented at the Annual Meeting. If the proposals are approved at the Annual Meeting, stockholders voting against such proposals will not be entitled to seek appraisal for their shares.

How many votes do I have?

On each matter to be voted upon, holders of our common stock have one vote for each share of our common stock owned as of the close of business on the Record Date.

How are the votes counted?

All votes will be tabulated by the inspector of elections appointed for the Annual Meeting who will separately tabulate affirmative and negative votes and abstentions. Any information that identifies a stockholder or the particular vote of a stockholder is kept confidential.

Will stockholders be asked to vote on any other matters?

The Board is not aware of any other matters that will be brought before the stockholders for a vote. If any other matters properly come before the meeting, the proxy holders will vote on those matters in accordance with the recommendations of the Board or, if no recommendations are given, in accordance with their own judgment. Stockholders attending the meeting may directly vote on those matters or they may vote by proxy.

How many Annual Reports and Proxy Statements are delivered to a shared address?

If you and one or more stockholders share the same address, it is possible that only one Proxy Statement and 2019 Annual Report was delivered to your address. This is known as “householding.” We will promptly deliver a separate copy of either document to you if you call or write us at our principal executive offices at 112 Westwood Place, Suite 350, Brentwood, Tennessee 37027, Attn: Secretary; telephone: (949) 681-2710. If you want to receive separate copies of a proxy statement or annual report to stockholders in the future, or if you are receiving multiple copies and would like to receive only one copy per household, you should contact your bank, broker, or other nominee record holder, or you may contact us at the above address and telephone number.

What does it mean if I receive more than one Notice or Proxy Card?

If you receive more than one Proxy Card, your shares are owned in more than one name or in multiple accounts. In order to ensure that all of your shares are voted, you must follow the voting instructions included in each Proxy Card.

Can I change or revoke my vote after I submit my proxy?

Even after you have submitted your Proxy Card or voted by Internet, you may change or revoke your vote at any time before the proxy is exercised by filing with our Secretary either a notice of revocation or a signed Proxy Card bearing a later date. The powers of the proxy holders will be suspended with respect to your shares if you attend the meeting in person and so request, although attendance at the meeting will not by itself revoke a previously granted proxy.

| 6 |

PROPOSAL 1 — ELECTION OF DIRECTORS

The Board currently consists of six directors. Directors are elected on an annual basis. Each of the six directors will stand for re-election at the 2020 Annual Meeting to serve as a director until the 2021 Annual Meeting of the Stockholders or until their successors are duly elected and qualified or their earlier death, resignation, or removal. The persons named on the proxy will vote to elect all of the nominees as directors for terms ending at the 2021 Annual Meeting of the Stockholders unless you withhold authority to vote for any or all of the nominees by voting to that effect or so voting in person. Each nominee has consented to serve as a director for the ensuing year. If one or more of the six nominees becomes unavailable to serve prior to the date of the Annual Meeting, the persons named as proxy holders will vote those shares for the election of such other person as the Board may recommend, unless the Board reduces the total number of directors. Proxies cannot be voted for a greater number of persons than the number of nominees named.

Nominees for Election

The six nominees for election as directors are set forth in the following table:

| Richard Berman | Mr. Berman, age 77, became a member of our board of directors in January 2015 and serves as Chairman of the Audit Committee and member of the Compensation Committee and Nomination and Governance Committee of our board of directors. Mr. Berman’s business career spans over 35 years of venture capital, senior management and merger & acquisitions experience. Mr. Berman has served as a director and/or officer of over a dozen public and private companies. From 2006 to 2011, he was Chairman of National Investment Managers, a company with $12 billion in pension administration assets. Mr. Berman is a director of four publicly traded healthcare companies: Advaxis, Inc., Cryoport, Inc., BioVie Inc., and BriaCell Therapeutics, Inc. He is also a director of ComSovereign Holding Corp., which is also publicly traded. From 2002 to 2010, he was a director of Nexmed Inc. where he also served as Chairman/CEO in 2008 and 2009 (formerly Apricus Biosciences, Inc.); From 1998 to 2000, he was employed by Internet Commerce Corporation (now Easylink Services) as Chairman and CEO, and was a director from 1998 to 2012. Previously, Mr. Berman worked at Goldman Sachs; was Senior Vice President of Bankers Trust Company, where he started the M&A and Leveraged Buyout Departments; created the largest battery company in the world in the 1980’s by merging Prestolite, General Battery and Exide to form Exide Technologies (XIDE); and advised on over $4 billion of M&A transactions. He is a past Director of the Stern School of Business of NYU where he obtained his BS and MBA. He also has U.S. and foreign law degrees from Boston College and The Hague Academy of International Law, respectively. Mr. Berman’s financial and business expertise, including his background in biotechnology, international management and banking, and his extensive experience as a director in the public company context makes him well-qualified to serve as a member of the board of directors. |

| Daniel M. Hancock | Mr. Hancock, age 69, was appointed to our board of directors in January 2019 and serves as member of the Audit Committee and Scientific and Technology Committee. Mr. Hancock is currently President of DMH Strategic Consulting LLC. He retired from General Motors ("GM") in 2011, after 43 years of service in GM's powertrain engineering and general management functions. His last position with GM was Vice President, Global Strategic Product Alliances. During this period, he served as Chairman of GM's DMAX and VM Motori diesel engine joint ventures with Isuzu and Fiat, respectively. Mr. Hancock's previous appointments at GM included: Vice President, Global Powertrain Engineering; CEO, Fiat-GM Powertrain; and President, Allison Transmission Division. Mr. Hancock is a director of Westport Fuel Systems (NASDAQ: WPRT), a Vancouver, B.C. based global supplier of clean gaseous fuel parts, and systems for the transportation industry. He is also serving as chairman of the board of SuperTurbo Technologies, Inc., a Loveland, CO based privately-held developer of advanced turbo compounding systems for engines and director of Achates Power, Inc., a San Diego, CA headquartered privately-held developer of innovative opposed-piston, two-stroke diesel engines. In addition, Mr. Hancock serves in an advisory capacity to several global suppliers to the automotive and commercial vehicle industries. He was President of SAE International in 2014 and is a member of the National Academy of Engineering. He received a Master of Science in Mechanical Engineering from Massachusetts Institute of Technology (MIT) and a Bachelor in Mechanical Engineering from General Motors Institute (now Kettering University), Michigan. We believe Mr. Hancock’s global business experience, strong business acumen, and extensive technical expertise qualifies him well to serve as a member of the board of directors. |

| 7 |

| Robert Hariri, M.D., Ph.D. | Dr. Hariri, M.D., Ph.D., age 61, became a member of our board of directors in September 2015 and serves as Chairman of the Scientific and Technology Committee and member of the Audit Committee and Nomination and Governance Committee of our board of directors. Dr. Hariri is a visionary surgeon, scientist, aviator and entrepreneur and serves as the Founder, Chairman and CEO of Celularity. Previously, he served as the CEO of the Cellular Therapeutics Division of Celgene Corporation. Prior to joining Celgene Cellular Therapeutics as president in 2002, Dr. Hariri was founder, chairman and chief scientific officer at Anthrogenesis Corporation/LIFEBANK, Inc., a privately held biomedical technology and service corporation involved in the area of human stem cell therapeutics, which was acquired by Celgene in 2002. Dr. Hariri is also a co-founder of Human Longevity, Inc., a genomics and health intelligence company. He has served on numerous private and public Boards of Directors including Bionik Laboratories Corp (OTCQX: BNKL), Myos Corporation (Nasdaq: MYOS), Provista Diagnostics and is a member of the Board of Visitors of the Columbia University School of Engineering &Applied Sciences and the Science &Technology Council of the College of Physicians and Surgeons; as well as a member of the Scientific Advisory Board for the Archon X PRIZE for Genomics, which is awarded by the X Prize Foundation. Dr. Hariri is also a Trustee of the Liberty Science Center and was appointed Commissioner of Cancer Research by New Jersey Governor, Chris Christie. Dr. Hariri was recipient of the Thomas Alva Edison Award in 2007 and 2011, the Pontifical Medal for Innovation and has received numerous other honors for his many contributions to biomedicine and aviation. He has pioneered the use of stem cells to treat a range of life-threatening diseases and has over 170 issued and pending patents, has authored over 100 published chapters, articles and abstracts and is most recognized for his discovery of pluripotent stem cells from the placenta as a member of the team which discovered TNF (tumor necrosis factor). A jet-rated commercial pilot with thousands of hours of flight time in over 60 different military and civilian aircraft, Dr. Hariri is a founder of the Rocket Racing League, an extreme aerospace corporation and Jet-A Aviation, a heavy-jet charter airline. Dr. Hariri received his undergraduate training at Columbia College and Columbia University School of Engineering and Applied Sciences and was awarded his M.D. and Ph.D. degrees from Cornell University Medical College. Dr. Hariri received his surgical training at The New York Hospital-Cornell Medical Center where he also later directed the Aitken Neurosurgery Laboratory and the Center for Trauma Research. Dr. Hariri’s training as a scientist, his knowledge and experience with respect to the biomedical and pharmaceutical industries and his extensive research and experience makes him well-qualified to serve as a member of the board of directors. |

| Ramkumar Mandalam, Ph.D. | Dr. Ramkumar Mandalam, Ph.D., age 55, became a member of our board of directors in June 2014 and serves as Chairman of the Nomination and Governance Committee and member of the Compensation Committee of our board of directors. Dr. Mandalam is the CEO, President and member of the board of directors of Cellerant Therapeutics, Inc., a private clinical stage biotechnology company developing novel cell-based and antibody therapies for cancer treatment and blood-related disorders. Under his leadership, Cellerant has developed a pipeline of candidates for treatment of hematological malignancies and has rapidly expanded from an early-stage to an advanced clinical-stage company. Prior to joining Cellerant in 2005, he was the Executive Director of Product Development at Geron Corporation, a biopharmaceutical company where he managed the development and manufacturing of cell-based therapies for treatment of degenerative diseases and cancer. From 1994 to 2000, he held various positions in research and development at Aastrom Biosciences, where he was responsible for programs involving ex vivo expansion of human bone marrow stem cells and dendritic cells. Dr. Mandalam serves on the Boards of Cryoport Inc. and Stempeutics Research Pvt. Ltd., which is a private clinical stage biotechnology company headquartered in India. Dr. Mandalam received his Ph.D. in Chemical Engineering from the University of Michigan, Ann Arbor, Michigan. Dr. Mandalam is the author or co-author of several publications, patent applications, and abstracts. Dr. Mandalam’s training as a scientist, extensive background in biotechnology and management expertise and makes him well-qualified to serve as a member of the board of directors. |

| 8 |

| Jerrell W. Shelton | Jerrell W. Shelton, age 74, became a member of our board of directors in October 2012 and was appointed President and Chief Executive Officer of the Company in November 2012. He was appointed Chairman of the Board in October 2015. He served on the Board of Directors and standing committees of Solera Holdings, Inc. from April 2007 through November 2011. From June 2004 to May 2006, Mr. Shelton was the Chairman and CEO of Wellness, Inc., a provider of advanced, integrated hospital and clinical environments. Prior to that, he served as Visiting Executive to IBM Research and Head of IBM’s WebFountain. From October 1998 to October 1999, Mr. Shelton was Chairman, President and CEO of NDC Holdings II, Inc. Between October 1996 and July 1998, he was President and CEO of Continental Graphics Holdings, Inc. And from October 1991 to July 1996, Mr. Shelton served as President and CEO of Thomson Business Information Group. Mr. Shelton has a B.S. in Business Administration from the University of Tennessee and an M.B.A. from Harvard University. Mr. Shelton’s extensive leadership, management, strategic planning and financial expertise through his various leadership and directorship roles in public, private and global companies, makes him well-qualified to serve as a member of the board of directors. |

| Edward J. Zecchini | Edward J. Zecchini, age 59, became a member of our board of directors in September 2013 and serves as Chairman of the Compensation Committee and member of the Audit Committee and Scientific and Technology Committee. Mr. Zecchini currently serves as Managing Member of IT Analytics LLC. Mr. Zecchini is a director of the publicly traded healthcare company Catasys, Inc. Prior to that, Mr. Zecchini served as Chief Information Officer at Remedy Partners, Inc. from April 2014 to October 2019, Executive Vice President and Chief Technology Officer at Sandata Technologies, LLC, from May 2010 to March 2014. Earlier in his career he held senior level positions at HealthMarkets, Inc., Thomson Healthcare and SportsTicker, Inc. Mr. Zecchini has over thirty years of experience in the healthcare and information technology industries. Mr. Zecchini holds a Bachelor of Arts degree from the State University of New York at Oswego. Mr. Zecchini’s business expertise, including his background and extensive experience in information technology and management makes him well-qualified to serve as a member of the board of directors. |

| 9 |

Required Vote

Directors are elected by the affirmative vote of the holders of a plurality of the shares for which votes are cast. The six nominees who receive the greatest number of votes cast “FOR” the election of such nominees shall be elected as directors. Abstentions and broker non-votes as to the election of directors will not be counted in determining which nominees received the largest number of votes cast. Stockholders may not cumulate votes in the election of directors.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR ELECTION OF EACH OF THE NOMINEES.

BOARD INFORMATION AND DIRECTOR NOMINATION PROCESS

How often did the Board meet during 2019?

During 2019, there were four meetings of the Board, as well as several actions taken with the unanimous written consent of the Board with informal discussions and communication prior to the execution of such consents, but without a meeting. In 2019, all directors attended at least 75% of the aggregate number of meetings of the Board and committees on which board members served (during the periods for which the director served on the Board and such committees). Mr. Shelton attended all Board meetings and chaired our 2019 Annual Meeting of Stockholders. The Company does not have a written policy requiring directors to attend the annual meeting of stockholders. Last year, one director, Mr. Shelton, attended our 2019 Annual Meeting of Stockholders.

Do we have independent directors?

Our Board is responsible for determining the independence of our directors. For purposes of determining director independence, our Board has applied the definitions set forth in NASDAQ Rule 5605(a)(2) and the related rules of the Securities and Exchange Commission (the “SEC”). Based upon its evaluation, our Board has affirmatively determined that the following directors meet the standards of independence: Mr. Berman, Mr. Hancock, Dr. Hariri, Dr. Mandalam and Mr. Zecchini.

What Committees has the Board established?

Our Board has established an Audit Committee, a Compensation Committee, a Nomination and Governance Committee and a Science and Technology Committee. Charters for each of these committees are available on the Company’s website at www.cryoport.com on the “Corporate Governance: Governance Documents” page under the heading “Investor Relations.” Information on the website does not constitute a part of this Proxy.

Audit Committee

The functions of the Audit Committee are to (i) review the qualifications of the independent auditors, our annual and interim financial statements, the independent auditor’s report, significant reporting or operating issues and corporate policies and procedures as they relate to accounting and financial controls; and (ii) consider and review other matters relating to our financial and accounting affairs. The current members of the Audit Committee are Mr. Berman, who is the Audit Committee Chairman, Mr. Hancock, Dr. Hariri and Mr. Zecchini. The Company has determined that (i) Mr. Berman qualifies as an “audit committee financial expert” as defined under the rules of the SEC and is “independent” under SEC and NASDAQ rules applicable to audit committee members, and (ii) Mr. Hancock, Dr. Hariri and Mr. Zecchini meet NASDAQ’s financial literacy and financial sophistication requirements and are “independent” under SEC and NASDAQ rules applicable to audit committee members. During 2019, the Audit Committee held seven meetings. In addition, the Audit Committee regularly held discussions regarding the consolidated financial statements of the Company during Board meetings.

| 10 |

Compensation Committee

The purpose of the Compensation Committee is to discharge the Board’s responsibilities relating to compensation of the Company’s directors and executive officers, to produce an annual report on executive compensation for inclusion in the Company’s Proxy Statement, as necessary, and to oversee and advise the Board on the adoption of policies that govern the Company’s compensation programs including stock incentive and benefit plans. The current members of the Compensation Committee are Mr. Zecchini, who is the Compensation Committee Chairman, Dr. Mandalam and Mr. Berman, each of whom is “independent” under SEC and NASDAQ rules applicable to compensation committee members. Each of the current members of the Compensation Committee is a “non-employee director” under Section 16 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”) and an “outside director” for purposes of Section 162(m) of the Internal Revenue Code of 1986, as amended (the “Code”). During 2019, the Compensation Committee held four meetings.

Nomination and Governance Committee

The functions of the Nomination and Governance Committee are to (i) make recommendations to the Board regarding the size of the Board, (ii) make recommendations to the Board regarding criteria for the selection of director nominees, (iii) identify and recommend to the Board for selection as director nominees individuals qualified to become members of the Board, (iv) recommend committee assignments to the Board, (v) recommend to the Board corporate governance principles and practices appropriate to the Company, and (vi) lead the Board in an annual review of its performance. The current members of the Nomination and Governance Committee are Dr. Mandalam, who is the Nomination and Governance Committee Chairman, Mr. Berman and Dr. Hariri. During 2019, the Nomination and Governance Committee held two meetings.

Science and Technology Committee

The functions of the Science and Technology Committee are to oversee matters pertaining to the Company’s strategic direction as related to product and services serving the Company’s client businesses and investments in research and development and technology relating to same. The current members of the Science and Technology Committee are Dr. Hariri, who is the Science and Technology Committee Chairman, Mr. Hancock and Mr. Zecchini. During 2019, the Science and Technology Committee held two meetings.

What are the nominating procedures and criteria?

Director Qualifications. The Nomination and Governance Committee believes that persons nominated to the Board should have personal integrity and high ethical character. Candidates should not have any interests that would materially impair his or her ability to exercise independent judgment or otherwise discharge the fiduciary duties owed by a director to the Company and its stockholders. Candidates must be able to represent fairly and equally all stockholders of the Company without favoring any particular stockholder group or other constituency of the Company and must be prepared to devote adequate time to the Board and its committees.

Identifying Director Candidates. The Nomination and Governance Committee utilizes a variety of methods for identifying and evaluating nominees to serve as directors when vacancies occur. The Nomination and Governance Committee has a policy of re-nominating incumbent directors who continue to satisfy the committee’s criteria for membership and whom the Nomination and Governance Committee believes continue to make important contributions to the Board and who consent to continue their service on the Board.

In filling vacancies of the Board, the Nomination and Governance Committee will solicit recommendations for nominees from the persons the committee believes are likely to be familiar with (i) the needs of the Company and (ii) qualified candidates. These persons may include members of the Board and management of the Company. The Nomination and Governance Committee may also engage a professional search firm to assist in identifying qualified candidates. In evaluating potential nominees, the Nomination and Governance Committee will oversee the collection of information concerning the background and qualifications of the candidate and determine whether the candidate satisfies the minimum qualifications required by the Committee for election as director and whether the candidate possesses any of the specific skills or qualities that under the Board’s policies must be possessed by one or more members of the Board.

| 11 |

The Nomination and Governance Committee’s written policy on Board diversity provides that, when evaluating potential candidates for nomination, we will consider all aspects of each candidate’s qualifications and skills in the context of the needs of the Company at that point in time with a view to creating a Board with diversity along multiple dimensions, including race, ethnicity, gender, age, education, cultural background, opinions, skills, perspectives, professional experiences and other differentiating characteristics. While there can be no assurance such candidates will emerge, it is in the best interest of the Company, as a global provider of logistics services to the life sciences industry, to embrace the richness of diversity whenever possible.

The Nomination and Governance Committee will make its selections based on all the available information and relevant considerations. The Nomination and Governance Committee’s selection will be based on who, in the view of the Committee, will be best suited for membership on the Board. In making its selection, the Nomination and Governance Committee will evaluate candidates proposed by stockholders under criteria similar to other candidates, except that the Committee may consider, as one of the factors in its evaluation, the size and duration of the interest of the recommending stockholder in the stock of the Company. The Nomination and Governance Committee may also consider the extent to which the recommending stockholder intends to continue to hold its interest in the Company, including whether the recommending stockholder intends to continue holding its interest at least through the time of the meeting at which the candidate is to be elected.

Stockholder Nominees. The Nomination and Governance Committee will consider director nominee recommendations by stockholders, provided the names of such nominees, accompanied by relevant biographical information, are properly submitted in writing to the Secretary of the Company in accordance with the manner described for stockholder nominations under the heading “Stockholder Proposals for Next Annual Meeting.” The Secretary will forward all validly submitted recommendations to the Nomination and Governance Committee. The acceptance of a recommendation from a stockholder does not imply that the Nomination and Governance Committee will recommend to the Board the nomination of the stockholder recommended candidate.

How is the Board Structured?

Pursuant to our Amended and Restated Bylaws, the Chairman of the Board presides at meetings of the Board. The Chairman of the Board is currently the Company’s President and Chief Executive Officer, Mr. Shelton.

The Board has determined that its current structure, with a combined Chairman and Chief Executive Officer, is in the best interests of the Company and its stockholders. The Board believes that combining the Chairman and Chief Executive Officer positions is currently the most effective leadership structure for the Company given Mr. Shelton’s in-depth knowledge of the Company’s technology, business and industry, and his ability to formulate and implement strategic initiatives. Further, Mr. Shelton is intimately involved in the day-to-day operations of the Company and is thus in a position to elevate the most critical business issues for consideration by the independent directors of the Board.

The Board has appointed Mr. Berman as the Lead Director. Among other responsibilities, Mr. Berman presides over regularly scheduled meetings at which only our independent directors are present, serves as a liaison between the Chairman and Chief Executive Officer and the independent directors, and performs such additional duties as our Board may otherwise determine and delegate. We believe the appointment of a Lead Director, the independent nature of the Audit Committee, the Compensation Committee, and the Nomination and Governance Committee, as well as the practice of the independent directors regularly meeting in executive session without Mr. Shelton and the other members of the Company’s management present, ensures that the Board maintains a level of independent oversight of management that is appropriate for the Company.

Are there any family relationships among the directors and the executive officers?

There are no family relationships among any of our directors and executive officers.

What is the Board’s Role in Risk Oversight?

The Board oversees an enterprise-wide approach to risk management that is designed to support the achievement of organizational objectives to improve long-term performance and enhance stockholder value. A fundamental part of risk management is not only understanding the risks a company faces and what steps management is taking to manage those risks, but also understanding what level of risk is appropriate for the Company. In setting the Company’s business strategy, the Board assesses the various risks being mitigated by management and determines what constitutes an appropriate level of risk for the Company.

| 12 |

While the Board has the ultimate oversight responsibility for the risk management process, various committees of the Board also have responsibility for risk management. In particular, the Audit Committee focuses on financial risk, including internal controls, and receives financial risk assessment reports from management. Risks related to the compensation programs are reviewed by the Compensation Committee. The Board is advised by these committees of significant risks and management’s response via periodic updates.

Do we have a Code of Ethics?

The Company has adopted a corporate code of conduct that applies to its directors and all employees, including the Company’s Chief Executive Officer and Chief Financial Officer. The Company has posted the text of its corporate code of conduct on the Company’s website at www.cryoport.com on the “Corporate Governance: Governance Documents” page under the heading “Investor Relations.”

How can stockholders communicate with the Board?

The Board encourages stockholders to send communications about bona fide issues concerning the Company to the Board or specified members through its Nomination and Governance Committee. All such communications, except those related to stockholder proposals discussed under the heading “Stockholder Proposals for Next Annual Meeting,” must be sent to the Nomination and Governance Committee Chairman at the Company’s offices at 112 Westwood Place, Suite 350, Brentwood, Tennessee 37027.

PROPOSAL 2 — TO RATIFY THE APPOINTMENT OF ERNST & YOUNG LLP AS THE INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM OF THE COMPANY AND ITS SUBSIDIARIES FOR THE YEAR ENDING DECEMBER 31, 2020

The Audit Committee has selected Ernst & Young LLP (“E&Y”) to audit the Company’s consolidated financial statements for the year ending December 31, 2020. The Board, upon the recommendation of the Audit Committee, has ratified the selection of E&Y as the Company’s independent registered public accounting firm for 2020, subject to ratification by the stockholders. E&Y has served in this capacity for the year ended December 31, 2019 and has reported on the Company’s December 31, 2019 consolidated financial statements. There were no disagreements between the Company and E&Y on any matter of accounting principles or practices, financial statement disclosure or auditing scope or procedure.

Representatives of E&Y are expected to be present at the Annual Meeting with the opportunity to make a statement if they desire to do so and are expected to be available to respond to appropriate questions.

Stockholder ratification of the selection of E&Y as the Company’s independent auditors is not required by our Amended and Restated Bylaws or otherwise. However, the Board is submitting the selection of E&Y to the stockholders for ratification as a matter of corporate practice. If the stockholders fail to ratify the selection, the Audit Committee will reconsider whether or not to retain that firm. Even if the selection is ratified, the Audit Committee in its discretion may direct the appointment of a different independent accounting firm at any time during the year if the Audit Committee determines that such a change would be in the best interests of the Company and its stockholders.

Required Vote

Approval of the ratification of the appointment of E&Y as the Company’s independent registered public accounting firm for 2020 requires the affirmative vote of a majority of votes cast. Abstentions will not be counted as votes for or against such proposal.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE FOR RATIFICATION OF THE APPOINTMENT OF ERNST & YOUNG LLP AS THE COMPANY’S INDEPENDENT REGISTERED PUBLIC ACCOUNTING FIRM FOR 2020.

| 13 |

Independent Registered Public Accounting Firm Fees

The following table shows the fees that were billed to us for the audit and other services provided to the Company by Ernst & Young LLP (“E&Y”) in 2019 and KMJ Corbin & Company LLP (“KMJ”) in 2018.

|

Year Ended December 31, 2019 |

Year Ended December 31, 2018 |

|||||||

| Audit Fees | $ | 378,557 | $ | 223,123 | ||||

| Audit-Related Fees | -- | 15,900 | ||||||

| Tax Fees | -- | 16,457 | ||||||

| $ | 378,557 | $ | 255,480 | |||||

The fees billed to us by E&Y and KMJ during or related to the years ended December 31, 2019 and 2018 consist of audit fees, audit-related fees and tax fees, as follows:

Audit Fees. Represents the aggregate fees billed to us for professional services rendered for the audit of our annual consolidated financial statements and for the reviews of our consolidated financial statements included in our Form 10-Q filings for each fiscal quarter.

Audit-Related Fees. Represents the aggregate fees billed to us for assurance and related services that are reasonably related to the performance of the audit and review of our consolidated financial statements that are not already reported in Audit Fees. These services include accounting consultations and attestation services that are not required by statute such as comfort letters and S-8 filings.

Tax Fees. Represents the aggregate fees billed to us for professional services rendered for tax returns, compliance and tax advice.

All Other Fees. There were no other fees billed by E&Y or KMJ for services rendered to the Company, other than the services described above in 2019 and 2018.

Policy on Audit Committee Pre-Approval of Fees

The Audit Committee must pre-approve all services to be performed for us by our independent auditors. Pre-approval is granted usually at regularly scheduled meetings of the Audit Committee. If unanticipated items arise between regularly scheduled meetings of the Audit Committee, the Audit Committee has delegated authority to the chairman of the Audit Committee to pre-approve services, in which case the chairman communicates such pre-approval to the full Audit Committee at its next meeting. The Audit Committee also may approve the additional unanticipated services by either convening a special meeting or acting by unanimous written consent. During the years ended December 31, 2019 and 2018, all services billed by E&Y and KMJ were pre-approved by the Audit Committee in accordance with this policy.

Information Regarding Change of Independent Registered Public Accounting Firms

As reported on the Company’s Current Report on Form 8-K, dated August 20, 2019, on August 15, 2019, the Company, at the direction of the Audit Committee, approved the appointment of E&Y as the Company’s new independent registered public accounting firm, effective upon the dismissal of KMJ on August 15, 2019.

During the Company’s two most recent fiscal years ended December 31, 2018 and 2017, and the subsequent interim period through August 15, 2019, neither the Company nor anyone acting on its behalf consulted with E&Y regarding either (a) the application of accounting principles to a specified transaction, either completed or proposed; or the type of audit opinion that might be rendered on the Company’s financial statements, and neither a written report was provided nor oral advice was provided to the Company that E&Y concluded was an important factor considered by the Company in reaching a decision as to the accounting, auditing or financial reporting issue; or (b) any matter that was either the subject of a disagreement (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions thereto) or a reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

| 14 |

The Company notified KMJ on August 15, 2019 that it would be replaced as the Company’s independent registered public accounting firm, effective immediately. The decision to change independent registered public accounting firms was approved by the Audit Committee. KMJ’s reports on the Company’s financial statements for the years ended December 31, 2018 and 2017 did not contain an adverse opinion or a disclaimer of opinion, and were not qualified or modified as to uncertainty, audit scope, or accounting principles.

During the Company’s two most recent fiscal years ended December 31, 2018 and 2017 and the subsequent interim period through August 15, 2019, there were (i) no disagreements (as defined in Item 304(a)(1)(iv) of Regulation S-K and the related instructions thereto) with KMJ on any matter of accounting principles or practices, financial statement disclosure, or auditing scope or procedure, which disagreements, if not resolved to the satisfaction of KMJ, would have caused it to make reference to the subject matter of the disagreements in connection with its reports on the consolidated financial statements of the Company for such years, and (ii) no reportable event (as described in Item 304(a)(1)(v) of Regulation S-K).

PROPOSAL 3 — TO APPROVE, ON AN ADVISORY BASIS, THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS

The Dodd-Frank Wall Street Reform and Consumer Protection Act of 2010 (“Dodd-Frank Act”) enables our stockholders to vote to approve, on an advisory (non-binding) basis, the compensation of our named executive officers as disclosed in this proxy statement. This advisory vote is commonly referred to as a “say-on-pay” proposal. Consistent with the mandate of the Dodd-Frank Act and as required by Section 14A of the Exchange Act, we are seeking our stockholders’ approval, on an advisory basis, of the compensation of our named executive officers as disclosed pursuant to the SEC’s compensation disclosure rules (which disclosure includes the related compensation tables in this Proxy Statement). At the 2013 and 2019 Annual Meeting of the Stockholders, a plurality of votes cast by stockholders present and entitled to vote on the proposal selected one year as the desired frequency of future stockholder say-on-pay votes with respect to the say-on-frequency proposal. As such, the Board adopted a resolution to hold “say-on-pay” votes annually. The stockholders will be asked to vote again on the say-on-frequency proposal at the 2025 Annual Meeting of Stockholders. Since 2013, a majority of votes cast by stockholders present and entitled to vote on the proposal have approved the say-on-pay proposal.

The Compensation Committee, which is responsible for designing and administering our executive compensation program, has designed our executive compensation program to provide a competitive and internally equitable compensation and benefits package that reflects the Company performance, job complexity, and strategic value of the position while seeking to ensure the individual’s long-term retention and motivation and alignment with the long-term interests of our stockholders. We are asking our stockholders to indicate their support for our named executive officers’ compensation as described in this proxy statement. The results of this advisory vote are not binding upon us. However, the Compensation Committee values the opinions expressed by stockholders in their vote and will consider the outcome of the vote in deciding whether any actions are necessary to address concerns raised by the vote and when making future compensation decisions for named executive officers.

This vote is not intended to address any specific item of compensation, but rather the overall compensation of our named executive officers described in this Proxy Statement. Accordingly, we are asking our stockholders to vote “FOR” the following resolution at the Annual Meeting:

“RESOLVED, that the compensation paid to the Company’s named executive officers, as disclosed pursuant to Item 402 of Regulation S-K, including the compensation tables and narrative discussion is hereby APPROVED.”

Required Vote

Adoption of this resolution will require a majority of votes cast. Abstentions and broker non-votes will not be counted as votes for or against such proposal.

THE BOARD OF DIRECTORS UNANIMOUSLY RECOMMENDS A VOTE FOR THE APPROVAL, ON AN ADVISORY BASIS, OF THE COMPENSATION OF THE NAMED EXECUTIVE OFFICERS.

| 15 |

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

The following table sets forth information with respect to the beneficial ownership of the Company’s common stock as of March 13, 2020 by, (i) each person or group of affiliated persons known to the Company to beneficially own 5% or more of its common stock, (ii) each of our named executive officers, (iii) each of our directors and, (iv) and all of our current executive officers and directors as a group.

Percentage of beneficial ownership is calculated based on 37,661,984 shares of common stock outstanding as of March 13, 2020. Beneficial ownership is determined in accordance with the rules of the SEC which generally attribute beneficial ownership of securities to persons who possess sole or shared voting power or investment power with respect to those securities and includes shares of our common stock issuable pursuant to the exercise of stock options, warrants, preferred stock or other securities that are immediately exercisable or convertible or exercisable or convertible within 60 days of March 13, 2020.

To calculate a stockholder’s percentage of beneficial ownership of common stock, we must include in the numerator and denominator those shares of common stock underlying options, warrants and convertible securities that such stockholder is considered to beneficially own. Shares of common stock underlying options, warrants and convertible securities held by other stockholders, however, are disregarded in this calculation. Therefore, the denominator used in calculating beneficial ownership of each of the stockholders may be different.

The following table gives effect to the shares of common stock issuable within 60 days of March 13, 2020, upon the exercise of all options and other rights beneficially owned by the indicated stockholders on that date. Unless otherwise indicated, the persons named in the table have sole voting and sole investment control with respect to all shares beneficially owned. Furthermore, unless otherwise indicated, the business address of each person is c/o 112 Westwood Place, Suite 350, Brentwood, Tennessee 37027.

| Beneficial Owner |

Number of Shares Owned(2) |

Percentage of Shares of Common Stock Beneficially Owned |

||||||

| Named Executive Officers and Directors: | ||||||||

| Jerrell W. Shelton | 3,305,321 | (1) | 8.1 | % | ||||

| Richard Berman | 151,522 | (1)(3) | * | |||||

| Robert Hariri, M.D. Ph.D. | 185,600 | (1) | * | |||||

| Edward Zecchini | 251,483 | (1) | * | |||||

| Ramkumar Mandalam Ph.D. | 243,648 | (1) | * | |||||

| Daniel Hancock | 72,872 | (1) | * | |||||

| Robert S. Stefanovich | 610,992 | (1) | 1.6 | % | ||||

| All directors and executive officers as a group (7 persons) | 4,821,438 | (1) | 11.5 | % | ||||

| Other Stockholders: | ||||||||

| Alger Associates, Inc. | 4,664,578 | (4) | 12.4 | % | ||||

| Black Rock, Inc. | 2,521,969 | (5) | 6.7 | % | ||||

| Victory Capital Management | 2,348,908 | (6) | 6.2 | % | ||||

| The Vanguard Group, Inc. | 1,868,923 | (7) | 5.0 | % | ||||

| Total for all Directors, Executive Officers and Other Stockholders | 12,007,985 | 31.9 | % | |||||

| * |

Represents less than 1%

|

|

| (1) |

Includes shares which individuals shown above have the right to acquire as of March 13, 2020, or within 60 days thereafter, pursuant to outstanding stock options and/or warrants as follows: Mr. Shelton — 2,903,725 shares; Mr. Berman — 151,522 shares; Dr. Hariri — 170,300 shares; Dr. Mandalam—212,502 shares; Mr. Zecchini—212,502, Mr. Hancock—70,070 and Mr. Stefanovich — 609,992 shares. |

| 16 |

| (2) | The number and percentage of shares beneficially owned is determined in accordance with Rule 13d-3 of the Exchange Act, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under such rule, beneficial ownership includes any shares as to which the holder has sole or shared voting power or investment power and also any shares which the holder has the right to acquire within 60 days. | |

| (3) | Includes 9,250 warrants and 8,138 shares owned by Mrs. Richard Berman, spouse of Mr. Berman. | |

| (4) | According to the Schedule 13G filed by Alger Associates, Inc. on February 14, 2020, the shares reported by Alger Associates, Inc. are beneficially owned by one or more open-end investment companies or other managed accounts that are investment management clients of Fred Alger Management, LLC, (“FAM”) a registered investment adviser. FAM is a 100% owned subsidiary of Alger Group Holdings, LLC (“AGH”), a holding company. AGH is a 100% owned subsidiary of Alger Associates, Inc., a holding company. Alger Associates, Inc., AGH, and FAM each hold sole power to vote, or to direct the vote of, and sole power to dispose, or to direct the disposition of, these shares. The shares are owned, directly or indirectly, by Alger Associates, Inc., FAM, or AGH. The address for these entities is 360 Park Avenue South, New York, NY 10010. | |

| (5) | According to the Schedule 13G filed by Black Rock, Inc. on February 5, 2020, the shares reported by Black Rock, Inc. are beneficially owned by Black Rock, Inc., which holds the sole power to vote or to direct the vote of 2,459,121 shares and sole power to dispose, or to direct the disposition of, 2,521,969 shares. The shares are owned, directly or indirectly, by Black Rock, Inc., or its subsidiaries BlackRock Advisors, LLC, BlackRock Asset Management Canada Limited, BlackRock Fund Advisors, BlackRock Asset Management Ireland Limited, BlackRock Institutional Trust Company, National Association, BlackRock Financial Management, Inc., BlackRock Asset Management Schweiz AG, and BlackRock Investment Management, LLC. The address for these entities is 55 East 52nd Street, New York, NY 10055. | |

| (6) | According to the Schedule 13G filed by Victory Capital Management Inc. on January 31, 2020, the shares reported by Victory Capital Management Inc. are beneficially owned by Victory Capital Management Inc. which holds the sole power to vote or to direct the vote of 2,276,508 shares, and sole power to dispose, or to direct the disposition of, 2,348,908 shares. The address for this entity is 4900 Tiedeman Rd. 4th Floor, Brooklyn, OH 44144. | |

| (7) | According to the Schedule 13G filed by The Vanguard Group, Inc. on February 11, 2020, with respect to the shares reported by The Vanguard Group, Inc. are beneficially owned by The Vanguard Group, Inc., except that Vanguard Fiduciary Trust Company (“VFTC”), a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 63,011 shares of the Common Stock outstanding of the Company as a result of its serving as investment manager of collective trust accounts and Vanguard Investments Australia, Ltd. (“VIA”), a wholly-owned subsidiary of The Vanguard Group, Inc., is the beneficial owner of 8,468 shares of the Common Stock outstanding of the Company as a result of its serving as investment manager of Australian investment offerings. The Vanguard Group, Inc. has (i) the sole power to vote or direct to vote 68,113 shares, (ii) shared power to vote or direct to vote 3,366 shares, (iii) sole power to dispose of or to direct the disposition of 1,802,546 shares, and (iv) shared power to dispose or to direct the disposition of 66,377 shares. The address for these entities is 100 Vanguard Blvd., Malvern, PA 19355. | |

EXECUTIVE COMPENSATION AND RELATED MATTERS

Compensation Overview

We are a “smaller reporting company” as such term is defined in Rule 405 of the Securities Act of 1933, as amended (the “Securities Act”), and Item 10 of Regulation S-K. Accordingly, and in accordance with relevant SEC rules and guidance, we have elected, with respect to the disclosures required by Item 402 (Executive Compensation) of Regulation S-K, to comply with the disclosure requirements applicable to smaller reporting companies. This “Compensation Overview” section discusses the compensation programs and policies for our executive officers and the Compensation Committee’s role in the design and administration of these programs and policies in making specific compensation decisions for our executive officers, including our “named executive officers.”

Our Compensation Committee has the sole authority and responsibility to review and determine, or recommend to the Board for determination, the compensation package of our chief executive officer and each of our other named executive officers, each of whom is identified in the “Summary Compensation Table” below. Our Compensation Committee also considers the design and effectiveness of the compensation program for our other executive officers and approves the final compensation package, employment agreements and stock award and option grants for all of our executive officers. Our Compensation Committee is composed entirely of independent directors who have never served as officers of the Company.

| 17 |

During 2019, Mr. Shelton reviewed the performance and compensation of the other named executive officer and made recommendations as to his compensation to the Compensation Committee. In making its decisions regarding executive compensation, the Compensation Committee meets outside the presence of executive officers when making final decisions about each executive officer. The Chief Executive Officer is periodically present during portions of these deliberations that relate to the compensation for other executive officers but does not participate in discussions regarding his own pay. In addition, the Compensation Committee has delegated to the Chief Executive Officer the authority to make share-based awards to employees who are not named executive officers within certain limitations on aggregate grants and specific award terms.

Set forth below is a discussion of the policies and decisions that shape our executive compensation program, including the specific objectives and elements. Information regarding director compensation is included under the heading “Director Compensation” below.

2019 Business Highlights

We reached a number of significant milestones during 2019, which include the following:

| · | Concluded 2019 with 73% in revenue growth year over year, |

| · | Grew revenue in the biopharma market by 64% year over year, further fortifying our leadership position in this market |

| · | Revenue from the distribution of the first two CAR T-cell therapies approved and commercially launched increased by 295% to $8.3 million year over year. |

| · | As of December 31, 2019, we were supporting a net total of 436 clinical trials, of which 361 are in the Americas, 61 in EMEA (Europe, the Middle East and Africa) and 14 in APAC (Asia Pacific). The number of Phase III clinical trials supported grew to 56, compared to 47 in the prior year. |

| · | Completed acquisition of the biostorage business, Cryogene, which provides comprehensive temperature-controlled sample management solution to the life science industry, including specimen storage, sample processing, collection, and retrieval. |

| · | Raised $68.8 million, net, through a public offering of common stock, ending the year with $94.3 million in cash, cash equivalents and short-term investments. |

| · | Delivered TSR (total shareholder return) of 49% for the one-year period ending December 31, 2019. |

| · | Delivered TSR of 408% and 212% for the three-year and five-year periods ending December 31, 2019, respectively, which is higher than any of our peer companies. |

General Executive Compensation Objectives and Philosophy

The objective of our executive compensation program is to attract, retain and motivate talented executives who are critical for our continued growth and success and to align the interests of these executives with those of our stockholders. To achieve this objective, besides annual base salaries, our executive compensation program utilizes a combination of annual incentives through structured cash bonuses based on pre-defined goals and long-term incentives through equity-based compensation. In establishing overall executive compensation levels, our Compensation Committee considers a number of criteria, including the executive’s scope of responsibilities, prior and current period performance, attainment of individual and overall company performance objectives and retention concerns, and the results of the advisory vote of the stockholders on the “say-on-pay” proposal at the prior years’ annual meeting of the stockholders. Our President and Chief Executive Officer and our Compensation Committee believe that substantial portions of executive compensation should be linked to the overall performance of our Company, and that the contribution of individuals over the course of the relevant period to the goal of building a profitable business and stockholder value will be considered in the determination of each executive’s compensation.

Generally, our Compensation Committee reviews and, as appropriate, modifies compensation arrangements for executive officers during the first quarter of each year, subject to the terms of existing employment agreements with our named executive officers, as discussed below. For 2019, our Compensation Committee considered our President and Chief Executive Officer’s executive compensation recommendations for the Company’s Chief Financial Officer. In making such determinations, the Compensation Committee considered the overall performance of each executive and his or her contribution to the growth of our company and its products, as well as overall company performance through personal and corporate achievements.

| 18 |

Independent Compensation Consultant

The Compensation Committee has the authority to directly retain the services of independent consultants and other experts to assist in fulfilling its responsibilities. The Compensation Committee engaged Frederic W. Cook & Co., Inc. (“FW Cook”) in 2017 and 2018 to review our executive compensation programs and to assess our executive officers’ base salaries, incentive opportunities, target and actual total cash, long-term incentive value and total direct compensation from a competitive standpoint. At that time, the Compensation Committee assessed the independence of FW Cook pursuant to SEC rules and the corporate governance rules of The NASDAQ Stock Market and concluded that no conflict of interest exists that would prevent FW Cook from independently advising the Compensation Committee. As described herein, in 2017 and 2018, FW Cook assisted the Compensation Committee in defining the appropriate market of our peer companies for executive compensation and practices and in benchmarking our executive compensation program against the peer group.

During 2017, FW Cook helped the Compensation Committee collect and analyze data and to compare all components of our officer compensation program, including base salary, annual cash bonus and long-term equity awards, to the practices of peer companies. During 2017, FW Cook developed a list of peer group of revenue-generating health care equipment and supply companies based on several characteristics, including, being publicly traded, relative company size (e.g., market capitalization and number of employees), and geographic location as compared to peer companies, as well as the specific responsibilities of our executives. The Compensation Committee approved the peer group and intends to review and modify this peer group periodically to ensure that this list remains aligned with our size and stage of development. During 2017, our peer group consisted of the following 22 companies:

| Aethlon Medical, Inc. | Cesca Therapeutics, Inc. | Skyline Medical Inc. |

| Alliqua BioMedical | Cutera, Inc. | Tandem Diabetes Care, Inc. |

| Alphatec Holdings, Inc. | Derma Sciences Inc. | TransEnterix, Inc. |

| Antares Pharma, Inc. | Dextera Surgical Inc. | Veracyte, Inc. |

| AxoGen, Inc. | InVivo Therapeutics Holding Corp. | Vermillion, Inc. |

| BIOLASE, Inc. | MGC Diagnostics Corp. | Viveve Medical, Inc. |

| BioLife Solutions, Inc. | Milestone Scientific Inc. | |

| CAS Medical Systems, Inc. | Misonix, Inc. |

In 2018, following a period of significant growth for the Company, FW Cook reviewed the peer group and developed a new list of peer companies that better reflect the Company’s current size. The Compensation Committee approved the peer group, which consists of the following 20 companies.

| Amber Road, Inc. | GenMark Diagnostics, Inc. | Senseonics Holdings, Inc. |

| American Software, Inc. | Lantheus Holdings, Inc. | Surmodics, Inc. |

| Anika Therapeutics, Inc. | Mitek Systems, Inc. | TransEnterix, Inc. |

| Antares Pharma, Inc. | MobileIron, Inc. | Vocera Communications, Inc. |

| Cerus Corporation | Model N, Inc. | |

| Corindus Vascular Robotics, Inc. | OraSure Technologies, Inc. | |

| Cutera, Inc. | Orthofix Medical Inc. | |

| Five9, Inc. | RTI Surgical, Inc. |

We believe that our select peer group provides useful information to help us establish competitive compensation practices and levels of compensation that allow us to attract, retain and motivate a talented executive team and, at the same time, aligns the interests of our executives with those of our stockholders. The executive employment market in our industry in the United States is very competitive because there are many high-growth technology and life sciences companies in that region of the world, many of which are similar to us in size and stage of development. We believe our executive compensation must be competitive within such peer group, yet fully aligned with our current stage of development and our responsibilities to stockholders.

| 19 |

The Compensation Committee uses the competitive data it obtains from FW Cook for evaluating our executive compensation practices, including our cash bonus policy, and the levels of cash and equity compensation provided to our officers.

Annual Management Incentive Plan

On March 28, 2018, the Compensation Committee approved the adoption of an Annual Management Incentive Plan (the “Bonus Plan”). It is a formal incentive plan with pre-established goals and weightings, which was designed to reward achievements based upon quantitative Company performance. Prior to 2018, our bonus plan was effectively discretionary due to our stage of development and limited ability to set meaningful goals.

Per the Bonus Plan, the Company’s executive officers, and certain other non-executive officers, may be eligible to receive a cash bonus expressed as a percentage of their base salary in the event the Company achieves certain business metrics and personal strategic objectives. Fifty percent (50%) of the bonus opportunity is based on the attainment of goals related to cumulative revenue (“Revenue”) as reported quarterly and annually in the Company’s public filings with the SEC; thirty percent (30%) of the bonus opportunity is based on the attainment of goals related to adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”) based on the Company’s quarterly and annual filings with the SEC (collectively, the “Base Financial Goals”); and twenty percent (20%) of the bonus opportunity is based on the attainment of personal strategic objectives, with such personal strategic objectives determined by the Committee. Additionally, if the Company attains Revenue and Adjusted EBITDA that is higher than the Base Financial Goals, and the participant meets his or her personal strategic objectives, then such participant’s cash bonus would be one hundred fifty percent (150%) of such participant’s bonus opportunity. The Compensation Committee established Mr. Shelton’s bonus opportunity for 2019 at one hundred percent (100%) of his base salary and Mr. Stefanovich’s bonus opportunity at fifty percent (50%) of his base salary.

Summary Compensation Table

The following table contains information with respect to the compensation of our Chief Executive Officer and Chief Financial Officer for the years ended December 31, 2019 and 2018. We refer to our Chief Executive Officer and Chief Financial Officer as our “Named Executive Officers.”

| Name and Principal Position | Year | Salary (1) ($) |

Bonus ($) |

Option Awards (2) ($) |

All Other Compensation ($) |

Total Compensation ($) |

||||||||||||||||||

| Jerrell W. Shelton | 2019 | 600,000 | 345,000 | (6) | 3,239,464 | (3) | — | 4,184,464 | ||||||||||||||||

| President and Chief Executive Officer | 2018 | 581,250 | 100,000 | (5) | 2,091,151 | (3) | — | 2,772,401 | ||||||||||||||||

| Robert S. Stefanovich | 2019 | 331,250 | 100,625 | (6) | 779,269 | (4) | — | 1,211,144 | ||||||||||||||||

| Senior Vice President and Chief Financial Officer | 2018 | 293,625 | 60,000 | (5) | 478,698 | (4) | — | 832,323 | ||||||||||||||||

| (1) | This column represents the dollar value of base salary earned during each fiscal year indicated. |

| (2) | This amount represents the total grant date fair value of all stock option awards at the date of grant. Pursuant to SEC rules, the amount shown excludes the impact of estimated forfeitures related to service-based vesting conditions. For information on the valuation assumptions with respect to the grants made during the years ended December 31, 2019 and 2018, see Note 2 “Summary of Significant Accounting Policies” in the consolidated financial statements included in the 2019 Annual Report. |

| (3) | Based on the recommendation of the Compensation Committee and approval by our board of directors, on April 1, 2019 and March 28, 2018, Mr. Shelton was granted an option to purchase 375,000 and 290,000 shares, respectively, of common stock in connection with his service as Chief Executive Officer of the Company. The exercise prices of the options are equal to or greater than the fair value of the Company’s stock as of the respective grant dates. |

| (4) | Based on the recommendation of the Compensation Committee and approval by our board of directors, on April 1, 2019 and March 28, 2018, Mr. Stefanovich was granted an option to purchase 90,000 and 66,300 shares of common stock, respectively, of common stock in connection with his service as Chief Financial Officer of the Company. The exercise prices of the options are equal to or greater than the fair value of the Company’s stock as of the respective grant dates. |

| (5) | This amount represents the bonus earned for the year ended December 31, 2018 as approved by the Compensation Committee of our board of directors. |